UNIVERSITY EXAMINATIONS: 2017/2018

EXAMINATION FOR THE DIPLOMA IN BUSINESS INFORMATION

TECHNOLOGY

DBIT402 COST ACCOUNTING

DATE: JULY 2018 TIME: 1 ½ HOURS

INSTRUCTION: Answer any THREE questions.

QUESTION ONE: (20 MARKS)

(a) Explain the importance of STOCK management in the organization (4 Marks)

(b) Briefly discuss four assumptions of Break even analysis (4 Marks)

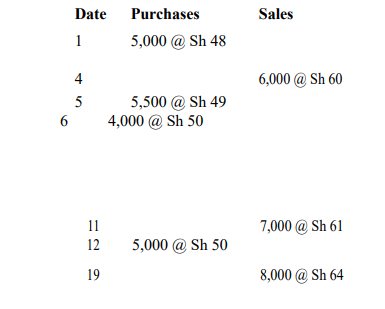

(c) Mashujaa Ltd buys and sells product Q-3. It values sock on the basis of first in first out

(FIFO). As at 1 June 2014, Opening Stock consisted of 4,500 units which were acquired

Required:

a) Stores ledger card based on FIFO (8 Marks)

c) Trading account for the month (4 Marks)

QUESTION TWO: (20 MARKS)

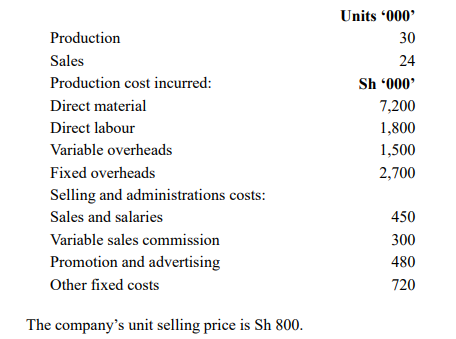

The following information has been extracted from the books of Duka Ltd for the year to

31 March 2017:

The company’s unit selling price is Sh 800.

Required:

a) Profit and loss statement under marginal costing approach. (8 Marks)

b) Profit and loss statement under absorption costing approach. (8 Marks)

c) An explanation of the difference in profit or loss in (a) and (b) above. (4 Marks)

QUESTION THREE: (20 MARKS)

a) Clearly and in detail, explain the differences between the following cost

classifications

and give examples in each case:

(i) Direct costs and Indirect costs (4 Marks)

(ii) Relevant (avoidable) and irrelevant (unavoidable) costs (4 Marks)

(iii) Sunk costs and opportunity costs (4 Marks)

b) Discuss the importance of cost accounting to a small enterprise. (8 Marks)

QUESTION FOUR: (20 MARKS)

a) Differentiate between Financial accounting and cost accounting (10 Marks)

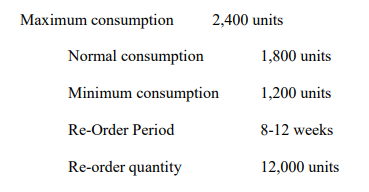

b) Keshi Enterprises has provided the following data in respect of its major raw materials.

Required:

i. Re-order level (2 Marks)

ii. Maximum stock level (3 Marks)

iii. Minimum stock level (3 Marks)

iv. Average stock level (2 Marks)

QUESTION FIVE: (20 MARKS)

a) Clearly, state and explain the key Limitations of Break even (CVP) analysis

(6 Marks)

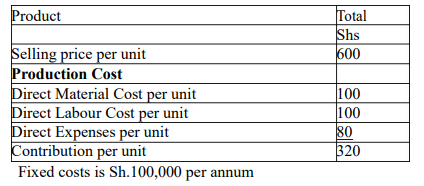

(b) Ukweli Company Ltd. manufactures sports shoe in Nairobi County.

The following information relates to the costs associated with the company’s production

in the year ending 31st December 2017.

activities:

Required

(i) Determine the company’s Break – Even Point (BEP) in both units and shillings

(6 Marks)

(ii) How many units should be sold in order to earn a target profit of Sh.1,000,000

(4 Marks)

(iii) Assuming the selling price and the fixed cost decreased by 30%. Determine the

new Break Even Point (4 Marks)