MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS

2018/2019 ACADEMIC YEAR

THIRD YEAR FIRST SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

BACHELOR IN SCIENCE IN FINANCIAL ECONOMICS

COURSE CODE: ECO 3110

COURSE TITLE: CORPORATE FINANCE

DATE: 3RD DECEMBER 2018 TIME: 11.00- 1.00PM

INSTRUCTIONS TO CANDIDATES

1. Answer Question ONE and any other THREE questions

2. Question one is compulsory and it carries 25 marks other questions are 15

marks each

This paper consists of four printed pages. Please turn over.

QUESTION ONE

a) Discuss how agency theory explains the relationship between the management

and shareholders of a corporation. (5 marks)

(b) How is wealth maximization as a goal of the corporate firm consistent with

agency theory? (6 marks)

(c)Is it true under agency theory that a corporate manager will always undertake

projects with positive net present value, under conditions of no capital rationing?

Explain. (6 marks)

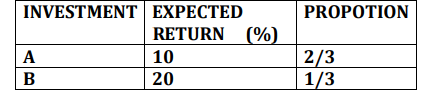

d) Consider two investments, A and B each having the following investment

characteristics;

Compute the expected return of a portfolio of the two assets. (4 marks)

d) Differentiate between bonds and debentures.

(4 marks)

QUESTION TWO

a) Discuss five factors to be considered when making capital structure decisions

(5 marks)

b) Bidii limited has a cost of capital of 10%. The company currently has 250,000

shares outstanding and selling on the stock exchange at sh 120 per share. The

companys earning per share is sh.10 and intends to maintain a dividend payout

ratio of 50% at the end of the current financial year. The companys expected

income for the current year is sh. 3million and the available investment

proposals are estimated at cost sh. 6 million.

Required: Using the Modigliani and Miller model, show that the payment of

dividends does not affect the value of the firm. (10 marks)

QUESTION THREE

Companies U and L are identical in every respect except that U is unlevered while L

has Sh 10 million of 5% bonds outstanding. Assume

(a) That all of the MM assumptions are met

(b) That there are no corporate or personal taxes

(c) That EBIT is Sh 2 million

(d) That the cost of equity to company U is 10%

Required:

i) Determine the value MM would estimate for each firm (4 marks)

ii) Determine the cost of equity for both firms (4 marks)

iii) What is the overall cost of capital for both firms? (3 marks)

iv)Suppose the value of U is Sh 20 million and that of L is Sh 22 million. Explain the

arbitrage process for a shareholder who owns 10% of company L’s shares. (4 marks)

QUESTION FOUR

a) Define the word time value of money and describe its relevance in finance

(3 marks)

b) Suppose you want to buy a house in 5 years from now and estimate that the

initial down payment of Sh. 2 million will be required at that time. You wish to

make equal annual end of year deposits in an account paying annual interest of

6%. Determine the size of the annual deposit. (6 marks)

c) Discuss three legal procedures that one firm can use to acquire another firm

(6 marks)

QUESTION FIVE

Bhasmati Rise Company is considering two mutually exclusive projects requiring an

initial outlay of shs. 100,000 each and with a useful life of 5 years. The company

required rate of return is 10% and the appropriate corporate tax rate is 50%. The

project will be depreciated on a straight line basis. Before taxes and depreciation

cash flows expected from the projects are as below:

Year 1 2 3 4 5

Project I shs. 40000 40000 40000 40000 40000

Project 2 shs. 60000 30000 20000 50000 50000

Required

a) Compute the after tax cash flows of both projects. ( 3 Marks)

b) Calculate for each project

i) Net present value (5 marks)

ii) Internal Rate of Return (5 marks)

iii)Which project should be accepted and why (2 marks