The Accounting equation forms the basis of double entry and therefore it should always be maintained. Any change in assets, liabilities or capital will have a double effect such that assets will always be equal to liabilities plus capital. If the owners put in additional

capital then this will increase the cash at bank and the capital amount therefore the equation is still maintained.

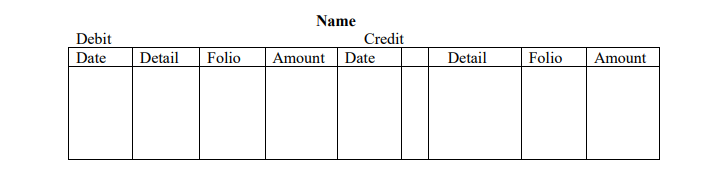

In this account the date will show the opening period of the asset, liability or capital i.e. the balance brought forward. It will also show the date when a transaction took place (i.e. either an asset was bought or liability incurred).

The detail column (also called the particulars column) shows the nature of the transaction and reference to the corresponding account. The Folio Column for purposes of detailed recording shows the reference number of the corresponding account. The amount

column shows the amount of the asset, liability or capital.

The left side of the account is called the debit side and the right side is called the credit side. All assets are shown or recorded on the debit side while all the liabilities and capital are recorded on the credit side. Each type of asset or liability must have its own account

whereby all transactions affecting them are recorded in this account. Therefore there should be an account for Premises, Plant and Machinery, Stock, Debtors, Creditors etc. Under the accounting equation if all assets are represented by liabilities and capital

therefore all debits should be the same as credits.

For the double entry to be reflected in the accounts, every debit entry must have a corresponding credit entry. The transactions affecting these accounts are posted in the account as debit entry and credit entry to complete the double entry.

When we make a debit entry we are either:

- Increasing the value of an asset.

- Reducing the value of a liability.

- Reducing the value of capital.

When we make a credit entry we are either:

- Reducing the value of an asset.

- Increasing the value of a liability.

- Increasing the value of capital.