Walter Model

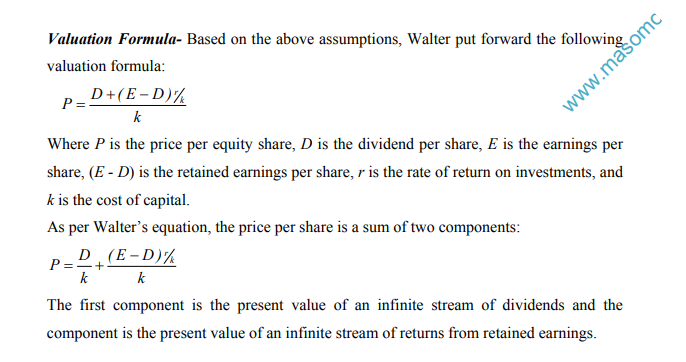

James Walter has proposed a model of share valuation which supports the view that the dividend policy of the firm has a bearing on share valuation. His model is based on the following assumptions:

- The firm is an all-equity financed entity. Further, it will rely only on retained earnings to finance its future investments. This means that the investment decision is dependent on the dividend decision.

- The rate of return on investments is constant.

- The firm has an infinite life

Implications

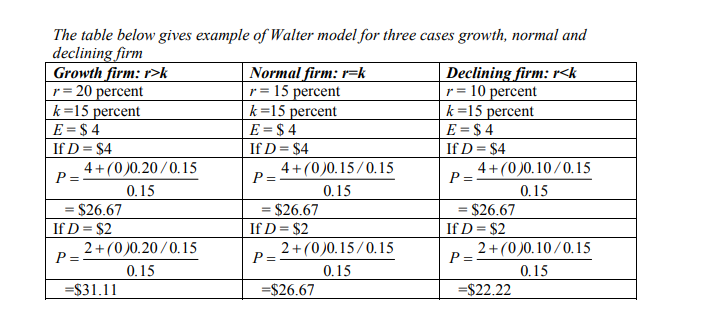

- When the rate of return is greater than the cost of capital (r > k), the price per share increases as the dividend payout ratio decreases

- When the rate of return is equal to the cost of capital (r = k), the price per share does not vary with changes in dividend payout ratio.

- When the rate of return is lesser than the cost of capital (r < k), the price per share increases as the dividend payout ratio increases

Thus Walter model implies that:

- The optimal payout ratio for a growth firm (r > k) is nil.

- The optimal payout ratio for a normal firm (r = k) is irrelevant.

- The optimal payout ratio for a declining firm (r < k) is 100 percent

Clearly these policy implications lead to very extreme courses of action which make limited sense in the real world. Despite this simplicity or naivete, the Walter model is a useful tool to show the effects of dividend policy under varying profitability assumptions.

Share this: