UNIVERSITY EXAMINATIONS: 2015/2016

UNIVERSITY EXAMINATIONS: 2015/2016

EXAMINATION FOR THE DIPLOMA IN INFORMATION

TECHNOLOGY

DBIT 504 BUSINESS FINANCE

DATE: AUGUST 2016 TIME: 1½HOURS

INSTRUCTIONS: Answer Any THREE Questions.

QUESTION ONE

(a) Define agency relationship from the context of a public limited company and briefly

explain how this arises. (6 Marks)

(b) Highlight the various measures that would minimize agency problems between the

owners and the management. (6 Marks)

(c) Distinguish between the goals of profit maximization and shareholder wealth

maximization (4 Marks)

(d) Explain the limitations of the goal of profit maximization (4 Marks)

QUESTION TWO

(a) Discuss the main factors which a company should consider when determining the

appropriate mix of long-term and short-term debt in its capital structure. (6 Marks)

(b) Malindi Leisure Industries is already highly geared by industry standards, but wishes to

raise external capital to finance the development of a new beach resort.

Outline the arguments for and against a rights issue by Malindi Leisure Industries.

(6 Marks)

(c) Examine the relative merits of leasing versus hire purchase as a means of acquiring

capital assets. (8 Marks)

QUESTION THREE

(a) Outline four limitations of the use of ratios as a basis of financial analysis. (4 Marks)

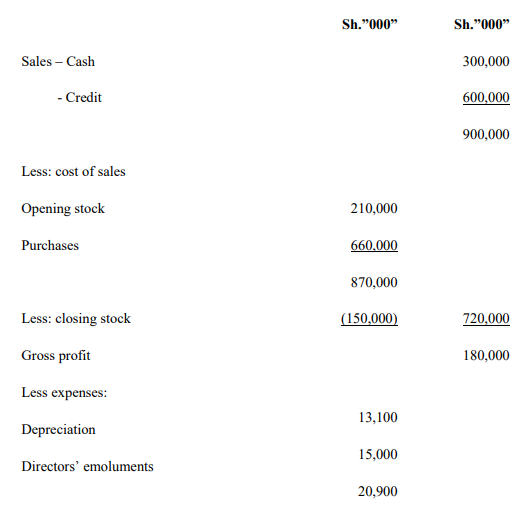

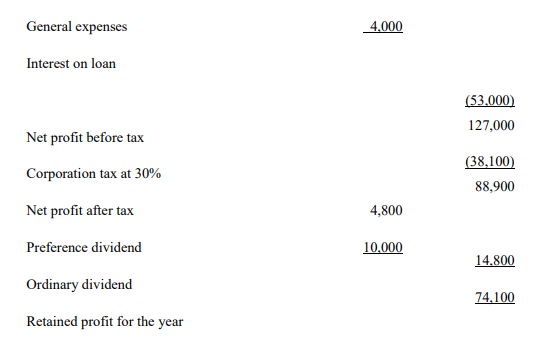

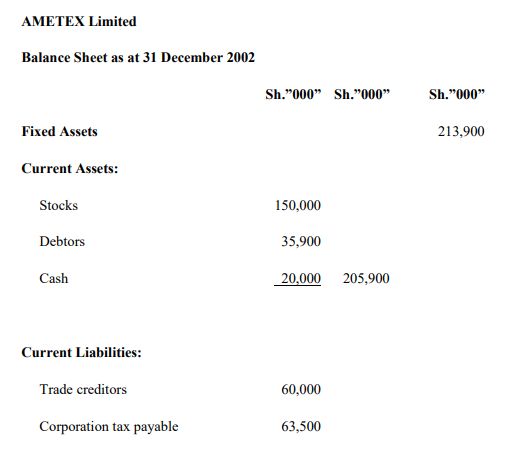

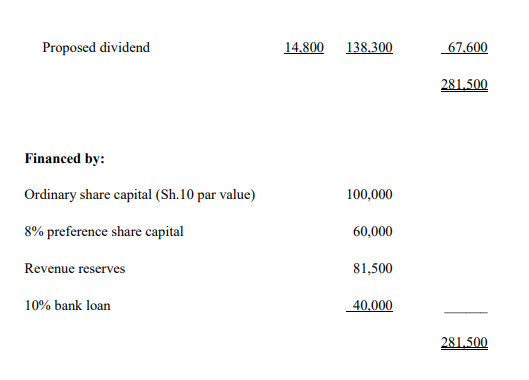

(b) The following information represents the financial position and financial results of

AMETEX Limited for the year ended 31 December 2002.

AMETEX Limited

Trading, profit and loss account for the year ended 31 December 2002

Additional information:

1. The company’s ordinary shares are selling at Sh.20 in the stock market.

2. The company has a constant dividend pay out of 10%.

Required:

Determine the following financial ratios:

(i) Acid test ratio. (3 Marks)

(ii) Operating ratio (3 Marks)

(iii) Return on total capital employed (3 Marks)

(iv) Price earnings ratio. (3 Marks)

(v) Interest coverage ratio (2 Marks)

(vi) Total assets turnover (2 Marks)

QUESTION FOUR

a) Analyse the practical difficulties of a small scale enterprise wishing to obtain credit to

expand production (10 Marks)

b) Distinguish between internal and external sources of finance for a limited liability

company. (10 Marks)

QUESTION FIVE

a) Outline the functions of a financial manager in a contemporary corporate set-up.

(12 Marks)

b) Discuss the factors that a manager considers as he takes up the capital budgeting decisions

for the company (8 Marks)