UNIVERSITY EXAMINATIONS: 2016/2017

ORDINARY EXAMINATION FOR THE DIPLOMA IN

INFORMATION TECHNOLOGY/ DIPLOMA IN

BUSINESS INFORMATION TECHNOLOGY

DBIT 106 DIT 302 FINANCIAL MANAGEMENT& FUNDAMENTALS

ACCOUNTING

DATE: AUGUST, 2017 TIME: 1½HOURS

INSTRUCTIONS: Answer Question one and Any Two Questions

QUESTION ONE

a) Discuss 5 accounting users and clearly indicate how they use it in decision making.

(10 Marks)

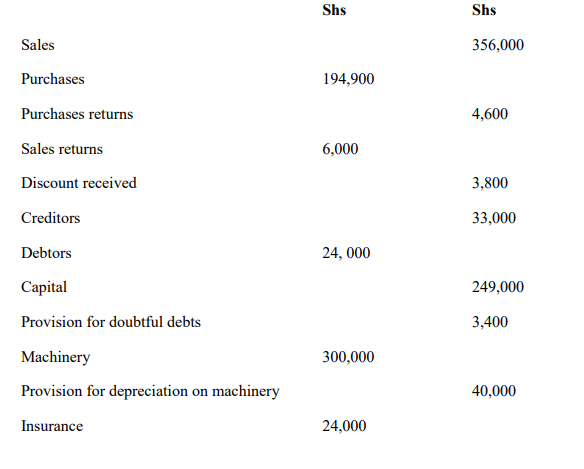

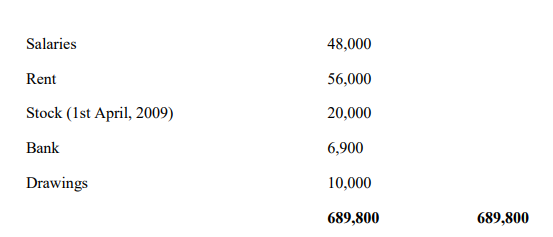

b) The following balances were extracted from the books of Nurse, a sole trader, as at

31st March, 2016

Additional information:

689,800 689,800

i) Stock at 31st March, 2010 was valued at sh. 48,000

ii) At 31st March, 2010 prepaid insurance amounted to sh. 4, 200

iii) Rent accrued was sh. 8,000

iv) Depreciation on machinery is provided at 20% per annum on cost.

Required:

a) Trading, Profit and Loss account for the year ended 31st March, 2010. (12 Marks)

b) Balance sheet as at at 31st March, 2010. (8 Marks)

QUESTION TWO

a) “As an expert in IT, how could you incorporate accounting knowledge you have

acquired in improving accountability and increasing organizational performance”.

Discuss. (10Marks)

b) Discuss the accounting elements that forms the foundation of accounting ( 10 Marks)

QUESTION THREE

Write up a two-column cashbook from the following details, and balance off as at the end

of the month of May 2016:

2016

May 1 Started business with capital in cash £1,000.

“ 2 Paid rent by cash £100.

“ 3 F Lake lent us £5,000, paid by cheque.

“ 4 We paid B McKenzie by cheque £650.

“ 5 Cash sales £980.

“ 7 N Miller paid us by cheque £620.

“ 9 We paid B Burton in cash £220.

“ 11 Cash sales paid direct into the bank £530.

“ 15 G Moores paid us in cash £650.

“ 16 We took £500 out of the cash till and paid it into the bank account.

“ 19 We repaid F Lake £1,000 by cheque.

“ 22 Cash sales paid direct into the bank £660.

“ 26 Paid motor expenses by cheque £120.

“ 30 Withdrew £1,000 cash from the bank for business use.

“ 31 Paid wages in cash £970.

(20 Marks)

QUESTION FOUR

a)

Discuss the five accounting elements that forms the foundation of

financial accounting.

(10 Marks)

b) Explain five limitations of financial accounting (10 Marks)

QUESTION FIVE

The following transactions took place during the month of May:2015 ,record the

transaction in the ledger account then draw a trial balance

May 1 Started firm with capital in cash of sh250.

“ 2 Bought goods on credit from the following persons: R Kelly sh54; Pcombs

sh87; ,J Role sh25; D Mobile sh76; I. Sims sh64.

“ 4 Sold goods on credit to: C Blanes sh43; B Long sh62; F Skin sh176.

“ 6 Paid rent by cash sh12.

“ 9 C Blanes paid us his account by cheque sh43.

“ 10 F Skin paid us sh150 by cheque.

“ 12 We paid the following by cheque: J Role sh25; R Kelley sh54.

“ 15 Paid carriage by cash sh23.

“ 18 Bought goods on credit from P Combs sh43; Mobile sh110.

“ 21 Sold goods on credit to B Long sh67.

“ 31 Paid rent by cheque sh18.