UNIVERSITY EXAMINATIONS: 2016/2017

EXAMINATION FOR THE DIPLOMA IN BUSINESS

INFORMATION TECHNOLOGY

SPECIAL/SUPPLEMENTARY EXAMINATION

DBIT 504 BUSINESS FINANCE

DATE: JULY, 2017 TIME: 1½HOURS

INSTRUCTIONS: Answer Any THREE Questions.

QUESTION ONE

(a) XYZ Ltd wants to raise new capital to finance a new project. The firm will issue

200,000 ordinary shares (Sh.10 par value) at Sh.16 with Sh.1 floatation costs per share,

75,000 12% preference shares (Sh.20 par value) at Sh.18 with sh.150,000 total floatation

costs, 50,000 18% debentures (sh.100 par) at Sh.80 and raised a Sh.5,000,000 18% loan

paying total floatation costs of Sh.200,000. Assume 30% corporate tax rate. The company

paid 28% ordinary dividends which is expected to grow at 4% p.a.

Required

i. Determine the total capital to raise net of floatation costs

ii. Compute the marginal cost of capital (12 Marks)

(b) Describe the main factors that may limit access of financial facilities by small and

medium enterprises in Kenya. (4 Marks)

(c) Discuss five main factors that determine the capital structure of business

organizations. (4 Marks)

QUESTION TWO

(a) Briefly explain four agency relationships in financial management between

i. Shareholders and managers

ii. Shareholders and creditors. (12 Marks)

(b) A project with initial outlay of Sh200,000 promises the following cash flows

If cost of capital is 10%, calculate NPV of the project. (8 Marks)

![]()

QUESTION THREE

a) Distinguish between compounding and discounting of cash flows. (4 Marks)

b) State and explain any four actions by management that may be harmful to the interest

of debt holders (8 Marks)

c) Given a principal of Sh. 1 million at 8% p.a for 5 years, its future value when the

principal is compounded:

i) Annually

ii) Semiannually

iii) Quarterly

iv) Monthly (8 Marks)

QUESTION FOUR

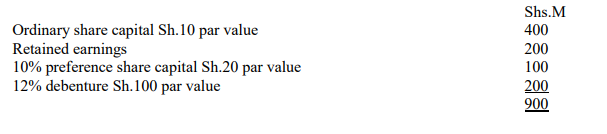

a) The following is the capital structure of XYZ Ltd as at 31/12/2002.

Ordinary share capital Sh.10 par value

Additional information

1. Corporate tax rate is 30%

2. Preference shares were issued 10 years ago and are still selling at par value MPS = Par

value

3. The debenture has a 10 year maturity period. It is currently selling at Sh.90 in the

market.

4. Currently the firm has been paying dividend per share of Sh.5. The DPS is expected

to grow at 5% p.a. in future. The current MPS is Sh.40.

Required

i. Determine the cost of each source of capital. (8 Marks)

ii. Determine the WACC of the firm. (4 Marks)

b) State and explain any four actions by management that may be harmful to the interest

of debt holders (8 Marks)

QUESTION FIVE

a) Find the present value of sh.300,000 to be paid 6 years from now when the prevailing

interest rate is 12% if interest is compounded

i. Annually

ii. Quarterly

iii. Monthly

iv. Daily (12 Marks)

b) Giving examples, differentiate between non discounted cash flow techniques and

discounted cash flow techniques in capital budgeting. (4 Marks)

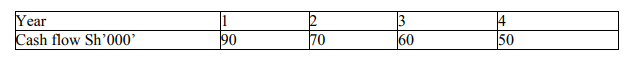

c) A project with an initial outlay of Sh200, 000 promises the following cash flow.

Calculate the payback period of the project. (4 Marks)