MONDAY: 23 November 2020. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated.

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2019.

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 12,298 1 – 147,580 10%

12,299 23,885 147,581 – 286,623 15%

23,886 35,472 286,624 – 425,666 20%

35,473 47,059 425,667 – 564,709 25%

Excess over – 47,059 Excess over – 564,709 30%

Personal relief Sh.1,408 per month (Sh.16,896 per annum).

Prescribed benefit rates of motor vehicles provided by employer

Monthly rates Annual rates

(Sh.) (Sh.)

Saloons, Hatch Backs and Estates

Up to 1200 cc 3,600 43,200

1201 1500 cc 4,200 50,400

1501 1750 cc 5,800 69,600

1751 2000 cc 7,200 86,400

2001 3000 cc 8,600 103,200

Over 3000 cc 14,400 172,800

Pick-ups, Panel Vans (unconverted)

Up to 1750 cc 3,600 43,200

Over 1750 cc 4,200 50,400

Land Rovers/Cruisers 7,200 86,400

Commissioner’s prescribed benefit rates

Monthly rates Annual rates

Services (Sh.) (Sh.)

Electricity (Communal or from a generator) 1,500 18,000

Water (Communal or from a borehole) 500 6,000

Agriculture employees: Reduced rates of benefits

Water 200 2,400

Electricity 900 10,800

QUESTION ONE

1. Explain the following terms as used in public finance management:

Public money. (2 marks)

County public debt. (2 marks)

2. Outline two objectives of the Public Finance Management Act, 2012. (4 marks)

3. Identify two parliamentary committees that exercise oversight in public finance in your country. (2 marks)

4. Discuss five roles of the office of Controller of Budget as outlined in the Constitution. (10 marks)

(Total: 20 marks)

QUESTION TWO

1. Summarise two functions of revenue authority in your country. (4 marks)

2. Outline six eligibility criteria for bidding for a contract or disposal of an asset as outlined in the Public Procurement and Asset Disposal Act, 2015. (6 marks)

3. APL Traders is a value added tax (VAT) registered business. The business owner has provided you with the following information relating to its transactions for the month of March 2020:

March 2: Purchased goods worth Sh.1,392,000 from MM Ltd.

March 8: Repaired motor vehicle and paid Sh.174,000.

March 10: Made cash sales amounting to Sh.696,000.

March 12: Sold goods on credit to S. Juma at Sh.208,800

March 14: Paid legal fees amounting to Sh.92,800.

March 17: S. Juma returned some goods worth Sh.34,800

March 20: Exported goods to Tanzania worth Sh.600,000

March 22: Paid tax consulting services amounting to Sh.23,200

March 24: Purchased goods worth Sh.1,160,000 on credit from Majani suppliers

March 25: Sold goods on credit to Banda Traders worth Sh.812,000

March 27: Purchased spare parts for motor vehicle amounting to Sh.104,400.

March 28: Sold goods to Baraka traders on credit for Sh.348,000.

March 30: Paid audit fees for audit of inventory amounting to Sh.150,800.

The above transactions are stated inclusive of VAT at the rate of 16% where applicable.

Required:

The VAT payable by or refundable to APL Traders for the month of March 2020. (10 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the following terms as used in classification of taxes: Progressive taxes. (2 marks)

Proportional taxes. (2 marks)

Degressive taxes. (2 marks)

2. Moses Zakwah is an employee of Patah Ltd. He has provided the following information relating to his income for the year ended 31 December 2019:

- His basic salary was Sh.225,000 per month. (PAYE: Sh.40,000 per month).

- He was provided with a 2000cc saloon car which he used for both official and private travel.

- During the year, the company paid Sh.60,000 for his life insurance policy.

- He was entitled to a holiday allowance equal to one month’s basic salary.

- His wife was given free goods worth Sh.50,000 by the company during the Christmas season.

- He received Sh.90,000 as an end year bonus which is usually payable to all employees in December every year.

- He was out of office on official duty for 5 days in which he was paid per diem of Sh.2,000 per day.

- During the year, Moses Zakwah was declared the best employee and the company rewarded him with Sh.100,000.

- During the year, he received entertainment allowance amounting to Sh.40,000.

- During the year, he received medical benefits amounting to Sh.320,000 from the employer. The company has a medical scheme for all its employees.

- He was provided with a security guard and a cook whom the company paid monthly salaries of Sh.18,000 and Sh.15,000 respectively.

- During the year, he earned an overtime allowance of Sh.180,000.

- During the year, Moses Zakwah claimed Sh.60,000 as mobile phone bills from the company.

Required:

Taxable income for Moses Zakwah for the year ended 31 December 2019. (10 marks)

Tax payable (if any) from the income computed in (b) (i) above. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. List four capital allowances that the revenue authority or similar body in your country could grant as incentives to investors who incur capital expenditure in various sectors of the economy. (4 marks)

2. Highlight four contents of a notice of assessment from the Commissioner of Domestic taxes. (4 marks)

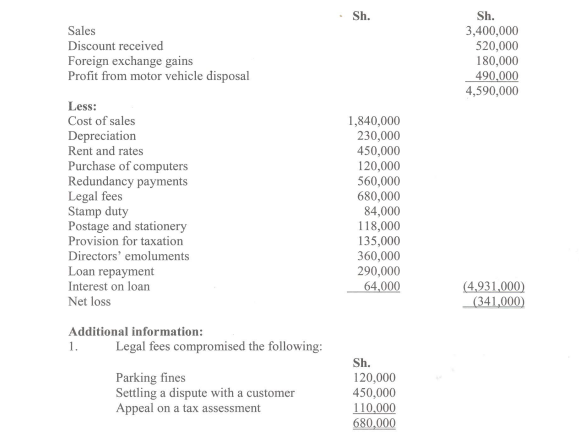

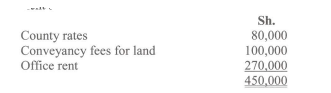

3. Kisima Ltd. provided the following income statement for the year ended 31 December 2019:

- Rent and rates comprised:

- Capital allowances were agreed with the revenue authority at Sh.182,000.

Required:

A statement of adjusted taxable profit or loss for Kisima Ltd. for the year ended 31 December 2019. (10 marks)

Tax payable (if any) by Kisima Ltd. for the year ended 31 December 2019. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Preston Mwanzale, after filing his individual income tax return for the year 2019 through the iTax portal, realised that he was in a tax refund position as per his e-Return acknowledgement receipt. He intends to apply for tax refund.

Required:

Advise Preston Mwanzale on four documents that he might require in order to apply for tax refund. (4 marks)

2. Outline four obligations of a value added tax (VAT) registered person. (4 marks)

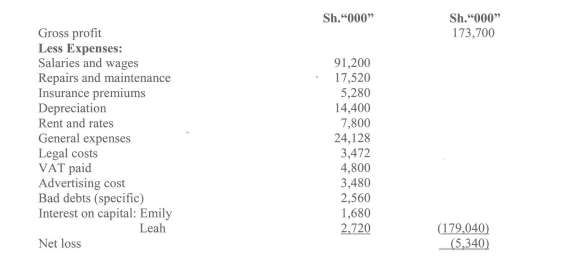

3. Emily and Leah are in a partnership business trading under the name Emile Enterprises. They share profits and losses in the ratio of 2:1 for Emily and Leah respectively.

The partners have presented the following income statement for the year ended 31 December 2019:

Additional information:

- Insurance expenses include Sh.192,000 paid to insure Emily’s private car.

- Salaries and wages included salary paid to partners as follows:

Emily – Sh.7,200,000

Leah – Sh.5,600,000

- General expenses included the following:

Sh.

Cash embezzled by cashier 640,000

Interest charge on hire purchase 480,000

Purchase of furniture and fittings 600,000

- Legal costs included the following:

Sh.

Parking fines 344,000

Tax assessment appeal 384,000

Settling customer disputes 360,000

Breach of contract 1,340,000

- Repairs and maintenance included the cost of two laptops purchased at Sh.80,000 each.

- Capital allowances were agreed with the revenue authority at Sh.2,400,000.

Required:

The adjusted partnership profit or loss for the year ended 31 December 2019. (10 marks)

Allocation of profits or loss in above to partners. (2 marks)

(Total: 20 marks)