E-COMMERCE – BUSINESS MODELS (TYPES OF E-COMMERCE)

E-commerce business models can generally be categorized into the following categories.

• Business – to – Business (B2B)

• Business – to – Consumer (B2C)

• Consumer – to – Consumer (C2C)

• Consumer – to – Business (C2B)

• Business – to – Government (B2G)

• Government – to – Business (G2B)

• Government – to – Citizen (G2C)

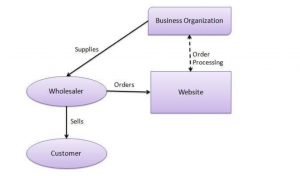

Business – to – Business

A website following the B2B business model sells its products to an intermediate buyer who then sells the product to the final customer. As an example, a wholesaler places an order from a company’s website and after receiving the consignment, sells the end product to the final customer who comes to buy the product at one of its retail outlets.

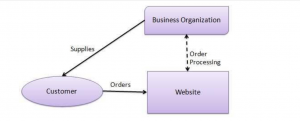

Business – to – Consumer

A website following the B2C business model sells its products directly to a customer. A customer can view the products shown on the website. The customer can choose a product and order the same. The website will then send a notification to the business organization via email and the organization will dispatch the product/goods to the customer.

Consumer –

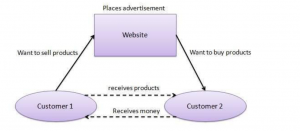

Consumer – to – Consumer

A website following the C2C business model helps consumers to sell their assets like residential property, cars, motorcycles, etc., or rent a room by publishing their information on the website. Website may or may not charge the consumer for its services. Another consumer may opt to buy the product of the first customer by viewing the post/advertisement on the website.

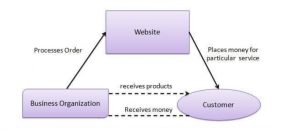

Consumer – to – Business

In this model, a consumer approaches a website showing multiple business organizations for a particular service. The consumer places an estimate of amount he/she wants to spend for a particular service. For example, the comparison of interest rates of personal loan/car loan provided by various banks via websites. A business organization who fulfills the consumer’s requirement within the specified budget, approaches the customer and provides its services.

Business – to – Government

B2G model is a variant of B2B model. Such websites are used by governments to trade and exchange information with various business organizations. Such websites are accredited by the government and provide a medium to businesses to submit application forms to the government.

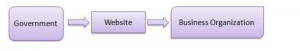

Government – to – Business

Governments use B2G model websites to approach business organizations. Such websites support auctions, tenders, and application submission functionalities.

Government – to – Citizen

Governments use G2C model websites to approach citizen in general. Such websites support auctions of vehicles, machinery, or any other material. Such website also provides services like registration for birth, marriage or death certificates. The main objective of G2C websites is to reduce the average time for fulfilling citizen’s requests for various government services.

E- COMMERCE PAYMENT SYSTEM

An e-payment system is a way of making transactions or paying for goods and services through an electronic medium, without the use of checks or cash. It’s also called an electronic payment system or online payment system.

E-commerce sites use electronic payment, where electronic payment refers to paperless monetary transactions. Electronic payment has revolutionized the business processing by reducing the paperwork, transaction costs, and labor cost. Being user friendly and less time-consuming than manual processing, it helps business organization to expand its market reach/expansion. Listed below are some of the modes of electronic payments: –

i. Credit Card

ii. Debit Card

iii. Smart Card

iv. E-Money

v. Electronic Fund Transfer (EFT)

a) Credit Card

Credit card is small plastic card with a unique number attached with an account. It has also a magnetic strip embedded in it which is used to read credit card via card readers. When a customer purchases a product via credit card, credit card issuer bank pays on behalf of the customer and customer has a certain time period after which he/she can pay the credit card bill. It is usually credit card monthly payment cycle. Following are the actors in the credit card system.

• The card holder − Customer

• The merchant − seller of product who can accept credit card payments.

• The card issuer bank − card holder’s bank

• The acquirer bank − the merchant’s bank

• The card brand − for example, visa or MasterCard.

b) Debit Card

Debit card, like credit card, is a small plastic card with a unique number mapped with the bank account number. It is required to have a bank account before getting a debit card from the bank. The major difference between a debit card and a credit card is that in case of payment through debit card, the amount gets deducted from the card’s bank account immediately and there should be sufficient balance in the bank account for the transaction to get completed; whereas in case of a credit card transaction, there is no such compulsion. Debit cards free the customer to carry cash and cheques.

c) Smart Card

Smart card is again similar to a credit card or a debit card in appearance, but it has a small microprocessor chip embedded in it. It has the capacity to store a customer’s work-related and/or personal information. Smart cards are also used to store money and the amount gets deducted after every transaction. Smart cards can only be accessed using a PIN that every customer is assigned with. Smart cards are secure, as they store information in encrypted format and are less expensive/provides faster processing. Mondex and Visa Cash cards are examples of smart cards.

d) E-Money

E-Money transactions refer to situation where payment is done over the network and the amount gets transferred from one financial body to another financial body without any involvement of a middleman. E-money transactions are faster, convenient, and saves a lot of time.

Online payments done via credit cards, debit cards, or smart cards are examples of emoney transactions. Another popular example is e-cash. In case of e-cash, both customer and merchant have to sign up with the bank or company issuing e-cash.

e) Electronic Fund Transfer

It is a very popular electronic payment method to transfer money from one bank account to another bank account. Accounts can be in the same bank or different banks. Fund transfer can be done using ATM (Automated Teller Machine) or using a computer.

(adsbygoogle = window.adsbygoogle || []).push({});