MONDAY: 5 December 2022. Afternoon paper. Time Allowed: 2 hours.

This paper is made up of fifty (50) Multiple Choice Questions. Answer ALL the questions by indicating the letter (A, B, C or D) that represents the correct answer. Do NOT write anything on this paper.

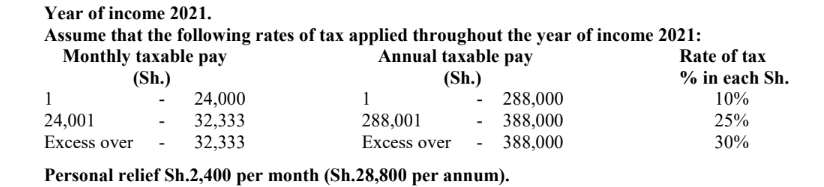

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax).

1. Which of the following dividends are NOT fully exempted from taxation?

A. Dividends received by an insurance company from its life fund

B. Dividends received from registered companies and Sacco

C. Dividends received from outside Kenya

D. Dividends received when a company is winding up (2 marks)

2. Which one of the following fall under classification of tax by rate?

A. Income taxes

B. Rental taxes

C. Production taxes

D. Progressive taxes (2 marks)

3. Which one of the following is NOT a right of Commissioner of VAT?

A. To expect that information obtained in the course of duty by the VAT officers shall be treated in confidence

B. To demand security from any taxable person for the unpaid tax

C. To retain books of account for a period long enough for him to complete his examination

D. To take samples of goods of a taxable person without payment (2 marks)

4. Which of the following is a method of tax avoidance?

A. Buying assets to enjoy capital allowances instead of leasing

B. Importing business to avoid high local production cost

C. Use of own capital to avoid interest charge by financial institutions

D. Overstating expenses to reduce taxable income. (2 marks)

5. For the purpose of computing housing benefit, employees are classified into three categories. Which one is not among the categories?

A. Ordinary employee and a wholetime service director

B. Agricultural employee

C. Directors other than whole time service director

D. Ordinary employee and low-income employee (2 marks)

6. Which one of the following is a source of revenue for a county government?

A. Advance tax

B. VAT tax

C. Fees and charges

D. Stamp duty (2 marks)

7. Which one of the following is NOT a positive role of excise duty in an economy?

A. Protect local industries from cheap imports

B. It raises revenue for the government

C. Discourage consumption of harmful products

D. Discourages growth of local industries (2 marks)

8. Which of the following rates is NOT applicable for advance tax for vans, pick-ups, trucks, prime movers and lorries

A. For public service vehicles higher of Sh.1,500 per ton load capacity per annum or Sh.2,400 per annum

B. For passenger carrying vehicles for every driver Sh.3,600 and for every conductor Sh.1,200 per annum

C. For minibus, station wagons and saloon cars higher of Sh. 60 per passenger capacity or Sh.2,400 per annum

D. For passenger carrying vehicles higher of Sh.250 per passenger capacity or Sh.2,400 per annum

(2 marks)

9. Which one of the following conditions must be fulfilled for passage to be excluded from taxation of an employee’s income ?

A. The employee must be a citizen of Kenya

B. The employee must be recruited or engaged in Kenya

C. The employee must get travel allowances from the employer

D. The employee must be solely in Kenya to serve the employer (2 marks)

10. The following are offences under the value added tax (VAT) Act EXCEPT?

A. Failure to register when eligible

B. Failure to supply taxable goods

C. Failure to issue a tax invoice

D. Failure to keep proper records (2 marks)

11. Which one of the following is NOT an objective of taxation?

A. To raise revenue

B. Equal distribution of resources

C. To bring peace

D. Economic stability (2 marks)

12. Which one of the following is a factor affecting tax shifting?

A. Type of market

B. Type of government

C. Type of company

D. Amount of revenue required (2 marks)

13. Which of the following is a tax-free benefit?

A. School fees paid by the employer for the employee’s children if it was taxed on the employer.

B. Employer contribution to unregistered pension scheme on behalf of an employee.

C. School fees paid by employer on behalf of employees’ children which has be expensed in employers’ books of accounts.

D. Medical benefits of senior staff in a company. (2 marks)

14. Explain the tax position of benefits in kind received from employer?

A. It is a tax-free benefit.

B. It is a tax-free benefit if it does not exceed Sh. 36,000 per annum.

C. It is allowable deduction up to Sh. 36,000 per annum.

D. It is a taxable benefit up to Sh. 36,000 per annum. (2 marks)

15. What is the tax position of contribution made to National Housing Development Fund under the affordable housing scheme?

A. It reduces the tax liability by 15% of the gross contribution subject to a maximum of Sh.108, 000 per annum

B. It is allowable deduction up to Sh.108,000 per annum

C. It is allowable deduction whereby the allowable amount is 15% of the gross contribution

D. It is allowable deduction up Sh.96,000 per annum (2 marks)

16. Which of the following transactions do NOT require a KRA Personal Identification Number (PIN)?

A. When applying for affidavit

B. When applying for passport

C. When registering a motor vehicle

D. When applying for insurance cover (2 marks)

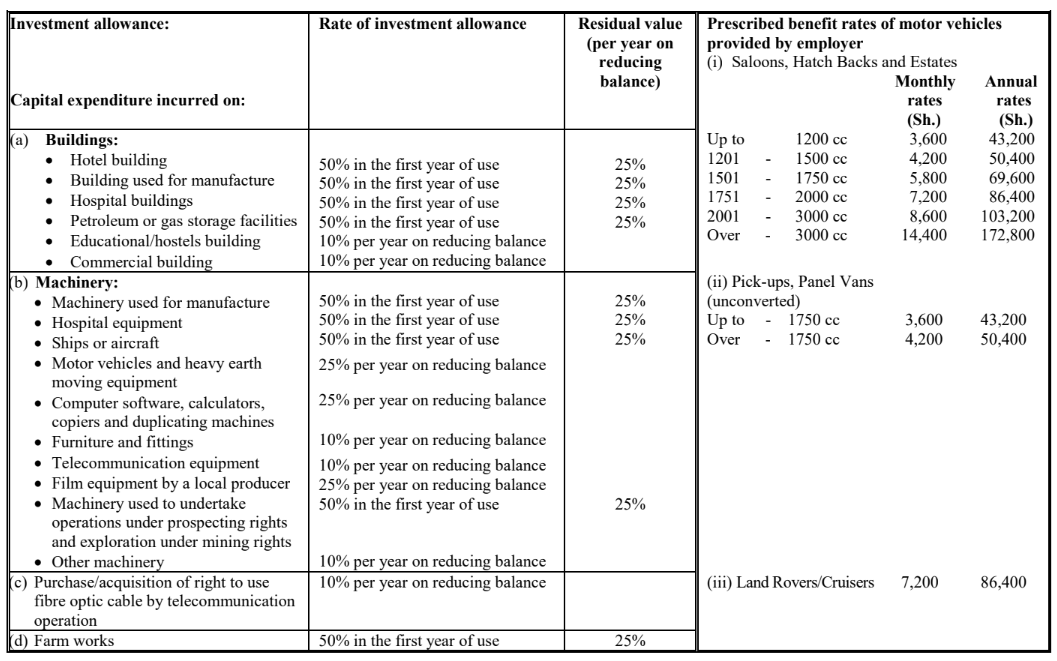

17. The following machineries qualify for investment allowance at the rate of 50% EXCEPT?

A. Lawnmower

B. Conveyor belt

C. Boiler

D. Transformer (2 marks)

18. What is the tax position of monthly pension income received by an individual aged 65 years and above?

A. Tax free up to Sh. 25,000 per month

B. Tax free up to Sh. 20,000 per month

C. Tax free up to Sh. 30,000 per month

D. Tax free in full (2 marks)

19. The following changes occurring to a registered VAT trader must be notified to the commissioner within 14 days EXCEPT?

A. Change of physical address of the business

B. Changes of partners in a partnership deed

C. Closure of place of business

D. Change of accountants in the business (2 marks)

20. Which of the following goods is NOT subject to pre-shipment inspection?

A. Used motor vehicles

B. New motor vehicles

C. Refrigerator, refrigeration equipment and air conditioners

D. Pharmaceutical, medical, dental and veterinary consumables (2 marks)

21. Which one of the following statements does NOT explain when value added tax (VAT) is due and payable?

A. When the goods are manufactured and packed ready for distribution

B. When goods or services are supplied to the purchaser

C. When an invoice is issued in respect of the supply

D. When part or full payment for the supply is made (2 marks)

22. The income of a taxable person can be assessed on another person under the following circumstances EXCEPT?

A. When a taxable person is a minor

B. When a taxable person is insane

C. When a taxable person is deceased

D. When a taxable person is illiterate (2 marks)

23. Which of the following assets matches its rate of investment allowance?

A. Boiler – 25% first year of use

B. Sport pavilion – 10% per year reducing balance

C. Air purifier – 10% first year of use

D. Fax machine – 12.5% per year reducing balance (2 marks)

24. Although value added tax (VAT) contributes significantly to government revenue, it has limitations which impact on the government, tax payers and the economy at large. Which of the following is not a limitation of VAT?

A. High tax avoidance and evasion where invoicing is not strictly enforced

B. It affects all the taxpayer uniformly since its proportional

C. Its discriminatory where some goods and services are not vatable

D. It requires many statutory records which are complicated to process (2 marks)

25. Charles Andai traded-in his duplicating machine A with a new duplicating machine B. The cost of the new duplicating machine B was Sh.336,000. The old duplicating machine A had a net book value of Sh. 126,000. He paid a cash of Sh.262,500 to obtain the new duplicating machine. What is the disposal value of the old duplicating machine?

A. Sh.126,000

B. Sh.73,500

C. Sh.262,500

D. Sh.210,000 (2 marks)

26. Betamax Ltd. purchased raw materials for Sh.1,334,000 inclusive of VAT, they incurred transport cost of Sh. 322,000 and conversion cost of Sh.460,000. The improved product was sold at a profit mark up of 10%. Determine VAT payable by Betamax Ltd.

A. Sh.184,000

B. Sh.156,032

C. Sh.339,250

D. Sh.372,416 (2 marks)

27. Joel Mutunga purchased a building in the year 2016 for Sh.5,440,000. He incurred Sh.168,000 valuation fee, Sh.144,000 agents commission and changing roof Sh. 240,000 He is anticipating to sell the building in the year 2023 January. Calculate the adjusted cost for capital gain tax purpose.

A. Sh.5,440,000

B. Sh.5,992,000

C. Sh.5,752,000

D. Sh.5,608,000 (2 marks)

28. Mary Akinyi received a basic salary of Sh.1,000,000 in the year 2021. She also received an annual medical allowance of Sh.187,500. She received an annual pension income of Sh.175,000. From her previous employer. What is Mary Akinyi’s taxable income for the year 2021?

A. Sh.1,187,500

B. Sh.1,000,000

C. Sh.1,362,500

D. Sh.1,012,500 (2 marks)

29. Kiandiko Kivuva received an income of Sh.1,040,000 for the year 2021. He took a mortgage loan to acquire his own house from Tatua Bank on 1 February 2021 amounting to Sh.3,900,000 at an interest rate of 4% per annum. What is Kivuva’s taxable income for the year ended 31 December 2021?

A. Sh.1,040,000

B. Sh.1,157,000

C. Sh.897,000

D. Sh.932,750 (2 marks)

30. Joly Max Manufacturing Ltd. started operations on 1 March 2021 to manufacturer animal feeds. The following expenses were incurred:

Sh.

– Factory building 3,360,000

– Plant and Machineries 1,080,000

– Office Buildings 720,000

– Equipment 336,000

– Motor Vehicles 1,800,000

Compute Joly Max Manufacturing Ltd.’s investment allowance for the year ended 31 December 2021?

A. Sh.7,296,000

B. Sh.2,826,000

C. Sh.1,824,000

D. Sh.3,648,000 (2 marks)

31. During the year ended 31 December 2021, Joyrass Enterprises bought two saloon cars at a cost of Sh.7,200,000 and one delivery van at Sh.1,800,000. One of the saloon cars was involved in an accident and the company was compensated Sh.2,400,000 by the insurance. Compute the investment allowance claimable by Joyrass Enterprises?

A. Sh.2,250,000

B. Sh.1,625,000

C. Sh.1,450,000

D. Sh.1,750,000 (2 marks)

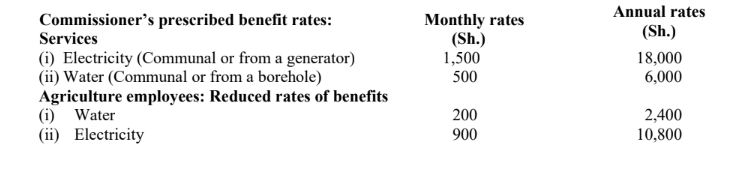

32. Margaret Dama is an employee of Uwezo Ltd. During the year 2021, she received a basic salary of Sh.1,152,000. She was housed by the employer with effect from 1 May 2021 in a rented house. She contributed Sh.240,000 during the year to an insurance company to cover her life. How much is the total taxable income for Margaret Dama for the year ended 31 December 2021?

A. Sh.1,392,000

B. Sh.1,267,200

C. Sh.1,324,800

D. Sh.1,252,800 (2 marks)

33. A company incurred the following legal fees in the year 2021.

Sh.

– Legal fees relating to debt collection 96,000

– Legal fees relating to company formation 192,000

– Legal fees relating to issue of debentures 112,000

– Legal fees relating to issue of tender documents 64,000

How much should the company deduct as allowable expense for tax purpose?

A. Sh.464,000

B. Sh.272,000

C. Sh.160,000

D. Sh.224,000 (2 marks)

34. Esbon Nyakundi received basic salary of Sh.65,000 in the month of November 2021 net of PAYE of Sh. 14,000. The employer contributed Sh.15,000 per month to cater for insurance for Esbon Nyakundi’s life insurance premium. Determine his total tax payable for the month of November 2021.

A. Sh.18,783.1

B. Sh.22,983.1

C. Sh.8,983.1

D. Sh.6,733.1 (2 marks)

35. Cosmas Bundotich obtained a loan amounting to Sh.3,600,000 from employer, Mumberes Ltd, at an interest rate of 9% per annum while the market rate was 12% per annum. What is the fringe benefit tax per month?

A. Sh.2,700

B. Sh.32,400

C. Sh.9,000

D. Sh.108,000 (2 marks)

36. Riana Ltd.’s trading profit for the year ended 31 December 2021 has been arrived at after deducting the following items:

Sh.

• Finance cost 163,800

• Amortisation 592,800

• Donation to street children 184,600

• Loss on sale of furniture 156,832

What amount should be added back to the trading profit when calculating the adjusted taxable profit?

A. Sh.1,098.032

B. Sh.941,200

C. Sh.913,432

D. Sh.934,232 (2 marks)

37. Kikwetu Ltd. had the following expenses deduced from its accounts before determining the net profit for the year ended 31 December 2021:

Sh.

Legal fee for breach of contract 60,000

Parking fines 15,200

Depreciation of furniture 30,500

License and permits 28,000

Salaries and wages 184,000

VAT paid 32,000

How much would the company add back to its accounting profits to arrive at its tax adjusted profit?

A. Sh.137,700

B. Sh.105,700

C. Sh.289,700

D. Sh.229,700 (2 marks)

38. Bahari Ltd is a withholding tax agent and deals with skin care products. During the month of October 2022, the company purchased goods from Mahari Ltd. worth Sh.1,127,520 inclusive of VAT. How much tax did the

company withhold?

A. Sh.155,520

B. Sh.174,960

C. Sh.19,440

D. Sh.58,320 (2 marks)

39. Martin Ouma is an employee of Maendeleo Ltd. During the year ended 31 December 2021, he was provided with a company car of 2500cc which had cost the company Sh.1,500,000 at the beginning of the year. How much was the car benefit due to Martin Ouma for the year ended 31 December 2021?

A. Sh.375,000

B. Sh.103,200

C. Sh.180,000

D. Sh.360,000 (2 marks)

40. Jamii Ltd. imported a processing machinery in December 2021 valued at Sh. 1,800,000 being cost, insurance and freight excluding import duty and VAT. Import duty rate was 25% while VAT rate was 16%. Determine the V.A.T payable in the Month of December 2021?

A. Sh.360,000

B. Sh.180,000

C. Sh.288,000

D. Sh.252,000 (2 marks)

41. Linkon Limited started ferry operations in the year 2021 after incurring various capital expenditures among them a ferry of 350 tonnes which was purchased at a cost of Sh.34,000,000. What is Linkon Limited’s investment allowance for the year 2021?

A. Sh.8,500,000

B. Sh.17,000,000

C. Sh.13,600,000

D. Sh.3,400,000 (2 marks)

42. Hamisi pays Sh.9,000 to a registered pension scheme, while his employer contributes a similar amount. Which of the following statement is TRUE?

A. Hamisi has a taxable benefit of Sh.9,000 and his taxable income reduced by the same amount

B. Hamisi has a tax-exempt benefit of Sh.9,000 and his taxable income reduced by the same amount

C. Hamisi’s taxable employment income is reduced by Sh.18,000

D. Hamisi has a taxable benefit of Sh.18,000 (2 marks)

43. Uninice Ltd. imported raw material from Yokohama Japan valued at Sh.7,200,000 being cost. The freight and insurance charges amounted to Sh.1,800,000. The import duty of 25% was waived by the government. Determine the VAT payable by Uninice Ltd. from this import.

A. Sh.1,152,000

B. Sh.1,440,000

C. Sh.1,800,000

D. Sh.2,250,000 (2 marks)

44. The following gifts and rewards are taxable EXCEPT?

A. If given by an employer in recognition of the service rendered

B. If given by the customer in recognition of services rendered

C. If given for attaining a certain target

D. If given by employer as birthday present (2 marks)

45. The following are examples of miscellaneous charges and levies EXCEPT?

A. Airport tax

B. Advance tax

C. Catering tax

D. Petroleum tax (2 marks)

46. The following are scope of taxable services under the digital services tax regulations EXCEPT?

A. Downloadable digital contents

B. Over the top services including streaming television shows

C. Provision of digital market place

D. Accessing of digital interface (2 marks)

47. The following are rules of taxing income in Kenya EXCEPT?

A. The income must have accrued in Kenya

B. The payment of the services must have originated in Kenya

C. The services must have been rendered in Kenya

D. The recipient of the income must be in Kenya (2 marks)

48. Which of the following rates is applicable under VAT Act?

A. 18%

B. 12%

C. 08%

D. 06% (2 marks)

49. Which one of the following is allowable expense while computing taxable income for a limited company?

A. General bad debt

B. Value added tax paid

C. Depreciation expenses

D. General expenses (2 marks)

50. The following are reasons why accounting profits are different from taxation profit EXCEPT?

A. Some expenses deducted in the accounting profit are not allowable for tax purposes

B. Some expenses deducted in the accounting profits are specifically mentioned in the Income Tax Act as non-allowable

C. The person preparing the accounting profits is different from the one preparing taxable profit

D. Some incomes included in the accounting profits are not taxable income (2 marks)