UNIVERSITY EXAMINATIONS: 2021/2022

EXAMINATION FOR THE DIPLOMA IN INFORMATION TECHNOLOGY

DIT 302: FINANCIAL MANAGEMENT FOR IT

DATE: NOVEMBER 2 HOURS

INSTRUCTIONS: ANSWER QUESTIONS ONE AND ANY OTHER TWO

QUESTION ONE (20 Marks)

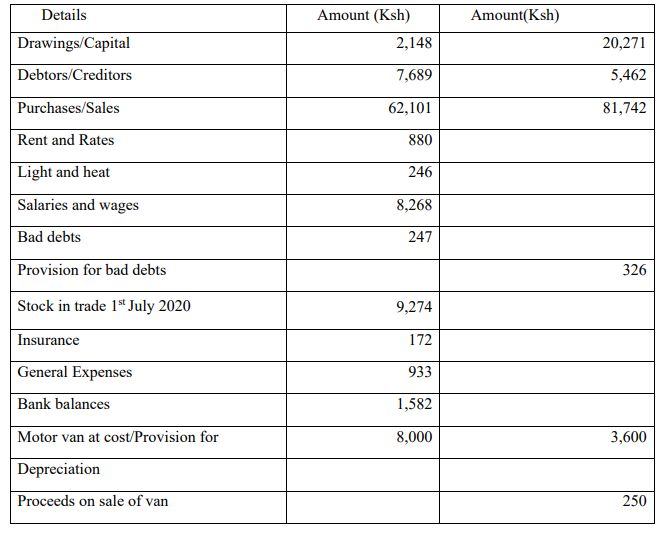

a) Grills Co. Ltd has been trading for some years as a distributor. The following list of

balances has been extracted from his ledger as at 30th June 2021

The following matters are to be taken in to account:

i) Stock in trade at 30th June 2021was Shs. 9,884

ii) Rates paid in advance at 30th June 2021, Shs.40

iii) Rent receivable due at 30th June 2021, Shs.250

iv) Lighting and heating due at 30th June 2021, sh.85

v) Provision for doubtful debts to be increased to Shs.388

vi) Included in the amount for insurance Shs.172, is an item for Shs. 82 for motor

insurance and this amount should be transferred to motor expenses.

vii)Depreciation has been and is to be charged on vans at an annual rate of 20% on cost.

viii) Depreciate buildings Shs.500

Required:

i) Prepare income statement for the year ended 30th June 2021 (10 Marks)

ii) Prepare statement of financial position as at 30th June 2021 (10 Marks)

QUESTION TWO (15 Marks)

a) The following transactions are extracted from the books of Wali enterprises for

the month ended 31st

July 2021

1: Started business with Kshs. 600,000 in the bank and 500,000 in cash

2 Bought goods on credit from Ndung’u Kshs. 270,000

3: Bought goods on credit form S. Muigai Kshs. 75,000

5: Bought goods for cash Kshs. 54,000

6: We returned goods to Ndung’u Kshs. 12,000

8: Bought goods on credit from S. Muigai Kshs. 57,000

10: Sold goods on credit to K. Mwaniki Kshs. 117,000

12: Sold goods for cash Kshs. 63,000

18: Took Kshs.900 of the cash and paid it to the bank

21: Bought machinery by cheque Kshs. 165,000

22: Sold goods on credit to M. Otieno Kshs. 66,000

28: We returned goods to S. Muigai Kshs. 9,000

29: We paid Ndung’u by cheque Kshs. 258,000

31: Bought machinery on credit from Kinuthia Kshs.81,000

Required:

i) Enter the transactions in the relevant ledger accounts. (8 Marks)

ii) Balance off the ledger accounts and extract a trial balance. (7 Marks)

QUESTION THREE (15 Marks)

An organization bought a motor vehicle at Ksh. 600,000. The motor vehicle depreciation is to be

calculated at a rate of 10% per annum.

Required:

i) Determine the value of depreciation for year 1,2 and 3 based on reducing balance

method. (2 Marks)

ii) Determine the value of depreciation for year 1,2 and 3 based on straight line method.

(3 Marks)

iii) Explain five significance of preparing income statement and balance sheets.

(5 Marks)

iv) Explain two uses of the special and three general journals. (5 Marks)

QUESTION FOUR (15 Marks)

a) Explain four errors that violate the equality of a trial balance totals

(4 Marks)

b) Write short notes on the following accounting concepts (3 Marks)

i) Prudence concept

ii) Revenue Realization Concept

iii) Historical Cost Concept

c) Explain two Characteristics of assets and liabilities (2 Marks)

d) Explain three significance of balancing off of the ledger accounts (3 Marks)

e) Explain three Limitations of accounting information (3 Marks)