WEDNESDAY: 7 December 2022. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Outline FOUR differences between a cash market and a derivative market. (4 marks)

2. Explain THREE types of forward commitment contracts. (6 marks)

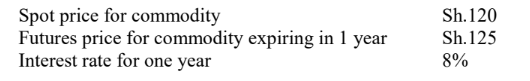

3. Joan Akoth believes she has identified an arbitrage opportunity for a commodity as indicated by the information provided below:

Required:

Describe THREE transactions necessary to take advantage of this specific arbitrage opportunity. (3 marks)

Calculate the arbitrage profit. (3 marks)

Describe FOUR market imperfections that could limit Joan’s ability to implement this arbitrage strategy. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Describe THREE types of risks involved in forward contract. (6 marks)

2. Babito Fund manager is evaluating various investment holdings in their portfolio and they have gathered the following information:

1. They are exposed to a four month forward to buy a zero coupon bond that will mature in one year. The current price of the bond is Sh.930 and the continuously compounded risk free rate of return is 6% per annum.

2. A three month all share index (currently at 400) futures contract with a continuously compounded dividend yield of 1% per annum and 6% interest rate (risk free rate).

3. A one year futures contract on gold costs Sh.20 per 10 gm to store it with payment made at the end of the year. Spot rate is observed at Sh.900 with a risk free rate of 7% per annum compounded continuously.

Required:

Using the cost-of-carry model, calculate:

The appropriate forward price on the zero coupon bond. (2 marks)

The arbitrage free future price of the index. (2 marks)

The theoretical price of the futures price on gold. (2 marks)

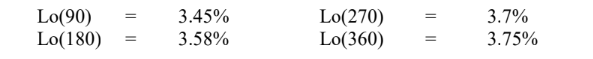

3. Zipro Limited is considering a swap in which they will pay the floating rate and receive the return on equity. The equity swap is for one year involving floating quarterly payments on 90 day, 180 day, 270 day and 360 day whose underlying is a 90-day London interbank offered rate (LIBOR) and receiving return on equity.

Annualised LIBOR rates are as follows:

Required:

Calculate the swap fixed rate. (4 marks)

60 days into the swap, the stock index is at 1436.59 while at the swap initiation the index was at 1405.72.

The present value factors are 0.9965, 0.9858, 0.9751 and 0.9643 respectively, 60 days into the swap.

Calculate the swap market value with a Sh.1 notional principal. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Assess THREE functions of a clearing house in relation to contract. (6 marks)

2. A British company intends to issue a five-year bond with £100 million at 4.5% but actually needs an equivalent amount in dollars, $1.50 million (current $/£ exchange rate is $1.50/£) to finance operations in the United States (US). A US company intends to issue $150 million bonds at 6% maturing in 5 years and needs £100 million to invest in London. To meet each other’s needs, both parties enter into a swap.

Required:

Explain the structure of the swap agreement. (2 marks)

Determine the amount that the British and US companies would spend on interest. (2 marks)

Evaluate the transactions that would take place at maturity of the swap. (2 marks)

3. Fanaka Investments are considering a share worth Sh.49 at the securities exchange. They establish that a call option

with an exercise price of Sh.50 costs Sh.6.25 and a put with an exercise price of Sh.50 cost Sh.5.875. Suppose Fanaka Investments goes ahead and buys a straddle.

Required:

Differentiate between a “straddle” and a “strangle” as used in option derivative. (2 marks)

Determine the value and profit at expiration from the straddle if price of the share at expiration is Sh.61. (2 marks)

The maximum loss from the straddle. (2 marks)

The breakeven price at expiration from the straddle. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Describe TWO ways of settling a forward contract. (4 marks)

2. Discuss THREE challenges of artificial intelligence (AI) in derivatives market. (6 marks)

3. European put and call options with an exercise price of Sh.90 expire in 115 days. The underlying is priced at Sh.96 and makes no cash payments during the life of the options. The applicable risk free rate for these instruments is 4.5%. The put recently has sold for Sh.7.50 and the call Sh.16.00.

Assume a 365-day year.

Required:

Determine whether there is any mispricing present in the option markets by comparing the price of the actual call with the price of the synthetic call. (4 marks)

4. Salim Karisa is a derivatives analyst and is interested in the valuation of a call option on Beta Company using a one

period binomial option pricing model. The underlying stock is a non dividend paying stock. Salim gathers the following data:

1. The current share price is Sh.50 and the call option exercise price is Sh.50.

2. In one period, the share price will either rise to Sh.56 or decline to Sh.46.

3. The risk free rate of return is 5%.

Required:

Calculate the following:

The optimal hedge ratio for the call option. (2 marks)

The risk-neutral probability of the up move for the Beta stock. (2 marks)

The value of the call option using the binomial model. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Discuss THREE weaknesses of delta hedging as a risk management strategy in derivatives contracts. (6 marks)

2. Eliud Dande is a portfolio manager and oversees a balanced fund. The balanced fund has a current market value of

Sh.700 million and a current allocation of 65% equity with an equity beta of 1.12 and 35% fixed income with a modified duration of 6.55.

Eliud Dande believes that reported earnings will be better than those anticipated by the market and based on this short-term market view, he decides to use futures contract to adjust the allocation of the balanced fund to 80% equity and 20% fixed income for the next three months. Dande wants to maintain the balanced fund’s current equity beta and modified duration.

Dande plans to use the stock equity index futures and Treasury bond futures to execute his transaction. He gathers

the data for the two contracts as shown below:

Additional information:

1. Both contracts expire three months from today.

2. The risk free rate is 1.85%.

3. Yield beta for the Treasury bond contract is 1.00.

Required:

Compute:

The number of stock index futures contract that Eliud Dande should buy in order to achieve the adjusted allocation. (3 marks)

The number of Treasury bond contracts that Eliud Dande should sell in order to achieve the adjusted allocation. (3 marks)

3. An investor has a short position in put options on 5000 shares of stock. Call option delta is given as 0.532 while put

option delta is given as –0.419. Assume that each option has one share of stock as the underlying.

Required:

The pre-existing portfolio given that the hedging instrument is stock. (3 marks)

The pre-existing portfolio given that the hedging instrument is call options. (3 marks)

Outline TWO assumptions of the Black model used in the valuation of European options on futures. (2 marks)

(Total: 20 marks)