UNIVERSITY EXAMINATIONS: 2017/2018

EXAMINATION FOR THE DIPLOMA IN BUSINESS INFORMATION

TECHNOLOGY

DBIT402 COST ACCOUNTING

DATE: APRIL, 2018 TIME: 1 ½ HOURS

INSTRUCTIONS: Answer any Three Questions.

QUESTION ONE: (20 MARKS)

a) Clearly and in detail, explain the differences between the following cost classifications

and give examples in each case:

(i) Variable costs and Fixed costs (4 Marks)

(ii) Relevant (avoidable) and irrelevant (unavoidable) costs (4 Marks)

(iii) Sunk costs and opportunity costs (4 Marks)

b) Discuss the importance of cost accounting to a small enterprise. (8 Marks)

QUESTION TWO: (20 MARKS)

a) Identify and explain any five benefits of controlling materials in the organization. (5 Marks)

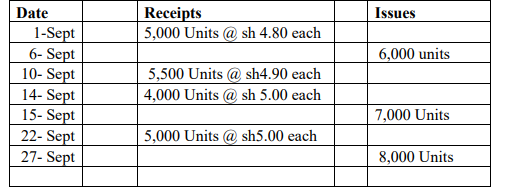

b) The following are the stock movements of stock item Q-3

The stock as at 31 August was 4,500 units valued at sh 5 each.

Required:

Prepare stock cards for stock item Q-3, using each of the following stock pricing methods:

i). FIFO (8 Marks)

ii). LIFO (7 Marks)

QUESTION THREE: (20 MARKS)

a. Define EOQ and state FOUR limitations of EOQ model (5 Marks)

b. EOQ model has assumptions that enable it to function properly. Enumerate and explain

three of these assumptions. (3 Marks)

c. Keshi Enterprises has provided the following data in respect of its major raw materials.

Maximum consumption 2,400 units

Normal consumption 1,800 units

Minimum consumption 1,200 units

Re-Order Period 8-12 weeks

Re-order quantity 12,000 units

Required:

i. Re-order level (3 Marks)

ii. Maximum stock level (3 Marks)

iii. Minimum stock level (3 Marks)

iv. Average stock level (3 Marks)

QUESTION FOUR: (20 MARKS)

a) Distinguish 5 differences between financial accounting and management accounting.

(10 Marks)

b) XY ltd has provided the following information with respect to their products

Estimated fixed costs Kshs 800,000

Variable costs Kshs 100 per unit

Selling price Kshs 200 per unit

Required:

i. Calculate the number of units to be sold so as to break even (4 Marks)

ii. Determine the number of units to be sold to earn a target profit of Ksh 60,000 (3 Marks)

iii. Determine the margin of Safety (3Marks)

QUESTION FIVE: (20 MARKS)

a) Explain FOUR differences between marginal and absorption costing (8 Marks)

b) The following data have been extracted from the budgets and standard costs of ABC

Limited, a company which manufactures and sells single product.

Selling price 450.00

Direct materials cost 100.00

Direct wages cost 40.00

Variable overhead costs 20.00

Fixed production overhead Sh.4,000,000 per annum

Fixed selling and distribution costs Sh.800, 000 per annum

The following patterns of sales and production are expected during the year 2016.

Sales (units) 150,000

There was no closing or

opening stock

Required:

Prepare profit statements for each of the two quarters, in a columnar format, using the

following:

(i) Marginal costing (6 Marks)

(ii) Absorption costing (6 Marks)