UNIVERSITY EXAMINATIONS: 2018/2019

EXAMINATION FOR THE DIPLOMA IN BUSINESS INFORMATION

TECHNOLOGY

DBIT402 COST ACCOUNTING

DATE: AUGUST 2019 TIME: 2 HOURS

INSTRUCTION: Answer Question ONE and any other TWO questions,

QUESTION ONE: (20 MARKS)

a. Elaborate the concept of CVP using the graph (3 Marks)

b. EOQ model has assumptions that enable it to function properly. Enumerate and explain

FIVE of these assumptions. (5 Marks)

c. Keshi Enterprises has provided the following data in respect of its major raw materials.

Maximum consumption 2,600 units

Normal consumption 2,000 units

Minimum consumption 1,400 units

Re-Order Period 10-16 weeks

Re-order quantity 15,000 units

Required:

i. Re-order level (3 Marks)

ii. Maximum stock level (3 Marks)

iii. Minimum stock level (3 Marks)

iv. Average stock level (3 Marks)

QUESTION TWO: (20 MARKS)

a) Discuss FIVE importance of cost accounting to a small enterprise. (10 Marks)

b) Distiguish between Fixed and Variable costs giving an example for each

(4 Marks)

c) XY ltd has provided the following information with respect to their products

Estimated fixed costs kshs 1,000,000

Variable costs kshs 500 per unit

Selling price kshs 900 per unit

Required:

Calculate the number of units to be sold so as to break even

I) In Ksh. (2 Marks)

Ii) In Units (2 Marks)

How much profit would the company yield if 2000 Units were sold (2 Marks)

QUESTION THREE: (20 MARKS)

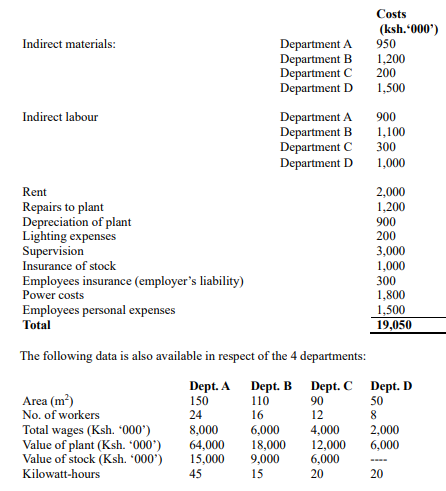

A modern company (X ltd) has 4departments A, B, C and D. The actual cost for a given period

was extracted from their books as follows:

Required:

Apportion the above costs to the various departments on the basis of the most equitable basis.

(20 Marks)

QUESTION FOUR: (20 MARKS)

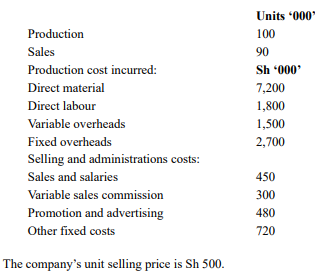

a) Differentiate between marginal and absorption costing. (6 Marks)

The following information has been extracted from the books of XYZ Ltd for the year

to 31ST Dec 2015:

Required:

a) Profit and loss statement under absorption costing approach. (7 Marks)

b) Profit and loss statement under marginal costing approach (7 Marks)

QUESTION FIVE: (20 MARKS)

a) Clearly, state and explain the key assumptions of CVP analysis (6 Marks)

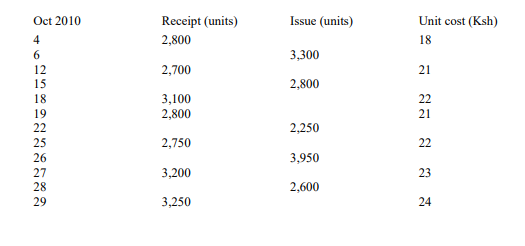

b) The following transactions relate to item X15 which is regularly acquired and stocked by

general Products Kenya Limited for the month of October 2018. The following was entered

in the Company stock ledger

The closing balance for September 2018 was 3,000 units received at a unit cost of Ksh 20.

Required;

Prepare stores ledger for October using:-

i) fifo (7 Marks)

ii) Lifo (7 Marks)