UNIVERSITY EXAMINATIONS: 2017/2018

EXAMINATION FOR THE DIPLOMA IN

INFORMATION TECHNOLOGY/ DIPLOMA IN

BUSINESS INFORMATION TECHNOLOGY

DIT302 FINANCIAL MANAGEMENT

DBIT106 FUNDAMENTALS ACCOUNTING

DATE: APRIL, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer Question one and Any Two Questions.

QUESTION ONE

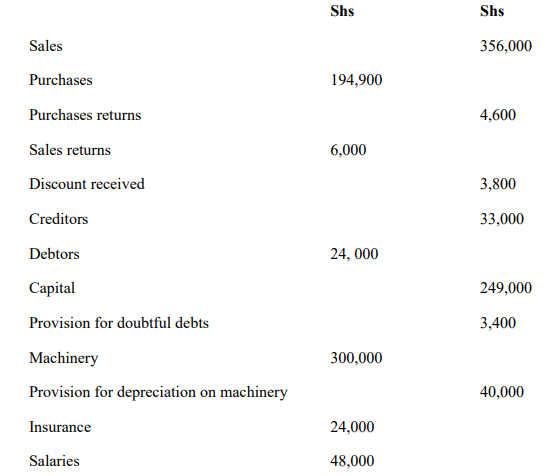

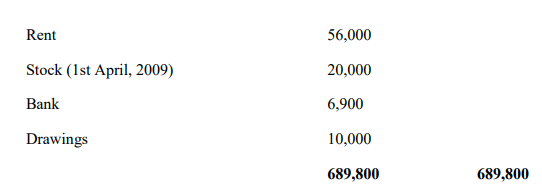

A) The following balances were extracted from the books of ABE, a sole trader, as at 31st

March, 2017

Additional information:

689,800 689,800

i) Stock at 31st March, 2010 was valued at sh. 48,000

ii) At 31st March, 2010 prepaid insurance amounted to sh. 4, 200 while

iii) Rent accrued was sh. 8,000

iv) Depreciation on machinery is provided at 20% per annum on cost.

Required:

C) Why is accounting necessary, explain the benefits of conducting transparency and

accountability to the development of the economy, give FIVE benefits using examples

where necessary. (10 Marks)

QUESTION TWO

a) In the Current World of technology, various accounting frauds are being perpetrated

through the system, Discuss FIVE ways in which accountability can be enhanced by use

of the information technology. (10Marks)

B) Discuss 5 users of accounting information and clearly indicate how they use it in

decision making. (10 Marks)

a) Trading, Profit and Loss account for the year ended 31st March, 2017. (12 Marks)

b) Balance sheet as at at 31st March, 2017

QUESTION THREE

Write up a two-column cashbook from the following details, and balance off as at the end

of the month of Jan 2018:

2018

May 1 Started business with capital in cash Ksh 1,000.

“ 2 Paid rent by cash Ksh 100.

“ 3 F Lake lent us Ksh 5,000, paid by cheque.

“ 4 We paid B McKenzie by cheque Ksh 650.

“ 5 Cash sales Ksh 980.

“ 7 N Miller paid us by cheque Ksh 620.

“ 9 We paid B Burton in cash Ksh 220.

“ 11 Cash sales paid direct into the bank Ksh 530.

“ 15 G Moores paid us in cash Ksh 650.

“ 16 We took Ksh 500 out of the cash till and paid it into the bank account.

“ 19 We repaid F Lake Ksh 1,000 by cheque.

“ 22 Cash sales paid direct into the bank Ksh 660.

“ 26 Paid motor expenses by cheque Ksh 120.

“ 30 Withdrew Ksh 1,000 cash from the bank for business use.

“ 31 Paid wages in cash Ksh 970.

Required

I) Record the above transactions on the ledger accounts (12 Marks)

Ii) Prepare a trial balance to record the above transactions (8Marks)

QUESTION FOUR

a) Discuss the following terms as used in accounting

(10 Marks)

I) Asset

ii Liability

iii Expenses

iv Income

v Capital

b) Explain five Principles/concepts of accounting (10 Marks)

QUESTION FIVE

i. Explain FIVE users of accounting information clearly stating how the information

helps them. (10 Marks).

ii. Accounting practice is exposed to various errors, List Five accounting errors

hindering accuracy in accounting. (5 Marks)

iii. Discuss FOUR qualitative characteristics of accounting information (5 Marks