TUESDAY: 26 November 2019. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated.

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2018.

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 – 12,298 1 – 147,580 10%

12,299 – 23,885 147,581 286,623 15%

23,886 35,472 286,624 425,666 20%

35,473 – 47,059 425,667 564,709 25%

Excess over 47,059 Excess over 564,709 30%

Personal relief Sh.1,408 per month (Sh.16,896 per annum).

Prescribed benefit rates of motor vehicles provided by employer

Monthly rates Annual rates

(Sh.) (Sh.)

(I) Saloons, Hatch Backs and Estates

Up to 1200 cc 3,600 43,200

1201 1500 cc 4,200 50,400

1501 1750 cc 5,800 69,600

1751 2000 cc 7,200 86,400

2001 3000 cc 8,600 103,200

Over 3000 cc 14,400 172,800

2. Pick-ups, Panel Vans (unconverted)

Up to 1750 cc 3,600 43,200

Over 1750 cc 4,200 50,400

3. Land Rovers/Cruisers 7,200 86,400

Commissioner’s prescribed benefit rates

Monthly rates Annual rates

Services (Sh.) (Sh.)

1. Electricity (Communal or from a generator) 1,500 18,000

2. Water (Communal or from a borehole) 500 6,000

Agriculture employees: Reduced rates of benefits

1. Water 200 2,400

2. Electricity 900 10,800

QUESTION ONE

1. Identify four constitutional commissions and two independent offices as outlined in Chapter fifteen of the Kenya Constitution, 2010. (6 marks)

2. In relation to Public Procurement and Asse,t,Disposal Act, 2015, distinguish between “pre-qualification procedure” and “supply chain management” (4 marks)

Summarise five roles of the Public Procurement Regulatory Board. (5 marks)

3. Highlight five functions of Public Sector Accounting Standards Board (PSASB). (5 marks)

(Total: 20 marks)

QUESTION TWO

1. Discuss four functions of the public debt management office as provided for under the Public Finance Management Act, 2012. (8 marks)

2. Kevin Muteta is a businessman operating as Kevta Enterprises and he is registered for value added tax (VAT) purposes.

Kevin has presented the following information relating to the transactions for the month of December 2018:

December 1: Opening stock was valued at Sh.900,000.

December 5: Imported goods valued at Sh.120,000 being cost, insurance and freight excluding import duty and VAT. Import duty rate was 20% during the month.

December 8: Purchased goods from Joe Mwazia for Sh.450,000.

December 9: Sold goods valued at Sh.810,000 to Poa Ltd. which is a withholding tax agent.

December 9: Purchased goods valued at Sh.600,000 from Kyama Ltd.

December 11: Paid Sh.15,000 for photocopying and printing of office documents.

December 12: Purchased furniture from King Ventures Ltd. for office use at a cost of Sh.90,000.

December 15: Sold goods to Mamba Ltd., a withholding tax agent for Sh.405,000.

December 17: Sold goods to Lukenya Enterprises for Sh.255,000.

December 18: Paid electricity expenses Sh.22,500 and telephone expenses Sh.11,500.

December 20: Paid for catering expenses Sh.28,500.

December 24: Sold goods to Lewis Karimi for Sh.300,000.

Additional information:

- Transactions are inclusive of VAT at the rate of 16% where applicable.

- VAT is withheld at the rate of 6% by the withholding tax agent.

Required:

Calculate for Kevta Enterprises for the month of December 2018:

Input VAT. (5 marks)

Output VAT. (4 marks)

VAT payable or refundable. (3 marks)

(Total: 20 marks)

QUESTION THREE

1. In a tax conference, one of the facilitators noted that, “most of the developing countries have introduced information communication technology (ICT) in taxation”.

With reference to the above statement, suggest four benefits that could be derived from application of IC-r by the taxpayers and revenue authority. (4 marks)

2. Outline four rights of a registered person for value added tax (VAT) purposes. (4 marks)

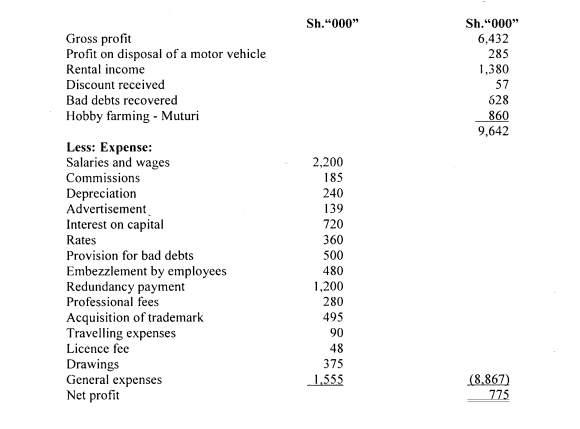

3. Muturi and Mwema are partners trading as Moonlight Enterprises and sharing profits and losses in the ratio of 1:3 respectively. The partners presented the following income statement for the year ended 3 I December 2018:

Additional information:

- Commissions include Sh.85,000 paid to Mwema.

- Salaries and wages include Sh.510,000 and Sh.565,000 paid to Muturi and Mwema respectively.

- Interest on capital relates to Sh.320,000 and Sh.400,000 paid to Muturi and Mwema respectively.

- Provision for bad debts include: Sh.

Specific provisions 220,000

General provisions 280,000

- Drawings relates to cash taken from the business by the partners as follows:

Sh.

Muturi 210,000

Mwema 165,000

- General expenses include:

Sh.

Fine and penalties 85,000

Staff NSSF contributions 40,000

Bank loan interest 180,000

Transfer to capital reserves 1,250,000

- Rates relate to the rental income received during the year.

- Licence fee relate to advance payment for the year 2019.

- Bad debts recovered relate to sale of equipment.

- Professional fees was earned by Muturi.

Required:

Adjusted profit or loss for the partnership business for the year ended 31 December 2018. (9 marks)

The allocation of profit or loss in (c) (i) above to the partners. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. Discuss four principles of an optimal tax system as advocated by Adam Smith. (8 marks)

2. John Mwea is an employee of Mavuno Ltd. He has provided the following information relating to his income for the year ended 31 December 2018:

- Basic salary Sh.120,000 per month (PAYE Sh.47,100 per month).

- He was provided with a house from 1 January 2018. The house was fully furnished by the employer at a cost of Sh.250,000 on 1 August 2018.

- He benefited from free medical treatment during the year valued at Sh.192,000 under the medical scheme operated by the company for all its employees.

- He was provided with a security guard and a cook whom the company paid monthly salaries of Sh.24,000 and Sh.21,750 respectively from 1 September 2018.

- The employer provided him with a pickup motor vehicle of 2000cc for his personal use. The company had bought the pickup for Sh.2,700,000 on 1 January 2017.

- He was provided with Sh.207,000 during the year by the company as school fees to support his two children. This amount was recovered in the company’s books as an expense.

- He is a member of a registered pension scheme where he contributed Sh.32,000 per month.

- The company paid for his life insurance premiums of Sh.6,000 per month.

- He received free goods worth Sh.120,000 from the company during the year.

- He received 20,000 shares from the company at a cost of Sh.20 per share. The market value per share was Sh.23.

Required:

Taxable income for John Mwea for the year ended 31 December 2018. (10 marks)

Tax payable (if any) from the income computed in (b) (i) above. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. All taxes may be classified as direct or indirect taxes.

List two types of taxes under each of the above categories. (4 marks)

2. Explain two circumstances under which the commissioner may allow an application for the extension of time to file a notice of objection. (4 marks)

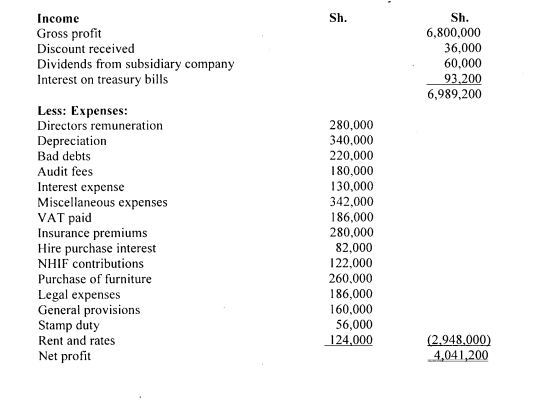

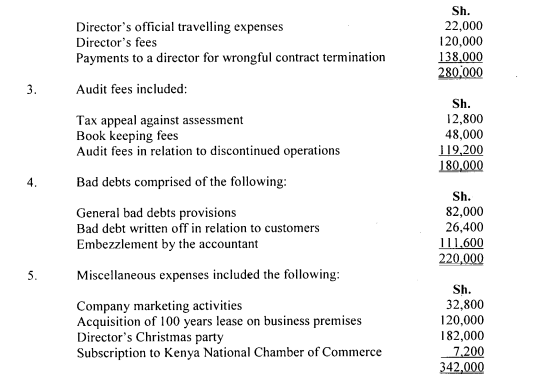

3. Chakacha Ltd. presented the following income statement for the year ended 31 December 2018:

Additional information:

- Insurance premiums include Sh.125,000 paid to the National Hospital Insurance Fund (NHIF) as a penalty for late submission of contributions.

- Director’s remuneration comprised the following:

Required:

Adjusted taxable profit or loss of Chakacha Ltd. for the year ended 31 December 2018. (10 marks)

Tax payable (if any). by Chakacha Ltd. for the year ended 31 December 2018 from the adjusted profit obtained in (c) (i) above. (2 marks)

(Total: 20 marks)