Dividend policy of a firm determines what proportion of earnings is paid to holders by way of dividends and what proportion is ploughed back in the firm for investment purposes. If a firm’s capital budgeting decision is independent of its dividend policy, a

higher dividend payment will entail a greater dependence on external financing. Thus the dividend policy has a bearing on the choice of financing. On the other hand, if a firm’s Capital budgeting decision is dependent on its dividend decision, a higher payment will

shrink its capital budget and vice versa. In such a case, the dividend policy has a bearing on capital budgeting decision. Discussions on dividend policy and firm value assumes that the investment decision of a firm is independent of it dividend decision. However, there are some models which assume that investment and dividend decisions are related. Two such models are and the Walter model Gordon model.

4.2 Dividend Theories

4.2.1 Walter Model

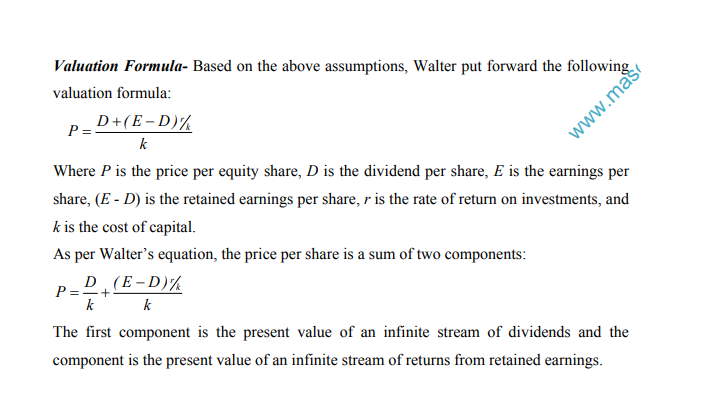

James Walter has proposed a model of share valuation which supports the view that the dividend policy of the firm has a bearing on share valuation. His model is based on the following assumptions:

- The firm is an all-equity financed entity. Further, it will rely only on retained earnings to finance its future investments. This means that the investment decision is dependent on the dividend decision.

- The rate of return on investments is constant.

- The firm has an infinite life

When the rate of return is lesser than the cost of capital (r < k), the price per share increases as the dividend payout ratio increases

Thus Walter model implies that:

- The optimal payout ratio for a growth firm (r > k) is nil.

- The optimal payout ratio for a normal firm (r = k) is irrelevant.

- The optimal payout ratio for a declining firm (r < k) is 100 percent

Clearly these policy implications lead to very extreme courses of action which make limited sense in the real world. Despite this simplicity or naivete, the Walter model is a useful tool to show the effects of dividend policy under varying profitability assumptions.

4.2.2 Gordon Model

Myron Gordon proposed a model of stock valuation using the dividend capitalization approach. His model is based on the following assumptions:

- Retained earnings represent the only source of financing for the firm. Thus, like the Walter model the Gordon model ties investment decision to dividend decision

- The rate of return on the firm’s investment is constant.

- The growth rate of the firm is the product of its retention ratio and its rate of return. This assumption follows the first two assumptions.

- The cost of capital for the firm remains constant and it is greater than the growth rate.

- The firm has a perpetual life.

- Tax does not exist.

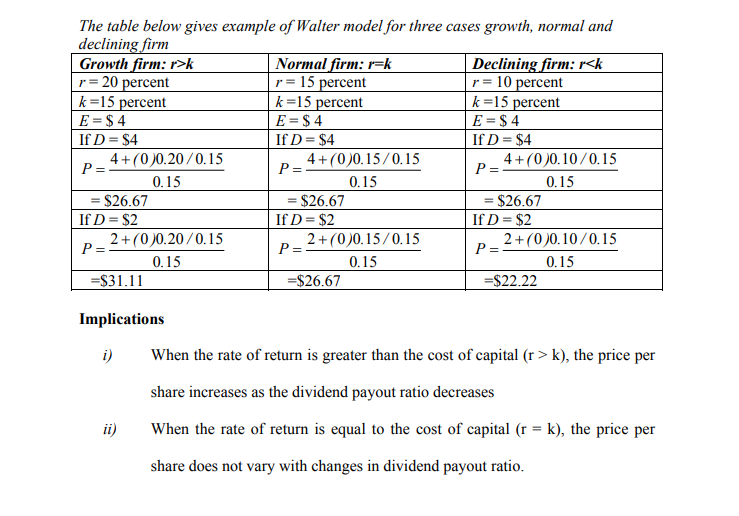

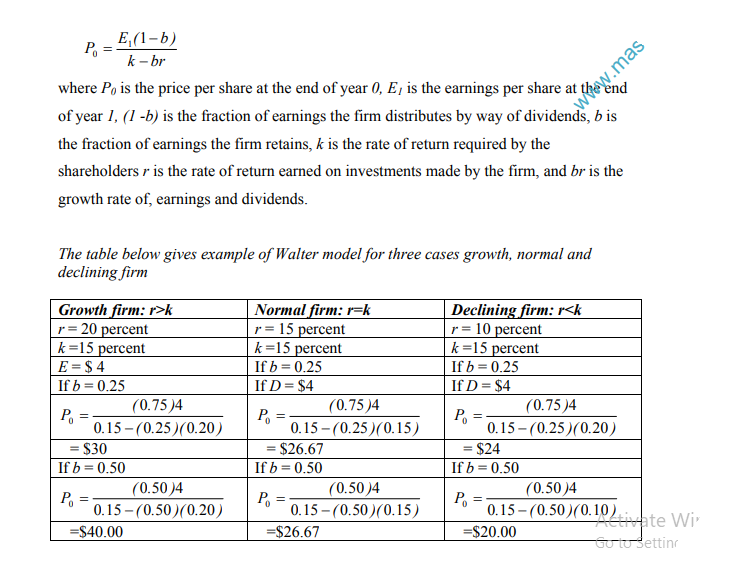

Valuation Formula Gordon’s valuation formula is:

Implications

- When the rate of return is greater than the discount rate (r > k), the price per share increases as the dividend payout ratio decreases

- When the rate of return is equal to the discount rate (r = k), the price per share remains unchanged in response to variations in the dividend payout ratio.

- When the rate of return is less than the discount rate (r< k), the price per share increases as the dividend payout ratio increases

Thus the basic Gordon model leads to dividend policy implications as that of the alter model:

- The optimal payout ratio for a growth firm (r > k) is nil.

- The payout ratio for a normal firm is irrelevant.

- The optimal payout ratio for a declining firm (r < k) is 100 percent.

4.2.3 Traditional Position

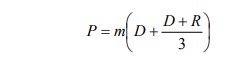

Traditional position expounded eloquently by Graham and Dodd holds that the stock market places considerably more weight on dividends than on retained earnings according to them:

Their view is expressed quantitatively in the following valuation model

![]()

Where, P is the market price per share, D is the dividend per share, E is the earnings per share, and m is a multiplier. According to this model, in the valuation of shares the weight attached to dividends is equal to four times the weight attached to retained earnings. This is clear from following version of the above equation in which E is replaced by (D + R).

The weights provided by Graham and Dodd are based on their subjective judgments and not derived from objective, empirical analysis. Notwithstanding the subjectivity of these weights, the major contention of the traditional position is that a liberal payout

has a favorable impact on stock price

4.2.4 Miller and Modigliani Position

Miller and Modigliani (MM, hereafter) have advanced the view that the value of a firm solely on its earning power and is not influenced by the manner in which its Earnings are split between dividends and retained earnings. This view, referred to as the

“dividend irrelevance” theorem, is presented in their celebrated 1961 article. In this article MM constructed their argument on the following assumptions.

- Capital markets are perfect and investors are rational: information is freely available, transactions are instantaneous and costless, securities are divisible, and no investor can influence market prices.

- Floatation costs are nil.

- There are no taxes.

- Investment opportunities and future profits of firms are known with certainty (MM drop this assumption later).

- Investment and dividend decisions are independent.

The substance of MM argument may be stated as follows: If a company retains earnings instead of giving it out as dividends, the shareholder enjoys capital appreciation equal to the amount of earnings retained. If it distributes earnings by way of dividends instead of retaining it, the shareholder enjoys dividends equal in value to the amount by which his capital would have appreciated had the company chosen to retain its earnings. Hence, the division of earnings between dividends and retained earnings is irrelevant from the point of the shareholders.

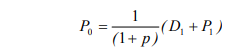

To prove their argument MM begin with the simple valuation model:

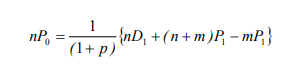

Where P0 is the market price per share at time 0 D1 is the dividend per share at time 1 P1 is the market price per share at time and r is the discount rate applicable to the risk class to which the firm belongs( this rate is assume to remain unchanged) From the above expression the value of outstanding equity shares at time 0 is obtained as follows:

Where n is the number of outstanding equity shares at time 0, nP0 is the total market value of outstanding equity shares at time 0, nD1 is the total dividend s in year 1 payable on the equity shares outstanding at time 0, m is the number of equity share issued at time

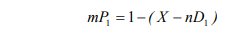

1 at price P1 ( the prevailing market price at time 1), (n + m)P1 is the total market value to all outstanding share at time 1, mP1 is the market vale of shares issued at time 1 and r is the discount rate What is the total amount of new equity stock issued at time 1, mP1, equal to? It is equal to the total investment at time 1 less the amount of retained earnings, in symbols:

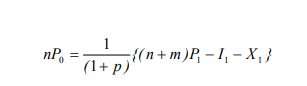

Where 1 is the total investment at the end of the year 1 and X is the total net profit of the firm for the year 1

As D1 is no found in this equation and as (n +m) P1, I1, X1, and r are independent of D1 MM reach the conclusion that the value of the firm does not depend on its dividend decision. Note that (n +m) P1, the value of the equity of the firm at the end of year 1 is in

no way affected by the dividend paid at the end of the year (D1) Why? The reason is simple: D1 influences P1 and m in a mutually offsetting manner. If the firm pays more D1, P1 decreases but m increases on the other hand, if the firm pays less D1, P1 increases but

m decreases. The foregoing analysis can be summarized as follows:

MM “dividend irrelevance” theorem rests on their “leverage irrelevance” theorem. Since the real cost of debt and equity as per MM “leverage irrelevance theorem is the same, it does not mater if the firm raises external finance by issuing debt or a combination of equity and debt. There is no conflict between the dividend capitalization approach to valuation advocated earlier and the MM “dividend irrelevance” theorem. MM “dividend irrelevance” theorem does not imply that the value of an equity share is not equal to the present value of future stream of dividends expected from its ownership. It merely says that even though the dividend policy of the firm may influence the timing and magnitude of dividend payments it cannot change the present value of total stream of dividends.

Criticisms of MM Position

Information about Prospects- In a world of uncertainty the dividends paid by the company, based as they are on the judgment of the management about future, convey information about the prospects of the company.

Uncertainty and Fluctuations- Due to uncertainty, share prices tend to fluctuate, sometimes rather widely. When share prices fluctuate, conditions for conversion of current income into capital value and vice versa may not be regarded as satisfactory by investors. Some investors who wish to enjoy more current income may be reluctant to sell a portion of their shareholding in a fluctuating market. Such investors would naturally prefer, and value more, a higher payout ratio. Some investors who wish to get

less current income may be hesitant to buy shares in a fluctuating market. Such investors would prefer, and value more, a lower payout ratio.

Offering of Additional Equity at Lower Prices- MM assume that a firm can sell additional at the current market price. In practice, firms following the advice and suggestions of merchant bankers offer additional equity at a price lower than the current market price. This practice of ‘underpricing’ mostly due to information asymmetry and other market imperfections ceteris paribus, makes a shilling of retained earnings more valuable than a shillings of dividends. This is because a higher pay out ration will lead to a greater dilution of the value of equity.

Transaction Costs- In the absence of transaction costs, current income (dividends) and capital gains are alike-a shilling of capital value can be converted into a shilling of current income and vice versa. In such a situation if a shareholder desires current income shares) greater than the dividends received, he can sell a portion of his capital equal in value to the additional current income sought. Likewise, if he wishes to enjoy income less than the dividends paid, he can buy additional shares equal in value difference between dividends received and the current income desired. In the real s however, transaction costs are incurred. Due to transaction costs, shareholders who have preference for current income would prefer a higher payout ratio and shareholders who have preference for deferred income would prefer a lower payout ratio.

Differential Rates of Taxes- MM assume that the investors are indifferent between a shilling of dividends and a shilling of capital appreciation. This assumption is true when the rate of taxation is the same for current income and capital gains. In the real world, the

effective tax on capital gains is lower than that for current income. Due to this difference, investors may prefer capital gains to current income.

Unwise Investments- MM assume that firms, rational as they are, do not invest beyond the point where the rate of return is equal to the cost of capital. In practice, however many firms invest in sub-marginal projects because of easy availability of internally generated funds. If a firm has such a tendency, its dividend policy matters. Its shareholders would benefit if liberal dividends are paid and would suffer if modest dividends are paid. The thrust of the above criticisms is that the dividend policy of the firm matters preference of investors for current income, the difficulty in converting capital value into current income, and the possibility of imprudent investments, suggest that a liberal ayout

4.2.5 Rational Expectations Hypothesis: A Way of Reconciliation

John F. Muth wrote a paper entitled “Rational Expectations and the Theory of Price Movements,” which was published in 1961 This has been recognized as one of the most influential contributions to economics in the last few decades as it challenges the intellectual foundations of the traditional macroeconomic theories propounded by Keynesians as well as monetarists.

What is the central argument of the rational expectations hypothesis? In very simple terms it says that what matters in economics is not what actually happens but the difference between what actually happens and what was supposed or expected to happen. Hence only the surprises in policy would have the kind of effects the policy maker is striving to achieve. The implications of the rational expectation hypothesis for the dividend policy a firm are that: If the dividend announced is equal to what the market expected, there

would be no change in the market price of the share, even if the dividend were higher (or for that matter lower) than the previous dividend. The market, expecting the dividend to be higher, had discounted it. Put differently, the higher expectation was reflected in the market price already. Hence the announcement of the higher dividend would not have any impact the market price.

4.3 Dividend Decisions

4.3.1 Plausible Reasons for Paying Dividends

Investor Preference for Dividends- If taxes and transaction costs are ignored, dividend and capital receipts should be perfect substitutes. Yet there appears to be a strong preference for dividends. Why? Explanations are based on the behavioral principles of self-control and aversion for regret. In essence argument is that investors have a preference for dividends due to behavioral reasons. Hence, dividends and capital receipts are not perfectly substitutable.

Information Signaling- management often has significant information about the prospects of the firm that it cannot (or prefers not to) disclose to investors. The information gap between management and shareholders generally causes stock prices to be less than what they would he under conditions of information symmetry. According to signaling theory, these firms need to take actions that cannot be easily imitated by firms that do not have such promising projects. One such action is to pay more dividends, Increasing dividends suggests to the market that the firm is confident of its earning prospects that will enable it to maintain higher dividends in future as well. By the same token, a decrease in dividends is perceived as a negative signal by the market because firms are reluctant to cut dividends.

Clientele Effect- Investors have diverse preferences some want more dividend income; others want more capital gains; still others want a balanced mix of dividend income and capital gains. Over a period of time, investors naturally migrate to firms which have a dividend policy that matches their preferences. The concentration of investors in companies with dividend policies that are matched to their preferences is called the clientele effect. The existence of a clientele effect implies that (a) firms get the investors they deserve (b) it will be difficult for a firm to change an established dividend policy.

Agency Costs If shareholders have complete faith in the integrity and rationality of management, there is no reason why a company that has profitable investment opportunities should pay any dividend. In reality, however, shareholders rarely consider management as a perfect agent. They are concerned that management may squander money over uneconomic projects. And, that is when the relevance of dividends lies. Several scholars have argued that dividends can mitigate agency costs.

Other reasons include:

- Bird in the Hand Theory

- Temporary Excess Cash

4.3.2 Determination of the Payout Ratio

Conditions relevant for determining the payout ratio are as follows:

- Funds requirement

- Liquidity

- Access to external sources of financing

- Shareholder preferences

- Differences in the cost of external equity and retained earnings

- Control

- Taxes

4.3.3 Dividend Policy Formulation

While formulating its dividend policy a firm should bear in mind the following considerations:

- Investment decisions have the greatest impact on value creation.

- External equity is more expensive than internal equity (retained earnings) because issue costs and underpricing.

- Most promoters are averse to dilute their stake in equity and hence are reluctant issue external equity.

- There is a limit beyond which a firm would have real difficulty in ranting debt financing.

- The dividend decision of the firm is an important means by which the management conveys information about the prospects of the firm.

Following guidelines emerge from the above considerations:

- Don’t pay dividends at the expense of positive NPV projects.

- Minimize the need to sell external equity.

- Define a target dividend payout ratio along with a target debt-equity ratio, taking into account the investment needs, managerial preferences, capital market norms and tax code.

- Accept temporary departures from the target dividend payout ratio and the target, debt-equity ratio.

- Avoid dividend cuts.

4.3.4 Bonus Shares

Bonus shares can be issued only out of free reserves built out of the genuine r share premium collected in cash only

Reasons for Issuing Bonus Shares

- The bonus issue tends to bring the market price per share within a more popular price range.

- It increases the number of outstanding shares. This promotes more active trading

- The nominal rate of dividend tends to decline. This may dispel the impressions of profiteering.

- The share capital base increases and the company may achieve a more respectable size in the eyes of the investing community.

- Shareholders regard a bonus issue as a firm indication that the prospects of the company have brightened and they can reasonably look for an increase in total dividends.

- It improves the prospects of raising additional funds. In recent years many firms have issued bonus shares prior to the issue of convertible debentures or other financing instruments.