MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS

2016/2017 ACADEMIC YEAR

FIRST YEAR SECOND SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

DIPLOMA IN BUSINESS MANAGEMENT

COURSE CODE: DBM 008

COURSE TITLE: FINANCIAL ACCOUNTING I

DATE: 27TH APRIL 2017 TIME: 2.30PM-4.30PM

INSTRUCTIONS TO CANDIDATES

• Answer question ONE (compulsory) and any other THREE

• Question one carries 25 marks

• All other questions carry 15 marks

This paper consists of 8printed pages. Please turn over

QUESTION 1

a) Distinguish between share premium and revaluation reserves (2 Marks)

b) Briefly explain how a company can utilize its share premium. (3 Marks)

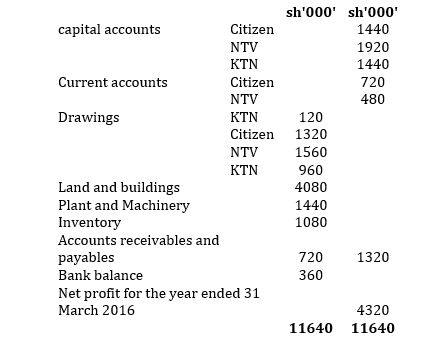

c) Citizen, NTV and KTN were in partnership sharing profit and losses equally after allowing for interest on capital at the rate of 10% per annum.

Citizen retired on 31 December 2015 and NTV and KTN agreed to continue with the business sharing profits and losses in the ratio of 3:2 respectively after allowing for interest on capital at the rate of 10% per annum.

The amount due to Citizen was to be paid in five equal installments commencing on 31 December 2016 and was to attract interest at 20% per annum.

Additional information:

1. For the purpose of Citizen retirement the partners agreed to:

i. Revalue the land and Buildings at shs 4,500,000 on 31 December 2015

ii. Value goodwill at shs 2,880,000 on 31 December 2015. The goodwill would not be retained in the books of the partnership.

2. No adjustments in respect of Citizen’s retirement had been recorded in the partnership’s books as at 31 March 2016.

3. Assume net profit accrued evenly throughout the financial year

Required

i. Profit and loss appropriation account for the year ended 31 March 2016 (8 marks)

ii. Partner’s current account (3marks)

iii. Partner’s capital account (3marks)

iv. Balance sheet as at 31 March 2016 (6marks)

QUESTION 2

(a) On 31st March 2017 the cash book of H. Njeri showed a balance at the bank of Sh Sh8, 100. The bank statement however showed a balance of Sh 6,700. Going through the bank statement she found out that:

1. A cheque received from Taifa Ltd on 1st March for Sh 600 and entered into the cash book did not appear on the bank statement

2. A cheque paid to E. KamaraSh 700on 25th March had not been presented

3. A cheque received from N Njiru on 24th March Sh 600 and entered into the cash book was returned dishonored. No entry in this regard was recorded I the cash book

4. Bank charges amounting to Sh 100 had not been entered into the cash book

5. The bank received directly Sh 1000from E.A.B.L as dividends on 18th March on behalf of H. Njeri

6. A cheque payment of Sh 2000 to Olivia had been entered in error Sh200 in the cashbook

Required

i. Make the necessary entries to update the cash book (4 marks)

ii. Prepare a bank reconciliation statement for H. Njeri for the month of March 2017 (3 marks)

b) Show the journal entries required to correct the following errors. Entries; narratives must be shown. (8 marks)

1. A cheque worth Shs.1200 paid to Jolly John, a trade creditor was completely omitted from the books of accounts.

2. Credit sale of goods for Shs.4050 to J Johnny was debited wrongly in J John’s account in the sales ledger.

3. Shs.15000 spent on the delivery and installation of a machine is debited to general expenses account.

4. Discounts allowed and discounts received are each overstated by Shs.2000.

5. Shs.1230 of returned goods is entered as Shs.1320in both H Hillary’s and returns inwards accounts.

6. Shs.1750 cash was received from H Hothead and was entered in the credit side of cash book and debited to H Hothead’s account in the sales ledger

QUESTION 3

a) State the assumptions, principles and constraints that would best describe the statements below: (6 Marks)

1. Company XYZ Ltd expenses the cause of waste basket in the year they occur

2. Company X reports current and non-current classification in its balance sheet

3. Company K reports information about pending suites in court

4. Company Q recognizes depreciation expense for an equipment over the equipment 5 years period.

5. Company B establishes an allowance for bad debts.

6. Company Z does not record its plant assets at liquidation value.

b) i. Define the term Depreciation ( 2 Marks)

ii. List and briefly explain the three methods of providing for depreciation (3 Marks)

iii. Mr. Right bought a pick up for business use of Kshs. 4,000,000. Depreciation is charged at the rate of 10% p.a

Required;

Calculate depreciation charges for 6 years using the reducing balance methods (4 Marks)

QUESTION 4

For accounting information to be able to effect the purpose for which it was meant there are certain attributes that it must fulfill. Explain the qualities of good accounting information (5 Marks)

a)Kisumuvaluers, a firm proving valuation services in the lakeside city of Kisumu, have provided you with the following information regarding the month of December 2009.

Dec

1 Mr. Kizito, the owner, invested shs 100,000 cash and shs 25,200 worth of equipment in the business

2 Paid shs 30,000 cash for office rent and shs 9,000 cash for insurance premium. The office rent and insurance policy were both for the three months ending in February 28,2010.

3 Made credit purchases of office supplies for shs 15,000

4 Completed work for a client and received shs 18,000 in cash

5 Completed work for another client who promised to pay shs 21,000 within 30 days

6 Withdrew shs 8,000cash for personal use

13 Paid shs 3,500 cash for electricity bill

30 Received shs. 15,000 cash being from sub tenant for the period of December 1 to February 28,2010

31 Musa the office assistant, had not been paid his salary for the month of December 2009 of shs 14,000and shs. 2000 worth of office supplies were still in stock

Note: Equipment’s useful life is 36 months and no salvage value

Required

i. Prepare the journal entries to record the relevant transactions from the information given (5 marks)

ii. Post the entries to relevant ledger accounts (use T-accounts) (5marks)

QUESTION 5

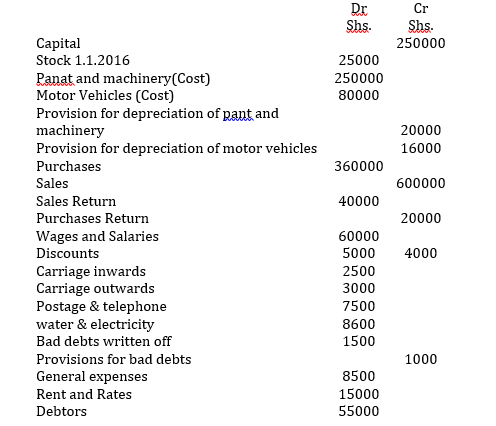

The following trial balance was extracted from the accounting records of Kenya Mpya Travellers as on 31st December 2016.

Additional information:

1. Closing stock on 31st December 2016 was valued at Shs. 22,500.

2. Depreciation is to be charged at 10% of cost of plant and machinery and 20% of cost of motor vehicles

3. Accrued rent is Shs. 3,000 and prepaid rates are shs. 1,000

4. Outstanding electricity expense is Shs. 600

5. Provisionfor bad debts is to be increased by Shs. 300

Required

Prepare the:

i. Statement of comprehensive income (7 marks)

ii. Statement of financial position as at 31st December 2016 (8 marks)