Cash flow statement summaries the cashbook, by reconciling the opening and closing balance of the cash and cash equivalents. Cash equivalents refer to liquid assets which can easily be transferred into cash and include;

- Cash

- Demanded deposits in banks

- Short term investments

- Bank overdraft

The cash movement activities are classified into 3 categories

- Operating cash movement/ activities

- Investing cash movement/ activities

- Financial cash movement/ activities

1.Operating Activities

These are the core activities of any business. They reflect the main or ordinary business activities. They indicate the net amount generated from business customers, after meeting all the necessary expenses to raise that revenue. Operating cash flows are most importance because they indicate ability of the business to sustain its activities

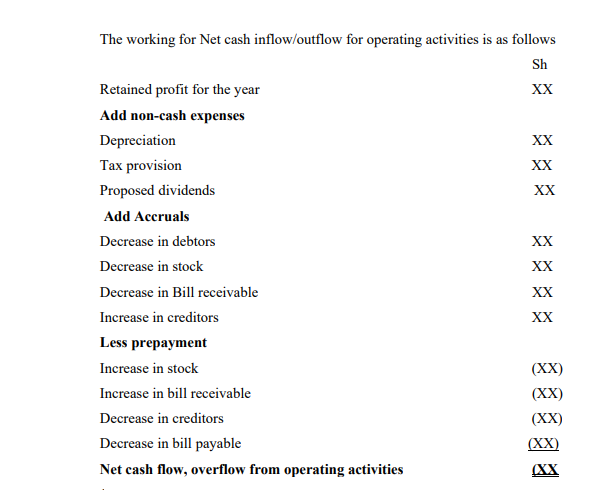

Operating cash flow can be determined directly or indirectly

- Directly-

Cash received is compared with cash paid in ordinary activities of business, which can be determined from cash book or from control ledger. The format is as followsCash paid for operating expense (XX) XX - Indirectly

Under this method operating profits is reconciled with operating cash flow. Operating profit is profit before interest and tax (EBIT) which is adjusted with non -cash flow items. Non-cash items are as given below.

1.Non-cash expenses

2.Prepayments

Cash received from customer XX

Cash received from other operating income XX

Cash paid to supplies (XX)

Cash paid to employee (XX)

These are items subtracted from P&L but do not involve payment.. As a result they should be added back. They include: depreciation, impairment losses, and losses on disposal among others

These refer to any cash paid in a period before it is recognized in the P&L statement. Mainly entail use of cash but no effect on profit as a result they should therefore be subtracted

Examples include:

Increase in debtors

Increase in stock

Increase in bills receivables

Decrease in creditors

Decrease in bills payables

3.Accruals

They refer to revenues or expenses in the P&K recognized without necessary receiving /paying cash.

As result they should be added back They include

Decrease in stock

Decrease in debtors

Decrease in bills receivables

Increase in bills payables

Increase in creditors

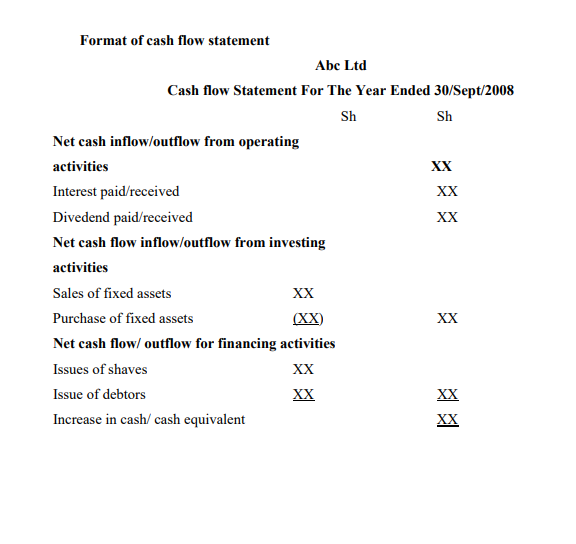

4.Investing activities

Refer to cash generated or used in relation to fixed assets. Fixed assets investments define capacity to generate revenue. The capacity should be continuously enhanced and where necessary renewed

5.Financing activities

Refer to cash generated or used in relation to long-term source of capital due as issues of shares, repayments of lower and debtors among others.