MONDAY: 17 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL our workings. Any assumptions made must be clearly and concisely stated.

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

Assume that the following rates of tax applied throughout the year of income 2020.

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 – 24,000 I – 288,000 10%

24,001 – 40,667 288,001 – 488,000 15%

40,668 – 57,334 488,001 – 688,000 20%

Excess over – 57,334 Excess over – 688,000 25%

Personal relief Sh.2,400 per month (Sh.28,800 per annum).

Prescribed benefit rates of motor vehicles provided by employer

Monthly rates Annual rates

(Sh.) (Sh.)

Saloons, Hatch Backs and Estates

Up to 1200 cc 3,600 43,200

1201 1500 cc 4,200 50,400

1501 1750 cc 5,800 69,600

1751 2000 cc 7,200 86,400

2001 3000 cc 8,600 103,200

Over 3000 cc 14,400 172,800

Pick-ups, Panel Vans (unconverted)

Up to 1750 cc 3,600 43,200

Over 1750 cc 4,200 50,400

Land Rovers/Cruisers 7,200 86,400

Commissioner’s prescribed benefit rates

Monthly rates Annual rates

Services (Sh.) (Sh.)

Electricity (Communal or from a generator) 1,500 18,000

Water (Communal or from a borehole) 500 6,000

Agriculture employees: Reduced rates of benefits

Water 200 2,400

Electricity 900 10,800

QUESTION ONE

1. Explain the following terms as used in public finance management:

Appropriation Act. (2 marks)

Sinking fund. (2 marks)

Budget circular. (2 marks)

2. Outline six roles of the Commission on Revenue Allocation (CRA) or its equivalent in your country. (6 marks)

3. Describe four types of offences that a public officer of a procuring entity might commit as envisaged by the Public Procurement and Asset Disposal Act. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. Identify four parties that could be interested in the Public Sector financial statements and the Auditor General’s report. (4 marks)

2. Summarise six roles of the Director of Public Prosecution (DPP). (6 marks)

3. Kenview Enterprises is a registered business for value added tax (VAT) purposes. During the month of August 2020, Kenview Enterprises made the following transactions:

Date Transaction Amount (Sh.)

August 5: Cash sales 480,000

August 7: Credit purchases 180,000

August 9: Returns inward 64,000

August 10: Purchase of stationery 172,000

August 12: Credit sales 640,000

August 13: Exports to Uganda 380,000

August 15: Cash purchases 560,000

August 16: Paid for legal fees 45,000

August 18: Returns outward 120,000

August 20: Bought airtime for mobile phones 12,000

August 23: Cash received from debtors 164,000

August 25: Paid for catering services 62,000

August 28: Paid suppliers 220,000

August 31: Paid for electricity 18,000

All transactions are stated exclusive of VAT at the rate of 14% where applicable unless otherwise stated.

Required:

A value added tax (VAT) account for the month of August 2020. (10 marks)

(Total: 20 marks)

QUESTION THREE

1. Highlight five ways through which the Revenue Authority could use to recover unpaid taxes as provided under the Tax Procedures Act. (5 marks)

2. Alex Namu provided the following information relating to his income for the year ended 31 December 2020:

- He was employed by Summerland Ltd. as an electrical engineer with a basic salary of Sh. I 75,000 per month.

- The company provided him with the following benefits:

- A saloon car (1,800cc) which was purchased in the year 2018 at a cost of Sh.1,800,000.

- A house which had a market rental value of Sh.45,000 per month.

- An annual bonus of Sh.200,000 payable in the month of December each year.

- A security guard and a domestic servant who were paid Sh.25,000 each per month by the company.

- During the year, the company paid Sh.80,000 as life insurance premiums for Alex Namu.

- He contributed Sh.20,000 per month to a registered pension scheme and Sh.10,000 per month to a home ownership savings plan (HOSP).

- In the month of June 2020, he received a cash gift of Sh.100,000 from the company for being among the best employees.

- The company paid Sh.35,000 as annual subscriptions to the Association of Electrical Engineers for Alex Namu.

- Medical bills amounting to Sh.500.000 were settled by the company in respect of Alex Namu’s sick child. The company has a medical scheme for its senior employees only.

- PAYE deducted by the employer during the year amounted to Sh.504,000.

Required:

Taxable income for Alex Namu for the year ended 31 December 2020. (12 marks)

Tax payable (if any) on the income computed in (b) (i) above. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. Argue four cases in favour of indirect taxes imposed by the revenue authority or similar body in your country. (8 marks)

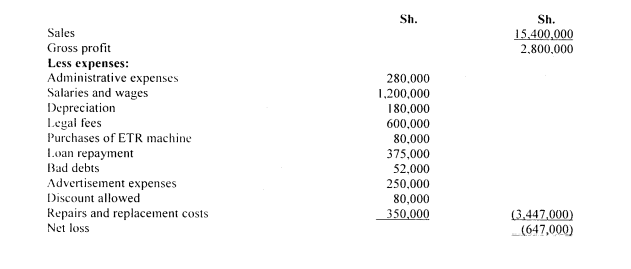

2. The following income statement relates to Bidii Ltd. for the year ended 31 December 2020:

Additional information:

Sales comprised: Sh.

Local sales 10,500,000

Export sales 4,900,000

Provision for general bad debts of Sh.30.000 was included in the reported bad debts.

- Advertisement expenses comprised: Sh.

Erection of a neon sign 35,000

Newspapers advertisement 173,000

Free samples to customers 42,000

- Legal fees comprised the following: Sh.

Debt collection 120,000

Court fines on breach of contracts 300,000

Stamp duty 180,000

- Repairs and replacement costs included Sh.180,000 for office partitioning.

- Capital allowances were agreed at Sh.196,000 with the Commissioner of Domestic Taxes.

- Assume that corporate tax rate during the year was 25%.

Required:

Adjusted taxable profit or loss for Bidii Ltd. for the year ended 31 December 2020. (10 marks)

Tax payable (if any) from the taxable profit computed in (b) (i) above. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Identify four structures or items that qualify for investment deduction allowance. (4 marks)

2. Distinguish between “single tax system” and “multiple tax system” as used in taxation. (4 marks)

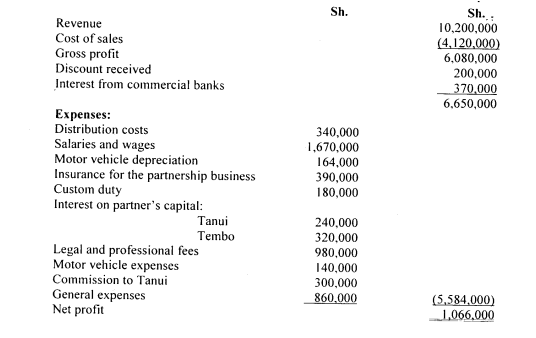

3. Tanui and Tembo are partners trading as Tembo Enterprises, sharing profits and losses equally.

The following is the partnership statement of profit or loss for the year ended 31 December 2020:

Additional information:

1. Salaries and wages include partners’ monthly salary of Sh.45,000 to each partner.

- Legal and professional fees include: Sh.

Stamp duty on purchase of partnership land 210,000

Book keeping fees 180,000

Defending Tanui on careless driving 150,000

Court expenses for collection of bad debts 85,000

Court expenses for breach of contracts 355,000

980,000

- General expenses include: Sh.

General bad debts provision 118,000

Installation of CCTV cameras 220,000

Bad debts written off 522,000

860,000

- Capital allowances during the year were agreed with the Commissioner of Domestic Taxes at Sh.960,000.

Required:

Adjusted taxable profit or loss for the partnership business for the year ended 31 December 2020. (9 marks)

A schedule showing the distribution of the partnership profit or loss computed in above. (3 marks)

(Total: 20 marks)