WEDNESDAY: 26 April 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Describe FOUR financial measures of managerial performance as used in corporate finance. (4 marks)

2. Explain THREE causes of conflicts between shareholders and auditors in relation to agency theory. (6 marks)

3. Nyota Ltd. belong to a risk class for which the appropriate capitalisation rate is 12%. It currently has 300,000 ordinary shares selling at Sh.100 each. The firm is contemplating the declaration of dividend of Sh.6 per share at the end of the current financial year. The company expects to have a net income of Sh.3,000,000 and a proposal for making new investment of Sh.6,000,000.

Required:

The price of an ordinary share at the end of the year assuming dividend is not paid. (1 mark)

The price of a company’s share at the end of the year assuming dividend is paid. (1 mark)

The number of new ordinary shares to be issued assuming dividend is paid. (3 marks)

The number of new ordinary shares to be issued assuming dividend is not paid. (3 marks)

Calculate the value of the firm in (c) (iii) and (c) (iv) above. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain FOUR factors that could affect a firm’s capital structure decision. (4 marks)

2. Propose THREE financial strategies that a country could adopt in order to stimulate green finance. (6 marks)

3. The following financial information has been extracted from the statement of financial position of Karne Ltd. for the year ended 31 December 2022:

Additional information:

1. The ordinary shares have a nominal value of Sh.1 per share and a current ex-dividend market price of

Sh.6.10 per share. A dividend of Sh.0.90 per share has just been paid.

2. The 6% preference shares have a nominal value of Sh.0.75 per share and an ex-dividend market price of Sh.0.64 per share.

3. The 8% loan notes have a nominal value of Sh.100 per loan note and a market price of Sh.103.50 per

loan note. Annual interest has just been paid and the loan are redeemable in five years’ time at a 10%

premium to nominal value. The bank loan has a variable interest rate.

4. The risk free rate of return is 3.5% per annum and the equity risk premium is 6.8% per annum.

5. The company’s equity beta is 1.25.

6. The corporation tax rate is 30%.

Required:

The cost of ordinary shares using the Capital Asset Pricing Model (CAPM). (2 marks)

The cost of preference shares. (2 marks)

The cost of loan notes. (2 marks)

The cost of bank loan. (1 mark)

Market weighted average cost of capital (MWACC) of the company. (3 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain TWO causes of unethical behavior in corporate finance. (4 marks)

2. Discuss THREE reasons why net present value (NPV) is regarded superior to internal rate of return (IRR) as an investment appraisal technique. (6 marks)

3. Rovaz Ltd. maintains a minimum cash balance of Sh.2,000,000. The standard deviation of the daily cash balance is Sh.1,000,000. The annual interest rate is 14%. The transaction cost of buying and selling of marketable securities is Sh.150 per transaction.

Assume that a year has 360 days.

Required:

Using the Miller-Or cash management model, determine:

The return point (target cash level). (3 marks)

The average cash balance. (3 marks)

The upper cash limit. (2 marks)

The spread. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Outline FOUR advantages of using bank overdraft as a source of finance. (4 marks)

2. Describe THREE religion’s features that make Islamic banking and finance systems distinct from other conventional banking. (6 marks)

3. Timothy Barasa has been appointed as a financial analyst of Tena Ltd. Timothy is considering investing in one of the two mutually exclusive projects; Project A or Project B. Project A will cost Sh.20 million and generate annual cash flow of Sh.7.5 million for 5 years, while project B will cost Sh.35 million and will generate Sh.8 million for 10 years. The cost of capital is 10% which is applicable to all projects.

Required:

The annual equivalent value (AEV) for project A and project B. (4 marks)

The net present value (NPV) using replacement chain method. (4 marks)

Advise Timothy Barasa on the project to undertake based on your results in (c) (i) and (c) (ii) above.

(2 marks)

(Total: 20 marks)

QUESTION FIVE

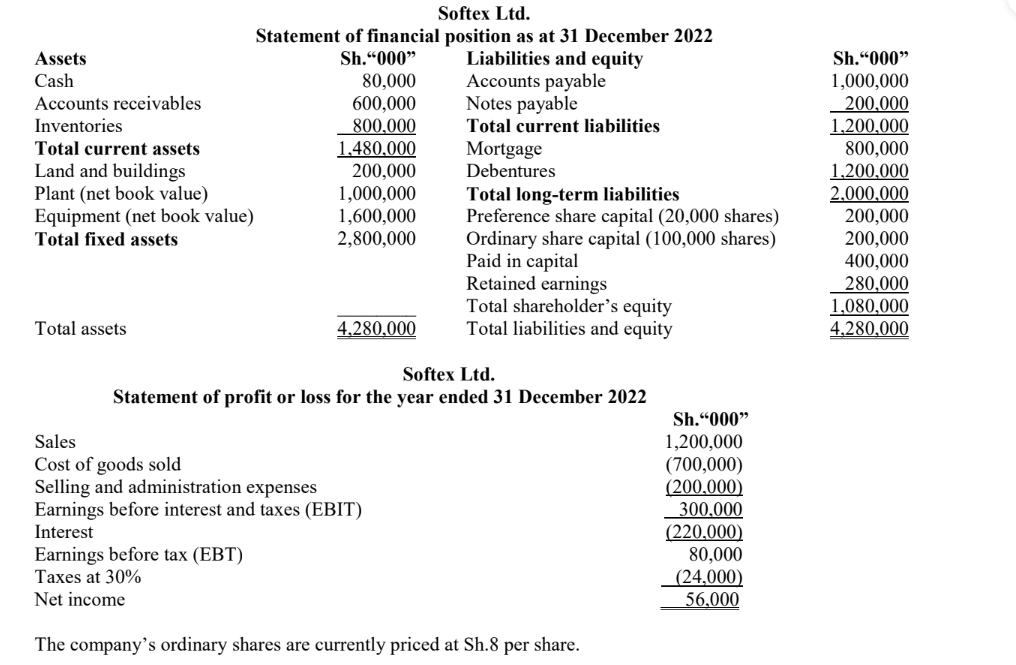

1. The following statement of financial position and statement of profit or loss relate to Softex Ltd. for the year ended 31 December 2022:\

Required:

Using the Springate model, assess the financial health of the company. (6 marks)

Other than the Springate model, evaluate TWO other models of predicting corporate failure. (4 marks)

Note: The Springate model takes the following form;

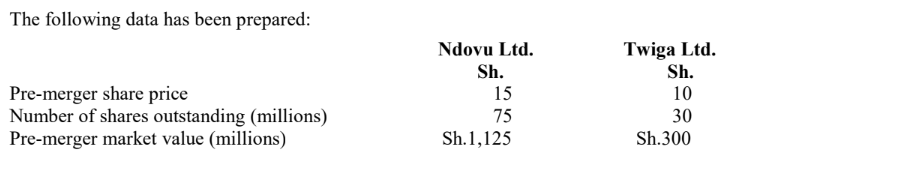

Ndovu Ltd. and Twiga Ltd. are negotiating a friendly acquisition of Twiga Ltd. by Ndovu Ltd. The management teams of both companies have informally agreed upon a transaction value of about Sh.12 per share of Twiga Ltd. stock but are presently negotiating alternative forms of payment. Three alternative offers have been presented by Ndovu Ltd.:

1. Cash offer: Ndovu Ltd. will pay Sh.12 per share of Twiga Ltd. stock.

2. Stock offer: Ndovu Ltd. will give Twiga Ltd. shareholders 0.80 shares of Ndovu Ltd.’s stock per share

of Twiga Ltd. stock.

3. Mixed offer: Ndovu Ltd. will pay Sh.6 plus 0.40 shares of Ndovu Ltd. stock per share of Twiga Ltd.

The merger of the two companies will result in economies of scale with a net present value (NPV) of Sh.90 million.

Required:

Determine the total premium paid to the shareholders of Twiga Ltd. under:

Cash offer. (2 marks)

Stock offer. (3 marks)

Mixed offer. (4 marks)

Advise the best offer to the Twiga Ltd. management team. (1 mark)

(Total: 20 marks)