MAASAI MARA UNIVERSITY

SCHOOL OF BUSINESS AND ECONOMICS

DEPARTMENT OF BUSINESS MANAGEMENT

DIPLOMA IN BUSINESS MANAGEMENT

END OF SEMESTER EXAMINATION APRIL 2014

DBM 02 : PRINCIPLES OF ACCOUNTING

Instructions answer Question one and any other three questions

QUESTION ONE

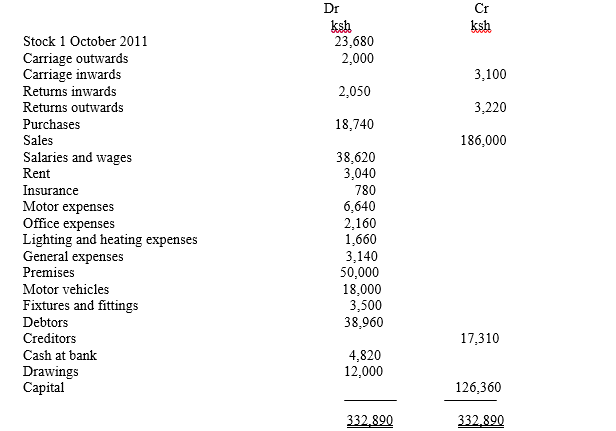

From the following trial balance of Fones draw up a trading and profit and loss account for the year ended 30 September 2012, and a balance sheet as at that date.

Required ;

a) Prepare the trading profit and loss account [ 9 marks ]

b) Balance sheet [ 6 marks]

QUESTION TWO

a) Explain the classifications of accounts [ 6 marks ]

b) Explain the relevance of the following accounting principles in the preparation of accounts. ( 9 marks )

i) Going concern concept

ii) Historic cost

iii) Accrual

iv) Duality concept

QUESTION THREE

The following transactions took place during the month of May 2009

May1 Started firm with capital in cash of Ksh250.

“ 2 Bought goods on credit from the following persons: R Kelly Ksh54; Pcombs Ksh87;

J Role Ksh25; D Mobile Ksh76; I. Sims Ksh64.

“ 4 Sold goods on credit to: C Blanes Ksh43; B Long Ksh62; F Skin Ksh176.

“ 6 Paid rent by cash Ksh12.

“ 9 C Blanes paid us his account by cheque Ksh43.

“ 10 F Skin paid us Ksh150 by cheque.

“ 12 We paid the following by cheque: J Role Ksh25; R Kelley Ksh54.

“ 15 Paid carriage by cash Ksh23.

“ 18 Bought goods on credit from P Combs Ksh43; Mobile Ksh110.

“ 21 Sold goods on credit to B Long Ksh67.

“ 31 Paid rent by cheque Ksh18.

Required

Pass these transactions in the relevant ledgers and draw a trial balance for the same .[ 15 marks]

QUESTION FOUR

a) Identify and explain any five documents use din recording accounts that are used in recording accounting information. ( 5 marks )

b) The following information was extracted from the books of neon traders in the months of may 2008

Mar 1 Balances brought forward: Cash Ksh230; Bank Ksh4,756.

“ 2 The following paid their accounts by cheque, in each case deducting 5 percent

Discounts: Burton Ksh140; Taylor Ksh220; Harris Ksh800.

“ 4 Paid rent by cheque Ksh120.

“ 6 Cotton lent us Ksh1,000 paying by cheque.

“ 8 We paid the following accounts by cheque in each case deducting a 2 ½ per cent cash discount: Black Ksh360; Towers Ksh480; Rowse Ksh300.

“ 10 Paid motor expenses in cash Ksh44.

“ 12 H Hankins pays his account of Ksh77, by cheque Ksh74, deducting Ksh3 cash discount.

“ 15 Paid wages in cash Ksh160.

“ 18 The following paid their accounts by cheque, in each case deducting 5 per cent cash discount: Winston Ksh260; Wilson & Son Ksh340; Winter Ksh460.

“ 21 Cash withdrawn from the bank Ksh350 for business use.

“ 24 Cash Drawings Ksh120.

“ 25 Paid T Briers his account of Ksh140, by cash Ksh133, having deducted Ksh7 cash discount.

“ 29 Bought fixtures paying by cheque Ksh650.

“ 31 Received commission by cheque Ksh88.

Required:-

Prepare a three column cash book for the year ending May 2008. ( 15 marks)

QUESTION FIVE

a) Explain any four factors affecting the balance on the cash book and the bank statement

( 4 mrks)

b) The following information relates to the transactions and the balances of Jirani enterprises. The bank statement from the KCB bank for the months of June 2010. Cash book balance on 31 December 2009 was shs 30,000 (DR). On the same date balance as per bank statement was sh 50,000 ( cr ).

On examining the bank statement and the cash book the following differences were observed;

i) The bank had not yet credited a cheque of sh. 8000 deposited by the Jirani

ii) The bank statement revealed service fee of shs 600

iii) Bank collected on behalf of Jirani dividends amounting to sh. 13,000

iv) A standing order to an insurance firm of sh. 800 had been paid by the bank but not entered in the cash book.

v) Cheques paid to suppliers but Not yet presented for payment by bank amounting to sh. 16,400

Required

a) An adjusted cash book balance (7 marks )

b) Bank reconciliation statement (4 marks )

QUESTION SIX

a) Identify and explain any four source of capital for a sole trader ( 6 marks)

b) Discuss the various users of accounting information. ( 9marks)