MASOMO MSINGI PUBLISHERS APP – Click to download and access all our materials in PDF

SAMPLE WORK

Complete copy of CPA FINANCIAL ACCOUNTING Revision Kit is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD copy

Phone: 0728 776 317

Email: info@masomomsingi.com

PAPER NO. 1 FINANCIAL ACCOUNTING

UNIT DESCRIPTION

This paper is intended to introduce the candidate to the overall purpose of accounting, applicable regulations, the accounting treatment and presentation of basic transactions and preparation and analysis of financial statements.

LEARNING OUTCOMES

A candidate who passes this paper should be able to:

- Prepare books of original entry and basic ledger accounts under the double entry system

- Prepare basic financial statements of sole traders, partnerships, companies, manufacturing entities and not for profit organisations

- Comply with the regulatory framework in the accounting field

- Analyse financial statements by use of ratios and statement of cash flows

- Demonstrate basic understanding of public sector accounting framework

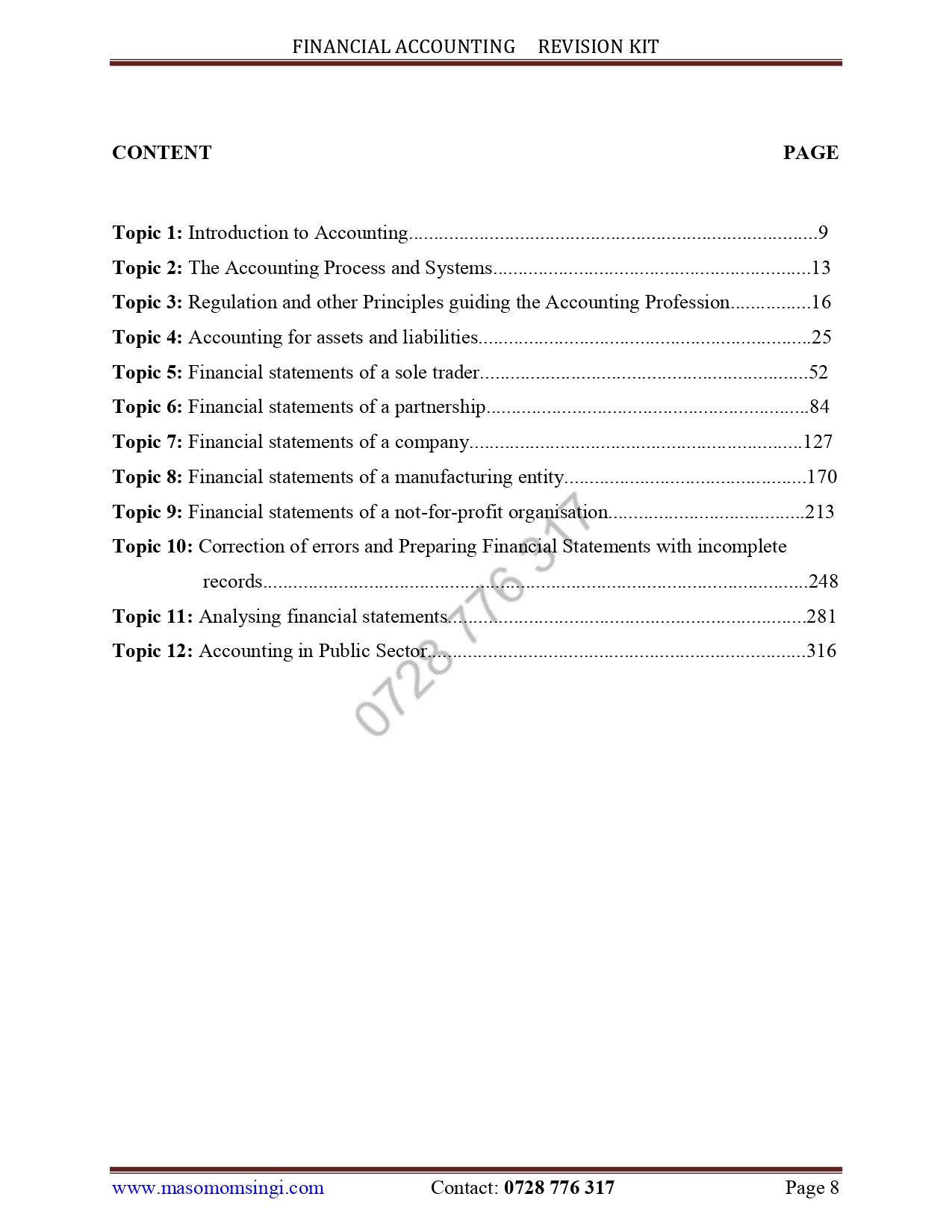

CONTENT

- Introduction to Accounting

- Nature and Purpose of Accounting

- The objective of Financial Accounting

- The Elements of Financial Statements

- The Accounting Equation

- The Users of Accounting Information

- The Accounting Process and Systems

- The Source documents such as receipts and invoices

- The Books of Prime entry/Original Entry from the journals, cashbooks, Petty cash books and registers

- The Ledger and the concept of double entry

- The Trial Balance

- The Financial Statements

- Regulation and other principles guiding the accounting profession

- The legal sources of regulation

- The professional sources of regulation (local and international bodies) and ethical requirements

- Accounting Standards

- Common accounting principles/concepts

- Qualities of useful financial information

- Accounting for Assets and Liabilities

- Property, Plant and Equipment (depreciation, acquisition, disposal, exchange, excluding revaluations)

- Intangible Assets

- Financial Assets and Financial Liabilities (Definition, Examples and Classification only)

- Inventory

- Cash in hand and cash at bank (bank reconciliation statements)

- Trade Receivables (Measurement and credit Losses)

- Trade payables

- Accrued Incomes/Expenses and Prepaid Incomes/Expenses

- Financial Statements of a sole trader

- Statement of Profit or Loss

- Statement of Financial Position

- Financial Statements of a partnership

- The partnership deed/agreement

- The statement of Profit or Loss and appropriation

- Partners’ capital and current accounts

- The statement of financial position

- Accounting treatment and presentation when there is a change in profit/loss sharing ratio, admission/retirement of a partner, dissolution of a partnership

- Financial Statements of a company

- Important concepts of a company (Ordinary and Preference share capital, issuing new shares by way of full market price, bonus shares and rights issue, Reserves, retained profits and corporation tax)

- Statement of Profit or Loss

- Other comprehensive incomes

- Statement of Financial Position

- Statement of Cash flows

- Financial Statements of a manufacturing entity

- Manufacturing Statement of production

- Statement of Profit or Loss

- Statement of Financial Position

- Statements of a not-for-profit entity

- Objectives of Not-for-profit organisations

- Statement of Income and Expenditure

- Statement of Financial Position

- Correction of errors and preparing financial statements with incomplete records

- Types and causes of errors

- Correcting errors in source documents, the books of prime entry, the ledger, the trial balance and financial statements

- Reasons for incomplete information

- Preparation of financial statements from incomplete information

- Analyzing Financial Statements

- The objective of analysing financial statements

- Analysing financial statements using financial ratios (Liquidity, Profitability, Solvency, Efficiency, Investor/Value and Cash Flow categories)

- Accounting in the Public Sector

- Features of public sector entities (as compared to private sector)

- Structure of the public sector (National and county governments, State Corporations, Departments and Agencies)

- Regulation and oversight (International Public Sector Accounting Standards Board, Director of Accounting Services, National Treasury, Parliamentary Committees, Accounting Officers at national and county levels)

- Objectives of public sector financial statements and Standards (IPSAS)

- Accounting techniques in public sector such as budgeting, cash, accrual, commitment and fund accounting)

SAMPLE WORK

Complete copy of CPA FINANCIAL ACCOUNTING Revision Kit is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD copy

Phone: 0728 776 317

Email: info@masomomsingi.com

TOPIC 3

REGULATION AND OTHER PRINCIPLES GUIDING THE ACCOUNTING PROFESSION

QUESTION 1

April 2024 Question One A

Explain the following accounting principles:

(i) Economic entity principle. (2 marks)

(ii) Matching principle. (2 marks)

Answer

i) Economic entity principle

The economic entity principle states that business transactions should be kept separate from the personal transactions of the business owner. In other words, the business is considered a separate legal entity from its owner.

ii) Matching principle

The matching principle dictates that expenses incurred to generate revenue should be recorded in the same accounting period as the revenue itself. This means that revenues and their related expenses should be matched to determine the period’s net income or loss.

QUESTION 2

December 2023 Question One A

The Conceptual Framework for Financial Reporting (the Conceptual Framework), identifies TWO fundamental qualitative characteristics and FOUR enhancing qualitative characteristics that useful financial information is required to have.

Required:

(i) Explain the TWO fundamental qualitative characteristics of useful financial information. (4 marks)

(ii) Describe any TWO enhancing qualitative characteristics of useful financial information. (4 marks)

Answer

The Fundamental and Enhancing Qualitative Characteristics of Useful Financial Information

(i) Fundamental Qualitative Characteristics

The Conceptual Framework outlines two fundamental qualitative characteristics that make financial information useful:

- Relevance: This means that the information should be capable of making a difference in the decisions of users. To be relevant, information must have:

- Predictive value: It helps users predict future events.

- Confirmatory value: It confirms or corrects prior expectations.

- Materiality: The omission or misstatement of the information could influence the decisions of users.

- Faithful representation: This means that the information should represent what it purports to represent. It requires:

- Completeness: All information necessary to understand the entity’s financial position, performance, and cash flows is included.

- Neutrality: The information is free from bias.

- Free from error: The information is presented and classified appropriately.

(ii) Enhancing Qualitative Characteristics

The Conceptual Framework also identifies four enhancing qualitative characteristics that make relevant and faithfully represented information more useful:

- Comparability: This means that information can be compared with information of other entities, or with similar information of the same entity for different periods.

- Verifiability: This means that different knowledgeable and independent observers could reach consensus on the substance of the information.

- Timeliness: This means that information is available to users in time to be relevant to their decision-making.

- Understandability: This means that information is presented clearly and concisely, and is understandable to users who have reasonable knowledge of business and financial matters.

QUESTION 3

April 2023 Question Five D

Describe FOUR benefits of adopting International Financial Reporting Standards (IFRSs). (4 marks)

Answer

Benefits of adopting international financial reporting standards (IFRS)

- They improve accountability and transparency

- It improves the reliability of accounts and boosts the confidence of external agencies

- it enhances comparability among government entities

- It emphasis on performance as well as reducing misuse of public funds

- Improvement in consistence in preparing and reporting of financial information

QUESTION 4

December 2022 Question Five A

Explain the following accounting concepts:

(i) Materiality concept. (2 marks)

(ii) Matching concept. (2 marks)

Answer

i) Maternity Concept – An item is considered to be material if its omission or misstatement will affect the decision of the users.

ii) Matching Concept – States that revenues earned in a period should be matched with the cost incurred in order to determine the profit or loss during the period.

QUESTION 5

August 2022 Question Two A

Outline four objectives of accounting regulatory bodies. (4 marks)

Answer

Objectives of accounting regulatory bodies

- Advancement of accountancy as a language of business

- To maintain professional competence of the members through relevant training

- To maintain high standards of practice and professional conduct

- To promote high standards of prequalification training and education

- To set high standards for entry into and detention of membership

- To promote public understanding and presentation of accountancy

QUESTION 6

December 2021 Question Five C

Evaluate four qualities of useful financial information. (8 marks)

Answer

Qualities of useful financial information

- Relevance – information is relevant when it provided on time and it has the ability of influencing decision of users.

- Reliability – information is reliable when it is free from errors and biases

- Understandable – Financial information must be understandable by the users.

- Comparability – users of financial information must be able to compare the financial statement of entity over time.

QUESTION 7

December 2021 Pilot Paper Question One A

Accountants prepare and maintain financial records for firms and other institutions and extract financial statements as guided by various International Accounting Standards and other statutory regulations.

Required:

Explain any four fundamental qualities of financial information. (8 marks)

Answer

Fundamental qualities of financial information

- Relevance – the information is relevant when is provided on time and it has the ability of influencing the decision of users.

- Reliability – information is reliable when it is free from errors and biases

- Understandability – financial information must be understandable by the users

- Comparability – users of financial information must be able to compare the financial statement of the entity over time.

QUESTION 8

December 2021 Pilot Paper Question Three A

Explain the meaning of the following accounting concepts

(i) Going concern concept. (2 marks)

(ii) Business entity concept. (2 marks)

(iii) Materiality. (2 marks)

Answer

Meaning of the following concepts:

i) Going concern concept – it is an accounting concept which states that tan entity will continue in operations for a foreseeable future with no intention of winding up.

ii) Business entity concept – This states that an entity should be regarded as a separate entity from its owners

iii) Materiality – an item is considered to be material if its omission or misstatement will affect the decision of users.

QUESTION 9

August 2021 Question One B

Discuss three functions of the International Accounting Standards Board (IASB). (6 marks)

Answer

Functions of the international accounting standards board (IASB)

- Development and creation of global accounting standards – This help users of the financial statements to participate in the worlds capital market and to make economic decisions

- Enforcement of standards – IASB committee has the power to enforce the organization to comply with the accounting standard that promotes the use of rigorous applications of those standards.

- Systematic and in depth research on enterprise – IASB does in depth research on the special needs of small and medium sized enterprises and emerging economies in fulfilling the objective of harmonization of an accounting standards.

QUESTION 10

November 2020 Question Five A

Explain the following accounting concepts:

(i) Matching concept. (2 marks)

(ii) Realisation concept. (2 marks)

Answer

Explanation

(i) Matching concept

This states that revenues earned in a period should be matched with the cost incurred in order to determine the profit or loss made during that period.

(ii) Realization concept

This requires revenues and profits be recognized when realized and shall not be anticipated

MASOMO MSINGI PUBLISHERS APP – Click to download and access all our materials in PDF