FRIDAY: 17 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Argue three cases against the existence of derivatives market in your country. (6 marks)

2. Explain the following terms used in derivatives market and contracts:

Exchange traded derivative. (2 marks)

Over the counter contract. (2 marks)

Contingent claims. (2 marks)

3. An investor anticipates that in the next month, interest rates are likely to decline significantly, and he would like to increase the bond portfolio’s duration to take advantage of interest rates decline. The investor would like to raise the duration on Sh.75 million of bonds from its current level of 6.22 to 7.5 (These are the modified durations). The investor has identified appropriate Treasury bond futures contract currently priced at Sh.82,500 with an implied modified duration of 8.12.

Yield on the bond portfolio is 5% more volatile than implied yield on futures. (Beta is 1.05).

Required:

State whether the investor should buy or sell futures contract. ( 1 mark)

Calculate the number of futures contract involved in raising bond portfolio’s duration. (3 marks)

Calculate the profit on futures contract if one month later the future’s price moves to Sh.85,000. (2 marks)

Assuming the investor wanted to reduce the duration to zero, explain whether he should buy or sell futures contract. (1 mark)

Determine the number of futures contract required to achieve the investors objective in (iv) above. (1 mark)

(Total: 20 marks)

QUESTION TWO

1. A futures contract is mostly constructed with the idea that the participants will hold their positions until the contract expires. However, there may be need to terminate a futures contract before maturity. In relation to the above statement, discuss three ways in which a derivatives market participant could terminate a futures contract. (6 marks)

2. An investor would like to hedge himself against stock market index volatility. He enters into a forward contract on the NSE share index currently valued at 1140. The continuously compounded risk-free rate is 4.6% and the continuous dividend yield is 2.1%. The forward contract is for 140 days.

Assume a year has 365 days.

Required:

The forward price. (2 marks)

The value of the forward contract after 95 days assuming the value of the NSE index is at 1025. (3 marks)

3. Makao Limited decided to venture into the bond market by buying a newly issued bond 200 days ago. The bond is a 10 year, 8% bond paying interest semi-annually and has a face value of Sh.1,000. Currently. the bond is selling at Sh.1,146.92.

The first four coupons are paid in 181 days, followed by the coupons paid in 365 days, 547 days and 730 days.

Makao Limited would like to sell the bond 365 days from today. The company is concerned about locking in the price at which they can sell the bond.

Required:

Advise Makao Limited whether it should enter into a long or short forward contract to lock in the price. (1 mark)

Calculate the non-arbitrage value of contract 180 days after forward contract was entered into.

Assume risk free rate is 6% at the start of contract and 4% 180 days into the forward contract. Price of the bond 180 days into forward contract is Sh.1,302.26. (8 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the following terms as used in options markets:

Bull spreads. (2 marks)

Bear spreads. (2 marks)

2. An investor simultaneously purchases an underlying having a price of Sh.77 and writes a call option on it with an exercise price of Sh.80 and selling at Sh.6.

Required:

Justify why the investor should take this position. (2 marks)

Calculate the value at expiration for the above strategy if the underlying at expiration is:

- Sh.75. ( 1 mark)

- Sh.85. (1 mark)

Determine the maximum profit. (1 mark)

Determine the break-even point. ( 1 mark)

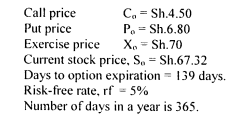

3. The following information relates to call and put options on a stock:

Required:

Using the put-call parity, evaluate the prices of the following:

Synthetic call option. (2 marks)

Synthetic put option. (2 marks)

Synthetic underlying stock. (2 marks)

Synthetic bond. (2 marks)

Identify any mispricing of each of the synthetic instruments in (i) – (iv) above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Summarise four differences between futures and options. (8 marks)

2. Juhudi Ltd. is planning to acquire a competing firm in 109 days. The acquisition will initially be financed by Sh.80 million bridge loan with a term of 180 days and at a rate of 180 day LIBOR plus 300 basis points.

Principal and interest will be paid at the end of the loan term. Juhudi Ltd. is concerned about a potential increase in interest rates before the initiation of the loan and seeks your guidance on fully hedging this interest rate risk. The year has 365 days.

You advise Juhudi Ltd. to buy an interest rate call option on 180 day LIBOR with an exercise interest rate of 2.0% for a premium of Sh.86,000. The call expires in 109 days and any payoff occurs at the end of the loan term. Current 180 day LIBOR is 2.2%. Juhudi Ltd. can finance the call option premium at current 180 day LIBOR plus 300 basis points. At initiation of the loan 109 days later, 180 days LIBOR is 3.5%.

Required:

The effective annual rate in basis points on the loan. (8 marks)

3. Consider a one-period binomial model in which the price of underlying is at Sh.65 and can go up 30% or down 22%. The risk-free rate is 8%.

Required:

Determine the price of a European call option with an exercise price of Sh.70. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the following terms in relation to the option Greeks:

Rho. (2 marks)

Vega. (2 marks)

Gamma. (2 marks)

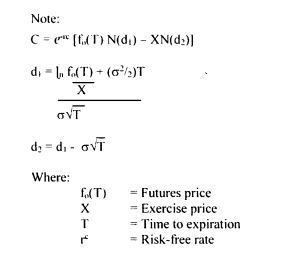

2. A European option on a futures contract priced at Sh.139.19 has an exercise price of Sh.125. The futures option expires in 215 days. The continuously compounded risk-free rate is 4.25% while the volatility is uiven as 0.15.

Required:

The futures call option price using the Black model. (5 marks)

3. An investor owns bonds issued by Maratiki Ltd. and buys a default protection from a credit default swaps (CDS) dealer. The bonds mature in one year and have a par value of Sh. 10 million.

Required:

Analyse the need for the use of this CDS to the investor. (2 marks)

If the dealer reckons that the probability of default is 2% and the recovery rate in the event of default to be 40%. Determine the fair premium for the CDS deal. (4 marks)

4. NEXT is the Nairobi Securities Exchange (NSE) derivatives market that facilitates futures trading in the Kenyan market.

Required:

Name the two futures products that one can trade in NEXT. (2 marks)

Identify the equity index that constitute the equity index futures contracts of NEXT. (1 mark)

(Total: 20 marks)