UNIVERSITY EXAMINATIONS: 2018/2019

ORDINARY EXAMINATION FOR THE DIPLOMA IN

INFORMATION TECHNOLOGY/ DIPLOMA IN

BUSINESS INFORMATION TECHNOLOGY

DIT 302: FINANCIAL MANAGEMENT

DBIT 106: FUNDAMENTALS ACCOUNTING

FULLTIME/PARTIME

DATE: NOVEMBER, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One and Any Two Questions.

QUESTION ONE

i) The following transactions are extracted from the books of Wali enterprises for the month

ended 31 October 2018.

March

1 Started in business with Kshs.800,000 in the bank and Ksh. 500,00 in cash

2 Bought goods for sale Ksh. 145,000 paying by a cheque.

5 Cash sales Kshs 500,000

6 Paid wages in cash Kshs 100,000

7 Sold goods by cheque Kshs 300,000.

9 Bought goods for cash Kshs 120, 000

10 Bought goods on credit Ksh. 200,000 from Victoria Ventures

12 Paid wages in cash Kshs.100, 000

13 Sold goods on credit Kshs.80,000 to Lions investment

15 Bought shop fixtures on credit from Mbao Ltd Kshs.74,000

17 Paid Victoria Furnitures by cheque Kshs.150,000

21 Paid Mbao Ltd Kshs.74, 000 in cash

24 Lions Investment paid us his account by cheque Kshs.64,500

30 Pauline lent us Kshs.100,000 by cash

31 Bought a motor van paying by cheque Kshs 625,000

Required

a) Enter the transactions in the relevant ledger accounts in the books of Wali Enterprises.

(12 Marks)

b) Balance off the ledger accounts and extract a trial balance for the months of October 2018

(8 Marks)

c) Explain FIVE reasons why accounting is so critical to any organization, use an example of

an organization of your choice. (10 Marks)

QUESTION TWO

a) Accounting is universally applicable irrespective of the type of business and or organization,

Identify and explain FIVE accounting principles that ensures standardization in the accounting

practice. (10 Marks)

Ii) Explain FIVE users of accounting information and how the information influences their

decision making in the organization. (10 Marks)

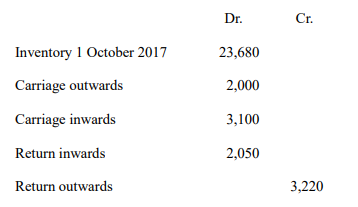

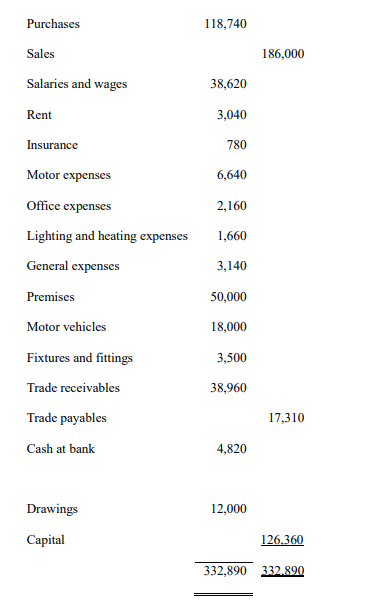

QUESTION THREE

The following trial balance of XYZ LTD, presents information for the year ending 31 st October 2018, Use it

to answer the questions below:

Required:

I) Draw up a trading, profit and loss account for the year ended 30 September 2018 (10 Marks)

Ii) Prepare a statement of financial position as at that date 30 September 2018. (10 Marks)

QUESTION FOUR

a) Discuss FIVE accounting errors and how they can be corrected

in the pursuit of ensuring accuracy in accounting information

(10 Marks)

b) Explain the following terms as used in accounting (10 Marks)

i) Asset

ii) Liability

iii) Capital

iv) Expense

v) Income

QUESTION FIVE

The following information was gathered from the books of ABC ltd for the month of January

2018 use the information to answer the following questions.

January 2018

1 Balances brought forward: Cash Sh.230; Bank Sh.4,756.

“ 2 The following paid their accounts by cheque, in each case deducting 5

percent discounts: R Burton Sh.140; E Taylor Sh.220; R Harris Sh.800.

“ 4 Paid rent by cheque Sh.120.

“ 6 J Cotton lent us Sh.1, 000 paying by cheque.

“ 8 We paid the following accounts by cheque in each case deducting a 5 per cent

cash discount: N Black Sh.360; P Towers Sh.480; C Rowse Sh.800.

“ 10 Paid motor expenses in cash Sh.44.

“ 12 H Hankins pays his account of Sh.77, by cheque Sh.74, deducting Sh.3 cash

discount.

“ 15 Paid wages in cash Sh.160.

“ 18 The following paid their accounts by cheque, in each case deducting 5 per cent

cash discount: C Winston Sh.260; R Wilson & Son Sh.340; H Winter Sh.460.

“ 21 Cash withdrawn from the bank Sh.350 for business use.

“ 24 Cash Drawings Sh.120.

“ 25 Paid T Briers his account of Sh.140, by cash Sh.133, having deducted Sh.7 cash

discount.

“ 29 Bought fixtures paying by cheque Sh.650.

“ 31 Received commission by cheque Sh.88.

Required

i) Prepare a three column cashbook for the month of January in the books of ABC ltd

(20 Marks)