UNIVERSITY EXAMINATIONS: 2020/2021

EXAMINATION FOR THE DIPLOMA IN BUSINESS INFORMATION TECHNOLOGY

DBIT 106: FUNDAMENTALS OF ACCOUNTING

FULL TIME/ PART TIME

DATE: DECEMBER, 2021 TIME: 2 HOURS

INSTRUCTIONS: Answer Question one and any other Two

QUESTION ONE (COMPUSORY- 20 Marks)

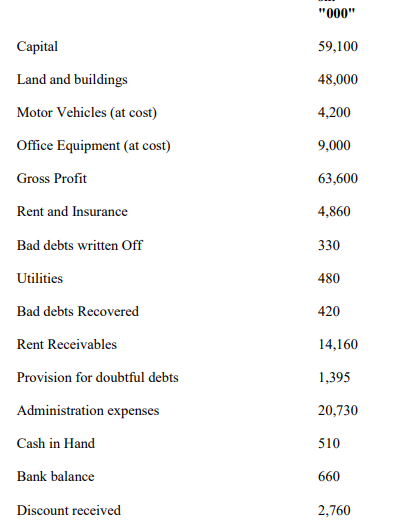

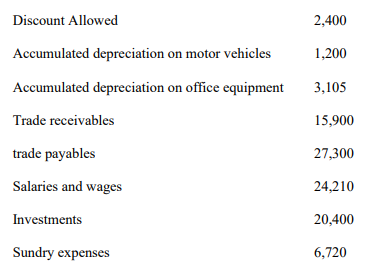

The following balances were extracted from the books of James as at 30 June 2018.

sh.

Additional Information:

1. As at 30 June 2019, inventory was valued at Shs. 14,640,000.

2. Depreciation is to be provided as follows:

Motor vehicle – 20% per annum on cost

Office equipment – 15% per annum on cost

3. Sundry expenses outstanding as at 30 June 2019 was 400,000 while prepared salaries and wages on

the same date was 249,000.

4. Bad debts of 200,000 was to be written off.

5. A provision of 5% on trade receivables was to be provided for doubtful debts.

Required:

a. Income statement for the year ended 30 June 2019. (10 Marks)

b. Statement of financial position as at 30 June 2019. (10 Marks)

QUESTION TWO (15 Marks)

a. State five reasons why the balance as per the cashbook may differ from the balance as per the bank

statement. (5 Marks)

b. KK ltd received their bank statement for the month of October 2019. It reflected a credit balance of Shs.

9,290,000. However, the cashbook balance as at 31 october 2019 indicated a higher amount by Shs.

4,530,000.

The company accountant investigated the matter and discovered the following discrepancies:

1. Cash amounting to Shs. 1,740,000 though entered in the cashbook as having been banked, had been

embezzled by the account clerk in the office.

2. The bank has erroneously credited KK ltd with an amount of Shs. 2,510,000.

3. Direct deposits by debtors amounting to Shs. 13,080,000. These deposits were made via electronic funds

transfers.

4. Uncredited cheques as at 31 October 2019 amounted to Shs. 9,624,000.

5. A standing order of Shs. 1,770,000 for goods purchased on hire purchase had been effected by the bank.

6. Cheques issued to suppliers, but not yet presented to the bank as at 31 October 2019 amounted to

2,640,000.

7. Bank charges amounting to Shs. 484,000 had not been entered in the cash book.

8. A cheque from the debtors for an amount of Shs. 1,446,000 were returned by the bank stamped

“Account closed”

9. A forged cheque in favor of ‘XYZ Ltd’ was presented to the bank. The cheque which amounted to Shs.

2,712,000 was paid by the bank.

Required:

a. Adjusted cash book as at 31 October 2019. (6 Marks)

b. Bank reconciliation statement as at 31 October 2019. (4 Marks)

QUESTION THREE (15 Marks)

a. Define the following accounting principles: (6 Marks)

i. Going concern principle

ii. Prudence concept

iii. Duality Principle

b. Discuss Five books of original entries that are used in accounting (9 Marks)

QUESTION FOUR (15 Marks)

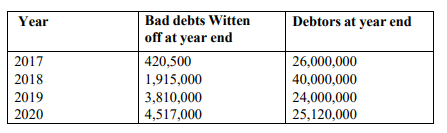

ABC Ltd. started trading on 1 January 2018. Is the norm of the company to provide a 5% provision for

doubtful debt for the outstanding balance of trade receivables?

The following details are available for the years ended 31 December 2017, 2018, 2019 and 2020.

Year Bad debts Witten

off at year end

Debtors at year end

Required:

i. Bad debts account for the four years ended 31 December 2017, 2018, 2019 and 2020 (3 Marks)

ii. Provision for bad and doubtful debts account for the years 2017, 2018, 2019 and 2020 (4 Marks)

iii. Income statement extract for the years ended 31 December 2017, 2018, 2019 and 2020 (4 Marks)

iv. The balance sheet extracts as at 31 December 2017, 2018, 2019 and 2020 (4 Marks)