QUESTION ONE

Examine five stages that are involved in the pre-start-up phase of a new business venture.

. Idea Generation stage

This is the preliminary stage for the business. Here, the entrepreneur does a lot of ground work to access the viability of the venture he is about to get into. At this stage, the entrepreneur is expected to come up with the business idea. Several needs may require to be fulfilled but the entrepreneur may not meet all of them; it becomes necessary at this stage to select the most viable business idea from the many available.

This stage may involve creativity and assessment of various ideas. It is at this stage that an entrepreneur decides on the business mission, scope and direction. This mean, an entrepreneur gives the prospective business a purpose. Some purposes may include provision of quality goods and services and to make profit

He will carry out due diligence to ensure he has taken all important factors into Recount setting off the business. He will incur expenses to execute some of these important activities. He may for instance require the services of a legal representative to acquire land. He may also hire the services of a surveyor if he wants to build his own premise, if he will hire personnel to assist in running the business, he should ensure that he has sufficient funds to pay them for at least 6 months. He may need to get a loan to do this.

Start – up stage

Activities at the start up stage may involve preparation of a formal business plan, registration of the business, sourcing capital, recruiting staff and designing the product. At this stage, business may also launch the product and sign up with distributors or dealers.

At this stage, the entrepreneur has already set the business up. The business is operational despite the setbacks that befall all businesses that start up at the initial stages. The entrepreneur realizes that he may need to make adjustments in order to survive. He may see the need to insure the property in case he hadn’t He may also realize that he does not need an extra staff hence he may cut down on that, sales may be slow in picking up, so he may decide to come up with new marketing strategies, He may see the need to have proper records for tax purposes.

Growth stage

- At the growth stage of business common experiences may include:

- Increased sales and profits

- Wider market coverage in terms of geographical regions.

- A growing number of employees

- Variety of products/services

- Increased competition

- Need for additional expenditure

During this phase, the business will experience rapid growth as customers’ needs become the main focus for the entrepreneur. It is at this stage that he will realize there is need to gain a competitive edge in order to make more sales. The entrepreneur at this stage may think seriously about automating his operations, hiring professionals like accountants, perhaps even expanding the business. The signs that these requirements are necessary will be felt by the growing need to meet the increasing and dynamic needs of the customer

Stabilization Stage

At this stage, the business sales and profits stagnate. The business may also experience intensified competition.

- There is also market saturation by similar (“look like”) products

- Consumers’ indifference to the-product

- Sales may decline and consequently profit may decline.

This is the phase that determines whether the business has managed to meet its long term objectives and a period to assess how successful the short term objectives have been met. At this stage, the entrepreneur is more concerned about corporate governance, issues and how this impacts on customer needs. He will also be concerned with the management of the business in various departments such as finance, sales and marketing. The entrepreneur will have his sights on a higher level of competition with other, firms that belong to a higher circle, hence he see the need of turning the business into a public limited company in order to compete as such levels.

This model can be applied to the growth or otherwise of a firm. The entrepreneur thus needs to ensure that the business opportunity he has before him has a road map charted in advance and based on due diligence. This does not mean that every firm will follow the above model. The entrepreneur needs to be aware of the possible outcomes.

Innovation Stage

Organizations that fail to innovate at stabilization stage are likely to decline. To ensure the firm comes back to growth, the entrepreneur is required to re- look at the ways business has been conducted. The aim is to undertake activities differently and rescue the firm from decline. It is expected that innovative strategies would ensure accelerated growth. .

Among innovative attempts include:

- Change of management

The aim is to bring new-and better ideas that will ensure the firm is back to the growth path.

- Re- package the product/ service

This would ensure the market gets the impression of a new product that is modified and. Better than the former. It is also a strategy of winning customers back from competitors.

- Change the technology

The aim of new technology is to ensure efficiency in production and enhance customer service. It is important that the entrepreneur chooses a technology that matches the type of business he is doing

- New distribution methods .

The firm may also design new distribution methods. Changing the distribution strategy would ensure customers access their products at the convenient places especially providing personalized distributions to customers or even ensuring 24 hour service to customers

- Advertise and promote differently

The firm may decide go to different regions and promote its product or services.

QUESTION TWO

Outline four reasons why government levy custom duty

- Defense Spending

One of the roles of government is to provide for a national defense. Most governments today do this by creating a military. The costs of maintaining a standing army are significant and include the costs of training, housing, equipping and paying soldiers for their services to the country. Defense spending also includes the cost of developing new technologies used for military purposes such as more effective weapons and unmanned technologies.

- Retirement Programs

A significant chunk of foe annual federal budget goes .towards paying for retirement programs like Social Security. Social Security provides retirement benefits to individuals who have paid into the retirement systems over the course of their working lives, in addition to Social Security, the government also must pay for pension plans for former government employees who are now retired.

- Interest Payments

Many governments have borrowed significant amounts of money and must pay interest on that debt. This debt is held by a variety of people and organizations including private citizens, government agencies and foreign governments.

- Altering Behaviour

The tax laws in any country are used to alter behaviors in addition to raising revenues. Individuals have a limited supply of money and so increasing taxes on behaviors the government dislikes can restrict people from participating in them. For example, when a government wants, to reduce cigarette smoking, it can increase the taxes on cigarettes making them more expensive for people to buy. If a government wants to increase the number, of companies that offer health care to their workers, it may pass a law offering increased tax deductions for payments that went toward workers health care.

Explain six features of a good financial plan

- Simplicity

The financial plan of a business should be as simple as possible. By ‘simplicity we mean that the plan should be easily understandable to all and it should be free from complications, and/or suspicion-arising statements. At the time of formulating capital structure of a business or issuing various securities to the public, it should be borne in mind that there would be no confusion, in the mind, of investors- about their nature and profitability.

- Foresight

The planner should always keep in mind not only the needs of today but also the needs of tomorrow so that a sound financial plan may be formed. Capital requirements of a business Can be estimated by the scope of operations and it must it must be planned in such a way that need for capital may be predicted as accurately as possible. Although, it is difficult to predict the demand of the’ product yet it cannot be an excuse for the promoters to use foresight to the b advantage in building the capital, structure of the company.

- Flexibility

The financial structure of a company must be flexible enough to meet the capital requirements of the company. The financial-plan should be chalked out .in such a way that both increase and decrease in capital may be feasible. The business may require additional capital for financing scheme of modernization, automation, betterment of employees etc. It is not difficult, to increase the capital. It may be done by issuing fresh shares or debentures to the public or raising loans from special financial institutions, but reduction of capital is really a ticklish problem and needs statesman like dexterity.

- Intensive use

Effective use of capital is as much necessary as its procurement. Every ‘paisa’ should be used properly for the prosperity of the enterprise. Wasteful use of capital is as bad as inadequate capital. There must be ‘fair capitalisation’, i.e., company must procure as much capital as requires nothing more and nothing less. Over-capitalisation and under capitalisation are both danger signals. Hence, there should neither be surplus nor deficit capital but procurement of adequate capital should be aimed, at and every effort be made to make best use of it.

- Liquidity

Liquidity means that a reasonable amount of current assets must be kept in the form of liquid cash so that business operations may be carried on smoothly without any shock to them due to shortage of finds. This cash ratio to current ratio to current assets depends upon a number of factors, e.g. the nature and size of the business, credit standing, goodwill and money market, conditions etc.

- Economy

The cost of capital procurement should always be kept in mind while formulating the financial plan. It should be the minimum possible. Dividend or interests to be paid to shareholder (ordinary and preference) should not be a burden to the company in any way. But the cost of capital is hot foe; only criterion, other factors should also be given due importance.

It is often said that 50% of privately owned business fail in the first year and 95% within the first five years

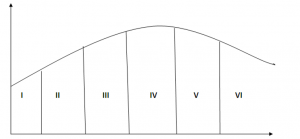

Using an appropriate diagram describe “Business lifecycle”

Idea Generation stage

This is the preliminary stage for the business. Here, the entrepreneur does a lot of ground work to access the viability of the venture he is about to get into. At this stage, the entrepreneur is expected to come up with the business idea. Several needs may require to be fulfilled but the entrepreneur may not meet all of them; it becomes necessary at this stage to select the most viable business idea from the many available.

This stage may involve creativity and assessment of various ideas. It is at this stage that an entrepreneur decides on the business mission, scope and direction. This mean, an entrepreneur gives the prospective business a purpose. Some purposes may include provision of quality goods and services and to make profit

He will carry out due diligence to ensure he has taken all important factors into Recount setting off the business. He will incur expenses to execute some of these important activities. He may for instance require the services of a legal representative to acquire land. He may also hire the services of a surveyor if he wants to build his own premise, if he will hire personnel to assist in running the business, he should ensure that he has sufficient funds to pay them for at least 6 months. He may need to get a loan to do this.

Start – up stage

Activities at the start up stage may involve preparation of a formal business plan, registration of the business, sourcing capital, recruiting staff and designing the product. At this stage, business may also launch the product and sign up with distributors or dealers.

At this stage, the entrepreneur has already set the business up. The business is operational despite the setbacks that befall all businesses that start up at the initial stages. The entrepreneur realizes that he may need to make adjustments in order to survive. He may see the need to insure the property in case he hadn’t He may also realize that he does not need an extra staff hence he may cut down on that, sales may be slow in picking up, so he may decide to come up with new marketing strategies, He may see the need to have proper records for tax purposes.

Growth stage

- At the growth stage of business common experiences may include:

- Increased sales and profits

- Wider market coverage in terms of geographical regions.

- A growing number of employees

- Variety of products/services

- Increased competition

- Need for additional expenditure

During this phase, the business will experience rapid growth as customers’ needs become the main focus for the entrepreneur. It is at this stage that he will realize there is need to gain a competitive edge in order to make more sales. The entrepreneur at this stage may think seriously about automating his operations, hiring professionals like accountants, perhaps even expanding the business. The signs that these requirements are necessary will be felt by the growing need to meet the increasing and dynamic needs of the customer

Stabilization Stage

At this stage, the business sales and profits stagnate. The business may also experience intensified competition.

- There is also market saturation by similar (“look like”) products

- Consumers’ indifference to the-product

- Sales may decline and consequently profit may decline.

This is the phase that determines whether the business has managed to meet its long term objectives and a period to assess how successful the short term objectives have been met. At this stage, the entrepreneur is more concerned about corporate governance, issues and how this impacts on customer needs. He will also be concerned with the management of the business in various departments such as finance, sales and marketing. The entrepreneur will have his sights on a higher level of competition with other, firms that belong to a higher circle, hence he see the need of turning the business into a public limited company in order to compete as such levels.

This model can be applied to the growth or otherwise of a firm. The entrepreneur thus needs to ensure that the business opportunity he has before him has a road map charted in advance and based on due diligence. This does not mean that every firm will follow the above model. The entrepreneur needs to be aware of the possible outcomes.

Innovation Stage

Organizations that fail to innovate at stabilization stage are likely to decline. To ensure the firm comes back to growth, the entrepreneur is required to re- look at the ways business has been conducted. The aim is to undertake activities differently and rescue the firm from decline. It is expected that innovative strategies would ensure accelerated growth. .

Among innovative attempts include:

- Change of management

The aim is to bring new-and better ideas that will ensure the firm is back to the growth path.

- Re- package the product/ service

This would ensure the market gets the impression of a new product that is modified and. Better than the former. It is also a strategy of winning customers back from competitors.

- Change the technology

The aim of new technology is to ensure efficiency in production and enhance customer service. It is important that the entrepreneur chooses a technology that matches the type of business he is doing

- New distribution methods .

The firm may also design new distribution methods. Changing the distribution strategy would ensure customers access their products at the convenient places especially providing personalized distributions to customers or even ensuring 24 hour service to customers

- Advertise and promote differently

The firm may decide go to different regions and promote its product or services.

Decline Stage

This stage is not in the normal plan of business. The entrepreneur does not foresee business declining at the start- up stage. Some of the experiences at this stage include:-

- Drastic fall in sales and profits

This is as a result of customers moving to competitors and in large numbers. It is also a result of consistent expenditure against limited income.

- Consumer indifference to the product/ service

This means consumers no longer prefer the product to competing brands. The entrepreneur may experience huge stocks of unsold product.

- Inability to meet bills/ debts as they fall due

This arises from persistent low income or losses against increased expenditure.

- Key management staffs leave the organizations.

This may result-from the organizations inability to remunerate top managers or provide them ‘ with adequate facilities for their performance of various tasks.

QUESTION THREE

outline four limitations of the use of social media network in an enterprise

- You will need to commit resources to managing your social media presence, responding to feedback and producing new content

- It can be difficult to quantify the return on investment and the value of one channel. Over another

- Ineffective use – for example using the network to push for sales without engaging with customers, or failing to respond to negative feedback – may damage your reputation

- The wrong online brand strategy could put you at a viral social disadvantage and may even damage your reputation, i.e. when you. Make a mistake offline, a few will know but when you make a mistake in front of hundreds or thousands of you online audience, most of them will know

- Using social media for marketing and advertising could be more time consuming than companies expect.

- In order to get social media’s full effect, you need to understand how it works, when and how to use it and which channels, to focus on depending on your end goal of using social media.

- Social media can have a. negative influence on worker productivity. Employees’ may waste valuable time using social; media channels such as Facebook and Twitter. They can also use social media to attack the company-s reputation!

- When social media is used excessively or in the wrong way, it could have serious detrimental outcomes on both mental and even physical health of individuals.

Highlight six measures that should be put in place in order to make on-line business networking more beneficial to an enterprise

Monitor your online persona

Just like you update your resume on a regular basis, you need to periodically run a web search on your own name to see what turns up in your online persona. Sometimes you can get erroneous information corrected, but often the easiest strategy is to make sure there is lots of accurate, current information about you, so the older, inaccurate information gets pushed further, down in the search results.

- Build quality relationships

Just because your profile is connected to someone else’s profile online, it doesn’t mean you have a personal connection with them. True networking is not about maximizing the number of electronic connections, but about building quality relationships with fellow professionals. Take the time to comment on your connections status updates, answer questions in discussions groups, and forward information they will find useful.

- Etiquette counts

When joining a new forum or trying out a new online tool, do your homework first Just like you wouldn’t run a new reaction without reading the literature, learn the written and unwritten rules for a newly community before jumping in. Some communities are highly structured and formal, and posting anything personal or off-topic will immediately brand you an outsider. Others are much more casual, and off-topic personal comments are allowed, or even expected. Knowing the tenor of the group, and how personal or professional members are, will allow you to frame your postings appropriately and appear neither too aloof nor too flippant.

- Contribute

Just reading discussions is useful for you, but adding to the conversation allows you to help others. As you contribute meaningful information, insights and resources, you are also building your own reputation as a knowledgeable expert, increasing the amount of positive information about you online, and making it even more likely that people will be able to find you

Think before you post

You may delete or forget what you wrote, but the internet will not. In addition, what you send privately to one person may be forwarded over and over again. Assume everyone .will see anything you write, If you want to make sure it stays private, make a phone call, or just don’t say it. The bottom line is that as long as you don’t do anything online that you wouldn’t do in person, online networking can be a great way to nurture and expand your professional network.

- Integrate social media into your overall business and marketing plans.

Determine they can work together to effectively meet your business goals.

Suggest five strategies which should which could be adopted by a local enterprise to become a multinational company

Branches

Branches are the more straightforward way to expand to another country. Simply take some cash, get the pertinent business licenses, hire a localization team and set up a branch a branch in a foreign country.

Subsidiaries

If your company is cash rich then acquisitions may be a better strategy than establishing branches. Acquiring a local company for the purpose of vertical or horizontal integration is fast and comparatively easy, provided that you plan to leave the original business (branch management, infrastructure) intact. By making the acquired company your subsidiary, you have the advantages of instant localization, name recognition and an experienced team at the helm. However, do your homework before acquiring a subsidiary, lest your company experience acquisition indigestion.

Joint venture

Perhaps you don’t want to purchase local companies due to the hefty price tag. Maybe a local competitor, who cannot be acquired, is already dominating the market .In this case, the old adage “if you can’t beat ‘them, join “them” comes, into play. Establishing a joint venture or, a partnership with a foreign company in the same industry is an attractive option. Both, companies set aside capital, resources and technology in a new, shared company which is separate from the main operations at both companies. This is a popular option in countries, such as China, where the law is extremely strict with foreign businesses. Joint ventures have all the advantages of foreign acquisitions such as localization and brand recognition at a fraction of the cost. Most joint ventures split expenditures and profits 50/50.

Franchises

A foreign affiliate will purchase a license from your company to use your brand in a foreign country. While the foreign affiliate retains ownership of your branded business, your company will receive royalties from each franchise. Franchising is the cheapest option and the fastest way to build an established presence in a foreign country with minimal risk. The higher risks (sales, profitability) are all absorbed by the foreign affiliate. However, foreign franchises have to be monitored closely, since the geographic and cultural divide can mask brewing problems.

Turn key Projects

Turn key projects are more common in businesses requiring precise technological expertise such as power plants, factories or oil drilling platforms. In this setup your business sells Its technological know-how to a foreign firm, which pays your company to build a modified copy of your plant to their specifications, from scratch to the operational stage. This includes all of your technologies and trade secrets. Once the plant is completed, you hand over the keys to the fully working- plant to the foreign firm. All they have to do is “turn the key” to get started. While selling factories is extremely profitable, you also forfeit your own direct expansion plans in the country, due to another firm already holding the license to your technology. This is the trickiest of the five criteria and the one you’re least likely to encounter, unless your company specializes in mass production or resource exploration plants focused on developing markets.

QUESTION FOUR

In the recent past, the prices of basic commodities have been on an upward trend party due to the global recession and social unrests in some oil producing Middle East countries. In relation to the above statement, identify four negative effects of the uncontrollable upward trend in prices of go and services on entrepreneurship

- Investment and long term economic growth is discouraged. This is because of the uncertainty and confusion that is more likely to occur during periods of high prices of goods and services.

- An economy can be rendered uncompetitive. This is particularly important for countries in the Euro-zone because they can’t devalue to restore competitiveness.

- Reduced value of savings. Increase in prices leads to a fall in the value of money. This makes savers worse off and can lead to a redistribution of income in society.

- Menu costs of changing prices lists. Not so significant with modern technology

Outline four reasons why it is important for an entrepreneur to have good organization structure in the enterprise

- It promotes success.

Businesses require structure to grow and be profitable. Designing an organization structure helps top management identify talent that needs to be added to the company planning the structure ensures there are enough human resources within the company to accomplish the goals set forth in the company’s annual plan. It is also important that responsibilities are clearly defined. Each person has a job description that outlines duties, and each job occupies its own position on the company organization chart

- Communication

The flow of information is essential to an organizations success. The organization structure should be designed to ensure that individuals and departments that need to coordinate their efforts have lines of communication that are built into the structure. The financial planning and analysis department might report to the Chief Financial Officer and the Senior Vice President of Marketing, because both of these members of the top management team depend on information and reports provided by financial planning.

- Reporting Relationships

Reporting relationships must be clear so all members of the organization understand what their responsibilities are and know to whom they are accountable. These clear relationships make it easier for managers to supervise those in lower organization levels. Each employee benefits by knowing whom they can turn to for direction or help. In addition, managers are aware of who is outside the scope of their authority, so ‘hey do not overstep their bounds and interfere with another manager responsibilities.

- Growth and Expansion

Companies that grow rapidly are those that make the best use of their resources, including management talent. A sound organization structure ensures that the company has the right people in the right positions. The structure may suggest weak spots or deficiencies in the company’s current management team. As the company grows, the organization structure must evolve with it. Many times more layers of management are created, when one department head has too many individuals reporting to him at one time to give each employee the attention and direction needed for the employee to succeed.

- Task Completion

A well-designed organization structure facilitates the completion of projects. Project managers can better identify the human resources available to them if the scope of each department’s responsibility and each team member s capabilities–is clear. A project to develop a new product would require market research. The project manager needs to know who in the organization can provide this research, and whose permission must be obtained for the research to be done.

- Fits Company’s Needs

Companies in different industries require different mixes of talent and a relatively greater emphasis on certain management functions. A software company often has a large development staff structuring the reporting relationships within the development team so creativity and productivity are maximized, and deadlines are met, is vital to that type of company’s success. Companies often have to go through a reorganization phase in which individual positions or even whole departments are repositioned on the organization chart in an effort to better utilize the company’s human resources and make the operation run more smoothly.

A business venture starts with an initial idea.

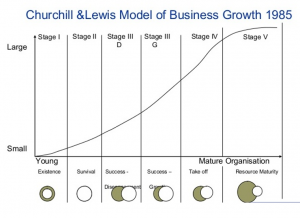

With the help of a suitable diagram, illustrate the Churchill and Lewis model of business growth

According to Neil C. Churchill and Virginia L. Lewis the following are the five stages of Business growth

- Existence

- Survival

- Success

- Take-Off (Growth)

- Resource Maturity

In this article, we will go over each stage of small business growth to help you determine where your business is and what you can do next.

Stage 1: Existence

A small business at this stage is challenging, especially since the owner is doing most of the work. One of the largest pain points is obtaining customers and delivering on the product or service. In order to remain alive, a new business must seek customers.

Stage 2: Survival

A business in this stage is now a more efficient working entity with some profit. The next step here is to ensure that profit remains. Therefore, again, businesses in this stage also need to seek customers as well as start looking at the return on investment (ROI).

In essence, merely staying open isn’t sufficient anymore. The businesses in survival stage must be establishing systems and processes to consistently ensure that ROI maintains and grows.

Stage 3: Success

Once systems are established and profits are consistent, the small business is now successful. The choice becomes continue to grow or maintain the success created until this point.

Having systems in place is a vital difference between Survival and Success stages. At the success stage, the owner is no longer doing the bulk of the work. The reason for waning the owner from major tasks is for continued growth as well as the opportunity to sell. And, everyone deserves a vacation once in a while.

Stage 4: Take-Off (Growth)

In this stage, the small business now requires increase in capital in order to accommodate the higher volumes of customers. This means more staff, more equipment and materials and better processes. At this stage, a small business has the chance to be a big company. However, if mismanaged, the small business could fail as a result of poor cost management of expenses over revenue.

Stage 5: Resource Maturity

A small business reaches maturity once it is ready for diversification. The company is now big and runs at a slower pace. This does not mean that a mature company will be unable to react to market changes. Hence, the need for diversification and finding other, related products and markets to tap and to expand the existing customer base beyond the reaches of the original business model. This will keep the company in flux, as parts of the company will now be in varying stages of growth.

QUESTION FIVE

- Analyze the limitations associated with a franchise arrangement

- Higher legal expenses

The necessity of preparing agreements, and related documents, and filing them in various states (with attached audited financials) represents a significant expense, although the year-to-year expenses are generally less than those initially incurred in setting up the structure and related documents. Additional legal (and possibly accounting) costs will be incurred if a separate legal entity is used for the franchising program.

- Regulation of the relationship

Franchise laws are particularly technical in their application (for example, if a Franchisor provides only 9 days of pre-sale disclosure rather than the required 10, the Franchisee has an automatic rescission right, even though the missing day was not the cause of any loss.)

- Technical constraints

Franchise laws in a number of states regulate the circumstances in which a Franchisor may terminate or refuse to renew a franchise. While generally not preventing Franchisors from achieving termination or non-renewal, these laws do present a number of technical requirements that must be complied with.

- Franchising marketing constraints

Advertisements, brochures, flip charts, video tapes, etc. offering the franchise (but not retail advertisements) must be pre-cleared with state agencies and cannot contain earnings claims.

- Control issues

As with dealerships, there may be quality control and related issues, at least as compared to company-owned operations.

- Business relationship issues

Perhaps more than with dealers, Franchisees typically view themselves as, to some degree, partners with the Franchisor in the development and possible success of the system. While most will agree that committee management doesn’t work and that there needs to be “one captain for the ship” a wise Franchisor will work with his Franchisees, probably with the help of a franchise advisory council, in charting strategic directions, implementing marketing plans, etc. A Franchisor must be psychologically comfortable working with Franchisees who will understandably take the view that “if we’re going to be in on the landing, we’d like to be in on the takeoff too”

- Potential loss of freedom

Unless carefully designed, awards of “exclusive territories” may generate legal and other problems when a Franchisor seeks to expand through alternative channels of distribution (Internet, mail order, etc.), co-branding opportunities, mergers with existing competitive chains, etc. Appropriate franchise agreement provisions, and prope education of Franchisees, and management of their expectations, can largely avoid these issues.

- Finding qualified franchisees

As may be true with dealerships, but more importantly where the franchise relationship is long term, finding and educating (not just training) good Franchisees is vital. The ideal Franchisee combines entrepreneurial energy with the willingness to follow systems and act as a “team player” Psychological testing and a detailed interview and training process are tools which many Franchisors use to select the right individuals.

- Unmanaged growth

Given franchising demonstrated potential for rapid expansion (financed primarily by Franchisees), the potential downside is too rapid expansion, with the needs of the Franchisees outstripping the support capabilities of the Franchisor.

In the context of business expansion, describe the factors that an entrepreneur should consider before making a business acquisition

- Take time to get to know the seller as well as his/her business—often the most successful acquisitions result from the personal chemistry that has developed from an existing business relationship, it can make negotiations easier, simplify due diligence and provide a barometer for integration potential.

- Consider hiring an investment banker—the decision whether to hire a buy-side investment banker depends on your knowledge of the pricing of comparable companies in your industry, the analytical capabilities of your financial team, and your experience in making acquisitions. Bankers can greatly increase the likelihood you will be successful. Fees should be payable upon success.

- Don’t get swept away in an auction process—Sellers often conduct an auction that can cause a buyer to lose its discipline for the sake of winning. A smart buyer sets its price parameters based on its own analysis of the targets market and prospects, and how the combined businesses w 11 match up. Sometimes the best deal decision is to pass.

- Pick the right inside deal leader—while acquisitions might begin with a discreet dinner between CEOs, a busy CEO is often not the best management point person for the deal. The deal leader should be a person who can tolerate legal and financial detail, is even tempered and can establish clear lines of responsibility. Often this is an Investment Banker.

- Make sure your letter of intent is non-binding, except for binding “no-shop” provisions—a letter of intent helps identify key business points and demonstrates to financing sources that the deal is real. Make sure that it is not a binding commitment to complete the purchase without the customary buyer protections found in a final purchase and sale agreement. There should be a binding commitment by the seller to not use your offer to shop for a better deal.

- Measure pre-closing operations objectively—it is not enough to provide in the acquisition agreement that the target will be run in the ordinary course of business between the signing of the agreement and closing. Objective measures, such as seller having a specified net worth at closing, provide clear protection for the buyer and help avoid disputes.

- Understand how to structure the deal— Due to a current lack of availability of financing for acquisitions, few deals are done today for “all cash”. Most transactions require a combination of cash, seller financing, and earn-out. If you can’t agree on price, consider an earn-out that entitles the seller to deferred payments if the target performs as advertised. Earn-out provisions are heavily negotiated and can dictate how the acquired business must be run and what happens if it is sold or shelved during the earn-out period.

- Remember to take care of the most important asset: people—Successful buyers often enlist the early support and confidence of sellers’ management. Private buyers frequently use creative bonus arrangements, rather than equity, to entice targets management given the illiquid nature of their stock. For the rank-and-file, a skilled human resources manager can send a reassuring signal by carefully planning a seamless transition of benefits.

- Begin integration planning early—Post-transaction integration teams with representatives from both companies should start early on the integration of products and technology, information systems, operations, and employee benefits. The success of this effort will often determine whether the revenue enhancements and cost savings that prompted the transaction will be realized.

- Never lose control of the process – Regardless of the experience, talent, and acknowledge of your advisors (legal, tax, banking, etc.), remember that in order to close a deal you have to control negotiations, deadlines, etc. Never leave the important decisions to others. Remain flexible.

QUESTION SIX

Highlight five behavior’s exhibited by employees which indicate the need for team building work

- Conflict among the workers

- Miscommunication

- missed deadlines

- low morale among the employees

- Confusion about who does what

- Lack of empowerment to get the job done

QUESTION SEVEN

Outline seven measures that an entrepreneur could put in place to minimize bad debts arising from dishonored cheques issued by debtors

- Accept only cheques from credit worthy customers.

- Accept only where possible a bankers cheque.

- Ensure that funds are available in the debtors account before accepting cheque payments.

- Review the debtors past history before accepting a cheque from the same debtor.

- Fix a fee charge on any cheque dishonoured and ensure that the penalty becomes compensating

- Accept only cheques in certain amounts of debts.

- Register with debt collectors for recovery of bad debts or doubtful debts.

Highlight seven market entry strategies available to an entrepreneur at the start-up stage of the business cycle.

- Reduce price to penetrate an existing market. By introducing a product at a lower price than the pioneer’s, a latecomer can attract new customers who would not have otherwise purchased such a product in effect expanding the total market

- Improve a product or service, with focus on a niche market. Companies can compete by being innovative in the marketplace. The innovation may be radical or incremental. One example of incremental innovation is an enhanced version of an. existing product. The enhanced product can compete directly with existing products, or it can be positioned to attract a smaller segment of the existing market.

- Target new geographic markets for existing products. As markets mature in the home base, companies traditionally look outside to more lucrative markets. Most consumer goods companies,, for instance, are setting their sights on China. Many heavy equipment manufacturers are targeting newly emerging markets that will need tractors and cranes for building.

- Develop new channels of distribution to access new markets or better penetrate existing ones. Going global is not the only solution. Sometimes the risk and the investment required to penetrate international markets may not be worth the return. Focusing on existing markets, where your company has a good understanding of the environment, can prove less risky and bring quicker successes.

- Exporting is the most traditional and well established form of operating in foreign markets. Exporting can be defined as the marketing of goods produced in one country into another.

- Piggybacking -The method means that organisations with little exporting skill may use the services of one that has. Another form is the consolidation of orders by a number of companies in order to take advantage of bulk buying. Normally these would be geographically adjacent or able to be served, say, on an air route.

- Countertrade; By far the largest indirect method of exporting is countertrade. Competitive intensity means more and more investment in marketing. In this situation the organisation may expand operations by operating in markets where competition is less intense but currency based exchange is not possible. Also, countries may wish to trade in spite of the degree of competition, but currency again is a problem. Countertrade can also be used to stimulate home industries or where raw materials ore in short supply It can, also, give a basis for reciprocal trade.

- Licensing: Licensing is defined as “the method of foreign operation whereby a firm in one country agrees to permit a company in another country to use the manufacturing, processing, trademark, know-how or some other skill provided by the licensor”.

- Joint ventures – Joint ventures can be defined as Am enterprise in which two or more investors share ownership and control over property rights and operation” Joint ventures are a more extensive form of participation than either exporting or licensing. In Zimbabwe, Olivine industries have a joint venture agreement with HJ Heinz in food processing.

- Ownership: The most extensive form of participation is 100% ownership and this involves the greatest commitment in capital and managerial effort. The ability to communicate and control L00% may outweigh any of the disadvantages of joint ventures and licensing. However, as mentioned earlier, repatriation of earnings and capital has to be carefully monitored. The more unstable the environment the less likely is the ownership pathway an option.

- Export processing zones (EPZ) :Whilst not strictly speaking an entry-strategy, EPZs serve as an “entry5 into a market. They are primarily an investment incentive for would be investors but can also provide employment for the host country and the transfer of skills as well as provide a base for the – flow of goods in and out of the country.

QUESTION EIGHT

Describe features of the five stages of the business life cycle

Stage One

The first stage of any business is obvious establishment. At this, stage, the business is being created, planned and the early days of its operations take place.

For some, this is the only stage that a business may see, as it is by far one of the most difficult to survive. Many things can go wrong at this stage; thus, good business planning a crucial and necessary part of it.

Without a good business plan, it is impossible to get a small business off the ground, running and eventually moving through to the next stages of its life cycle.

Stage two

The second stage is the growth period.

During this stage, a business has an initial time of negative profit until it break even and begins to show increased revenues that allow it to truly grow. This is also the stage that the real test of a business comes into play.

How the business is managed and how it is able to compete within its designated market will determine whether it will survive, heading to the next stage – or whether it will decline and reach the last stage of its life’.

Stage Three

The third stage is about expansion. This is the point at which a business gets to the point where there is sufficient revenue being brought in so that there are no doubts of its survival and it can expand its horizons.

This includes taking on staff, expanding the office space of the business or even investing in equipment to deal with a larger base of clientele. This stage also entails producing more products if necessary.

Stage Four

The fourth stage is about maturity

The business is now stable enough to survive most unforeseen circumstances. It has enough backing, capital and support to ensure that even if the market becomes unstable, it can pull through

This may be accomplished rearranging, its management plan, getting, rid of one product to replace another or adding an additional product to an already existing product line. However, if the market declines, it may survive, though its profits may take a temporary slide backwards

Stage Five

The fifth stage is about decline. In fact, it is the easiest stage to reach for any business because it is the point where a starting business will fail.

An existing business, even a mature one, can decline in profits, take heavy losses and eventually either fall or cease operations to avoid further losses. As any small business owner can attest to, the stages of business are necessary and a normal part of the small business life cycle.