UNIVERSITY EXAMINATIONS: 2018/2019

ORDINARY EXAMINATION FOR THE DIPLOMA IN INFORMATION

TECHNOLOGY/ DIPLOMA IN BUSINESS INFORMATION

TECHNOLOGY

DIT302 DBIT106 FINANCIAL MANAGEMENT &

FUNDAMENTALS ACCOUNTING

DATE: AUGUST 2019 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One and Any Two Questions.

QUESTION ONE: (30 MARKS)

a) Accounting is dependent on the basic elements in which the practice is founded, list and

explain FIVE of such accounting elements (10 Marks)

b) You are to enter the following transactions, completing the double entry in the books of ZED

ltd for the month of May 2018.

2018

May 1 Started business with sh. 2,000 in the bank.

“ 2 Purchased goods sh. 175 on credit from M Rooks.

“ 3 Bought furniture and fittings sh. 150 paying by cheque.

“ 5 Sold goods for cash sh. 275.

“ 6 Purchased goods on credit sh. 114 from P Scot.

“ 10 Paid rent by cash sh. 15.

“ 12 Bought stationery sh. 27, paying in cash.

“ 21 Let off part of the premises receiving rent by cheque sh. 5.

“ 23 Sold goods on credit to U Foot for sh. 77.

“ 24 Bought a motor van paying by cheque sh. 300.

“ 30 Paid the month’s wages by cash sh. 117.

“ 31 The proprietor withdrew cash for himself sh. 44.

Required

i) Prepare the relevant ledger accounts in the books of ZED ltd. (9 Marks)

ii) Prepare a trial balance for the month of May in the books of ZED ltd. (5Marks)

c) Explain THREE types of errors that can be committed in accounting practice? (6 Marks)

QUESTION TWO: (20 MARKS)

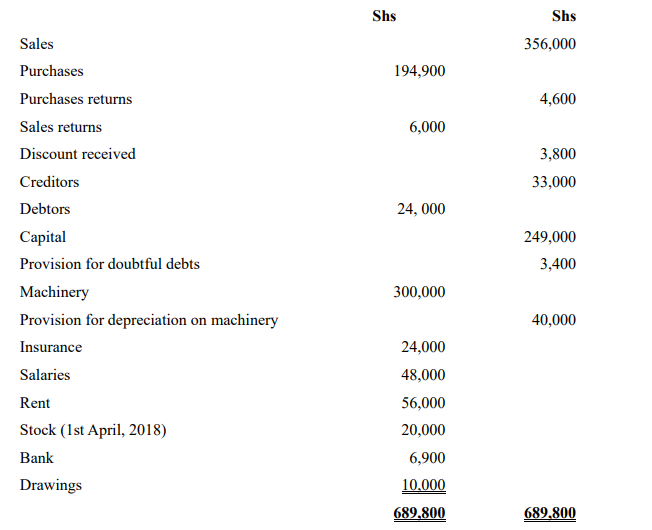

The following balances were extracted from the books of ABC ltd, as at 31st March, 2019

i) Stock at 31st March, 2019 was valued at sh. 48,000

ii) At 31st March, 2019 prepaid insurance amounted to sh. 4, 200 while

iii) Rent accrued was sh. 8,000

iv) Depreciation on machinery is provided at 20% per annum on cost.

Required:

a) Trading, Profit and Loss account for the year ended 31st March, 2019. (12 Marks)

b) Balance sheet as at at 31st March, 2019. (8 Marks)

QUESTION THREE: (20 MARKS)

a) The accounting profession has for a long time relied on certain accounting conventions to guide

accounting practice. Yet the application of the same conventions has been the source of criticism

of the quality and relevance of information contained in financial reports. Explain the meaning

of these conventions as outlined below:

i. The business entity principle. (2 Marks)

ii. The historical cost principle. (2 Marks)

iii. The monetary principle. (2 Marks)

iv. The accrual principle. (2 Marks)

v. The prudence principle. (2 Marks)

b) Explain FIVE importance of accounting in the growth of the economy . Relate your

argument to the Kenyan situation. (10 Marks)

QUESTION FOUR: (20 MARKS)

a) Explain FIVE qualitative aspects of accounting information and the role they play in

accounting . (10 Marks)

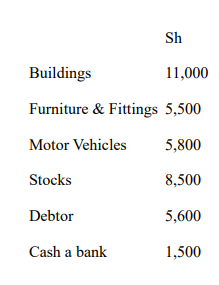

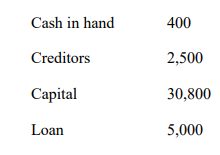

b) Kendi has a business that has been trading for some time. You are given the following

information as at 31.12.2019

You are required to prepare a Balance Sheet as at 31 December 2019 (10 Marks)

QUESTION FIVE: (20 MARKS)

The following transactions took place during the month of May:2019 ,record the transaction in

the journal entries, ledger account and then extract a trial balance

May 1 Started firm with capital in cash of sh250.

“ 2 Bought goods on credit from the following persons: R Kelly sh54; Pcombs

sh87; ,J Role sh25; D Mobile sh76; I. Sims sh64.

“ 4 Sold goods on credit to: C Blanes sh43; B Long sh62; F Skin sh176.

“ 6 Paid rent by cash sh12.

“ 9 C Blanes paid us his account by cheque sh43.

“ 10 F Skin paid us sh150 by cheque.

“ 12 We paid the following by cheque: J Role sh25; R Kelley sh54.

“ 15 Paid carriage by cash sh23.

“ 18 Bought goods on credit from P Combs sh43; Mobile sh110.

“ 21 Sold goods on credit to B Long sh67.

“ 31 Paid rent by cheque sh18.

(20 Marks)