WEDNESDAY: 19 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Jamii Ltd. has decided to purchase a new machine that costs Sh. 3 million. The machine will be worthless after three years and will be depreciated on a straight line basis. Umoja Bank has offered Jamii Ltd. a three year loan of Sh.3 million. The repayment schedule is composed of three-yearly principal repayments of Sh.l million and an interest charge at the rate of 12% per annum on the outstanding balance of the loan at the beginning of each year. The market wide rate of interest is 12% per annum. Both principal repayments and interest are due at the end of each year.

Pamoja leasing Ltd. offers to lease the same machine to Jamii Ltd. The lease payments of Sh.1.2 million per year are due at the end of each of the three years of the lease.

The corporation tax rate is 30%.

Required:

Advise Jamii Ltd. on whether it should lease the machine or buy it with bank financing. (8 marks)

2. Bidii Machinery Ltd. is planning to replace an old machine with a new one. The old machine had a cost of Sh.650,000 and the new one will cost Sh.780,000. The new machine will be depreciated on a straight line basis to zero over its five year useful life. It will have a salvage value of Sh.140,000 after five years.

The old machine is being depreciated at the rate of Sh.130,000 pear year. It will be completely written off in three years. If it is not replaced now, it will have to be replaced in two years. It can be sold now for Sh.230,000; in two years, it will be worth Sh.90,000.

The new machine will save Bidii Machinery Ltd. Sh.125,000 per year in operating costs. The corporate tax rate is 30% and the discount rate is 14%.

Required:

Determine whether the machine should be replaced now or Bidii Machinery Ltd. should wait to replace it in two years’ time. (12 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain three types of commonly used contracts in Islamic finance. (6 marks)

2. Explain two limitations of sensitivity analysis in capital investment decisions. (4 marks)

3. Bahati Ltd. sells Product A and Product B, with sales of both products occurring evenly throughout the year.

Product A

The annual demand for Product A is 300,000 units and an order for new inventory is placed each month. Each order costs Sh.267 to place. The cost of holding Product A in inventory is Sh.0.10 per unit per year. Buffer inventory equal to 40% of one month’s demand is maintained.

Product B

The annual demand for Product B is 456,000 units per year and Bahati Ltd. buys this product at Sh.1 per unit on 60 days credit. The supplier has offered an early settlement discount of 1% for settlement of invoices within 30 days.

Additional information:

- Bahati Ltd. finances working capital with short-term finance costing 5% per year.

- There are 365 days in a year.

Required:

For Product A, calculate the net cost or savings of introducing an ordering policy using the economic order quantity (EOQ). (6 marks)

Calculate the net value to Bahati Ltd. of accepting an early settlement discount for Product B. (4 marks)

(Total 20 marks)

QUESTION THREE

1. Describe three financial strategies that could be used in corporate restructuring. (6 marks)

2. Faida Ltd. is analysing the possible acquisition of Hasara Ltd. Neither firm has debt. The forecast of Faida Ltd. shows that the purchase would increase its annual after-tax cash flow by Sh.600,000 indefinitely.

Additional information:

- The current market value of Hasara Ltd. is Sh.20 million.

- The current market value of Faida Ltd. is Sh.35 million.

- The appropriate discount rate for the incremental cash flow is 8%.

- Faida Ltd. is trying to decide whether it should offer 25% of its stock or Sh.15 million in cash to Hasara Ltd.

Required:

Determine which alternative Faida Ltd. should use. (6 marks)

3. Bamboo Ltd. has an equity cost of capital of 14.4% and a debt cost of capital of 6%. The firm maintains a debt- equity ratio of 1. Bamboo Ltd. is considering an expansion that will contribute Sh.4 million in free cash flows for the first year growing by 4% per year thereafter. The expansion will cost Sh.60 million and will be financed with Sh.40 million in new debt initially with a constant debt-equity ratio maintained thereafter.

Bamboo Ltd.’s corporate tax rate is 30%, the tax rate on interest income is 15% and the tax rate on equity income is 5%.

Required:

Compute the value of the expansion using the adjusted present value (APV) method. (8 marks)

(Total 20 marks)

QUESTION FOUR

1. Explain three disadvantages of using the internal rate of return in project appraisal. (6 marks)

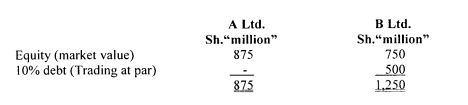

2. A Ltd. and B Ltd. are firms operating in the same industry and are considered to be in the same risk class. Each firm generates operating profit (EBIT) of Sh.125 million in each year. The capital structures of both firms are as follows:

Each of the two firms adopts a 100% payout ratio as its dividend policy. The corporation tax rate applicable is 30%.

Required:

Using the Modigliani and Merton Miller (MM) 11 proposition with corporation tax:

Determine the equilibrium market value for both firms. (2 marks)

Calculate the weighted average cost of capital (WACC) for both firms. (4 marks)

Comment on your observations in (i) and (ii) above. (2 marks)

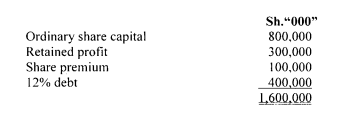

3. Unda Ltd.’s current earnings per share (EPS) is Sh.12. The firm adopts a 40% dividend payout ratio as its dividend policy. The firm has in issue 10,000,000 ordinary shares. The existing capital structure of the firm is given as follows:

Additional information:

- The firm’s equity beta coefficient is 1.4.

- The risk free rate of return is 10%.

- The expected rate of return on market portfolio is 15%.

Required:

Using the capital asset pricing model (CAPM), determine the minimum required return on the company’s equity shares. (2 marks)

Using the dividend growth model, compute the current value of each equity share. (4 marks)

(Total: 20 marks)

QUESTION FIVE

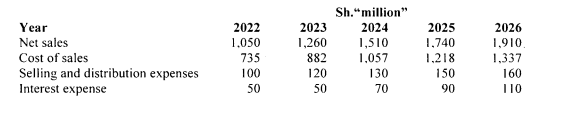

1. X Ltd. is considering acquiring Y Ltd. The following information relates to Y Ltd. for the next five years:

Additional information:

- After the year 2026, cash flows available to X Ltd. from Y Ltd. are expected to grow by 10% per annum in perpetuity.

- Y Ltd. will retain Sh.40 million for internal expansion every year.

- The cost of capital is 18%.

Required:

Estimate the annual free cash flows. (4 marks)

Determine the maximum price payable by X Ltd. to acquire Y Ltd. (8 marks)

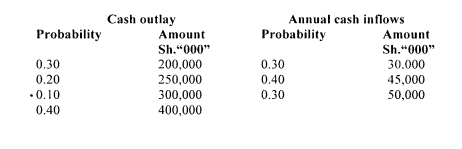

2. Timba Ltd. has an investment opportunity for which the initial cash outlay and future cash inflows are uncertain.

The firm expects to delay implementation of the project for 1 year. The cash outlay in year 1 and subsequent annual cash inflows and probability of their occurrence are summarised as follows:

Additional information:

- The cost of capital is 12%.

- Life expectancy of the project is ten years.

- The salvage value is nil.

Required:

Using decision tree analysis:

Compute the expected net present value (NPV) of the project. (7 marks)

Advise on the suitability or otherwise of the project. (1 mark)

(Total: 20 marks)