WEDNESDAY: 1 September 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Safariland Ltd. is a large company listed on a major Securities Exchange. In recent years, the board of Safariland Ltd. has been criticised for weak corporate governance and two of the company’s non-executive directors have just resigned. A recent story in the financial media has criticised the performance of Safariland Ltd. and claims that the company is failing to satisfy the objectives of its key stakeholders.

Required:

In relation to the above statement, discuss five ways of encouraging managers to achieve stakeholder objectives. (5 marks)

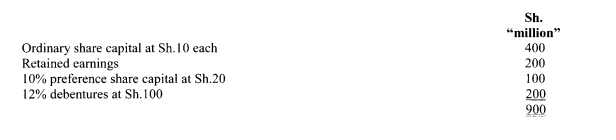

2. The following is the capital structure of Ndege Ltd. as at 31 December 2020:

Additional information:

- The corporate tax is 30%.

- Preference shares were issued ten years ago and are still trading at par.

- The debentures have a ten year maturity period. They are currently selling at Sh.90 in the market.

- The ordinary shares are trading at Sh.40. Dividend paid last year was Sh.5 and is expected to grow at a rate of 5% per annum.

Required:

The weighted average cost of capital (WACC) of the company using market value weights. (7 marks)

3. ABC Limited is evaluating two mutually exclusive projects. Project A will cost Sh.1,000,000 now and will generate cash flows of Sh.500,000 each year over its useful life of four years. Project B will cost Sh.2,500,000 and will generate cash flows of Sh.1,200,000 over its useful life of three years.

The cost of capital is 12%.

Required:

Advise the management of the company on the project to undertake using the equivalent annual net present value (EANPV) approach. (4 marks)

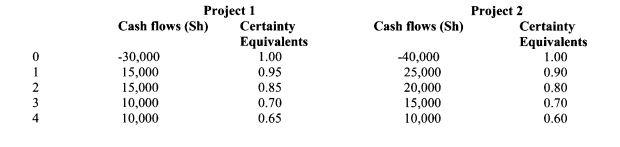

4. A company is considering two mutually exclusive projects. The company uses the certainty equivalent approach.

The estimated cash flow and certainty equivalents for each project are as follows:

The risk free rate is 5%.

Required:

Advise the company on the project to undertake using the certainty equivalent method. (4 marks)

(Total: 20 marks)

QUESTION TWO

Pendo Limited is considering investing Sh.5,750,000 in a new machine to produce product “X”. The expected life of the machine is five years. The machine will have a zero salvage value at the end of five years. It is expected that 20,000 units of product “X” will be sold each year at a selling price of Sh.345 per unit. Variable production costs are expected to be Sh.189.75 per unit, while incremental fixed cost, mainly the wages of a maintenance engineer, are expected to be Sh.1,150,000 per year.

Pendo Limited uses a discount rate of 12% for investment appraisal purposes and expects investment projects to recover their initial investment within two years.

Required:

1. Evaluate the sensitivity of the project’s net prevent value to change in the following project variables:

Sales volume. (2 marks)

Sales price. (2 marks)

Variable cost. (2 marks)

2. Upon further investigation, it is found that there is a significant chance that the expected sales volume of product “X” of 20,000 units per year will not be achieved. The sales manager of Pendo Limited suggests that sales volumes could depend on expected economic states that could be assigned the following probabilities:

Economic state Poor Normal Good

Probability 0.30 0.60 0.10

Annual sales volume (units) 17,500 20,000 22,500

Required:

Calculate and comment on the Expected Net Present Value (ENPV) of the project. (6 marks)

Describe three advantages of sensitivity analysis in capital budgeting. (3 marks)

3. Azera Limited is being evaluated as an acquisition target. Zablon Okeyo, a financial analyst at Wetu Capital, has estimated the following values for the year 2022:

- Net income Sh.300 million

- Net interest after tax Sh.100 million

- Change in deferred taxes Sh.25 million

- Depreciation Sh.200 million

- Change in net working capital Sh.30 million

- Capital expenditure (CAPEX) Sh.250 million

Required:

The firm’s estimated free cash flow (FCF). (5 marks)

(Total: 20 marks)

QUESTION THREE

1. In relation to corporate growth and restructuring:

Explain two reasons for divestments. (4 marks )

Discuss two primary ways of growth of a business organisation. (4 marks)

2. Examine two criticisms of the Modigliani and Miller (MM) hypothesis without taxes. (4 marks)

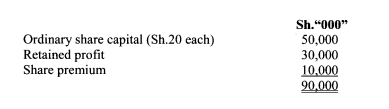

Mashariki Ltd. is currently an all equity financed company. The firm’s current capital structure is given as follows:

Additional information:

- The firm’s ordinary shares are currently trading at the Securities Exchange for Sh.25 each.

- The cost of equity for an all equity financed firm is 12%.

- The firm is considering acquisition of a 16% irredeemable debenture capital to raise Sh.20 million in order to finance an expansion. This will effectively change the firm’s status from unlevered to a levered firm.

- The corporation tax rate is 30%.

Required:

Using the Modigliani and Miller (MM) proposition in a world of corporation taxes, advise on whether the firm should change its capital structure. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. Highlight six potential pitfalls that a merger analyst should consider when reviewing acquisition transactions. (6 marks)

2. KK Limited is considering taking over Oak Limited, a firm in the same industry in order to consolidate their market share.

Given below are financial data for both firms:

KK Limited Oak Limited

Number of issued ordinary shares 20 million 10 million

Earnings per share (EPS) Sh.2.5 Sh.1.5

Market price per share (MPS) Sh.50 Sh.30

Two alternative financing options available for KK Limited are given as follows:

Option 1

Issue new ordinary shares to the shareholders of Oak Limited in exchange for their current shareholding. A maximum exchange ratio of 0.5 shall be applied.

Option 2

Issue 20 units of 10% debenture for every 400 existing ordinary shares. The par value for each unit of debenture is Sh.10.

Corporation tax rate is 30%.

Required:

Post acquisition earnings per share (EPS) under both financing options. (6 marks)

Using the results obtained (b) (i) above, recommend the preferable financing option. (2 marks)

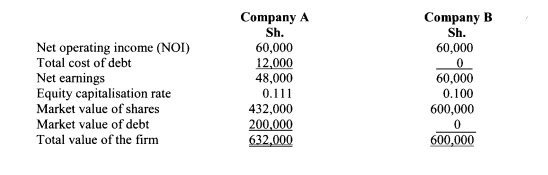

3. Company A, a levered company and Company B, an unlevered company are identical in every respect except that Company A has 6% Sh.200,000 debt outstanding. Jacob Omondi holds Sh.2,000 worth of the Company A shares.

As per the net income (NI) approach, the valuation of the two firms is provided below:

Required:

Demonstrate how Jacob Omondi will reduce his outlay to earn the same return through the use of arbitrage. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Describe four main principles of Islamic Finance. (4 marks)

2. Outline four factors that could affect the level of working capital requirements of a business. (4 marks)

3. Kimbo Limited wishes to improve its working capital management as part of an overall cost cutting strategy to increase profitability. Two areas the company has been considering are working capital funding strategy and inventory management. Kimbo Limited currently follows a policy of financing working capital needs as much as possible from long-term sources of finance, such as equity. The company has been considering its inventory management and has been looking specifically at component A.

Current position:

Kimbo Limited purchases 1,500,000 units of component A each year and consumes the component at a constant rate. The purchase price of component A is Sh.14 per unit. The company places 12 orders each year. Inventory of component A in the financial statements of Kimbo Limited is equal to average inventory of component A.

The holding cost of component A, excluding finance costs is Sh.0.21 per unit per year. The ordering cost of component A is Sh.252 per order.

Economic order quantity (EOQ):

Kimbo Limited wishes to investigate whether basing ordering component A on the economic order quantity will reduce costs.

Bulk order discount:

The supplier of component A has offered Kimbo Limited a discount of 0.5% on the purchase price of component A provided the company orders 250,000 units per order.

Additional information:

Kimbo Limited has no cash but has access to short-term finance (overdraft facility) at an interest rate of 3% per year. This overdraft currently stands at Sh.550,000

Required:

The annual holding and ordering costs of Kimbo Limited’s current inventory management system. (2 marks)

The financial effect of adopting the economic order quantity (EOQ) as the basis for ordering inventory. (5 marks)

The financial effect of accepting the bulk order discount. (4 marks)

Recommend which option should be selected by Kimbo Limited based on your results in (i) – (iii) above. (1 mark)

(Total: 20 marks)