Increasing competition demands more competitiveness from companies and constant and accurate information about competitors and the market place.

This requires the development of performance evaluation methods. In accordance to RBV (Resource Based View) approach, the main cause of the variety of firm‘s performance in the market lies in the specific nature of their resources, since this specificity makes them inimitable, un-transferrable and un-substitutable, consequently guaranteeing the obtainment of differentiated profits. The fundamental basis of long-run success of a firm is the achievement and maintenance of a sustainable competitive advantage (SCA). A

competitive advantage (CA) can result either from implementing a value-creating strategy not simultaneously being employed by current or prospective competitors or through superior execution of the same strategy as competitors. A resource-based view emphasizes that a firm utilizes its resources and capabilities to create a competitive advantage that ultimately results in superior value creation. In order to develop a competitive advantage the firm must have resources and capabilities that are superior to those of its competitors. The sustainable competitive advantage requires the long-time preservation of singularity or heterogeneity. This means that the nature of the assets should be analyzed not only through the obtainment factors (ex-ante) but also the factors of maintenance of the firm‘s competitive position over time (ex-post).

Attaining and maintaining a sustainable competitive advantage is increasingly dependent on knowledge assets and as result, organizations need to assess and understand how knowledge management (KM) best contributes to organizational performance. When a firm sustains profits that exceed the average for its industry, the firm is said to possess a competitive advantage over its rivals. Porter identified two basic types of competitive advantage: cost advantage and differentiation advantage. Without this superiority, the competitors simply would replicate what the firm was doing and any advantage would quickly disappear.

A company must possess some characteristics if it is to have resources and capabilities that are superior to those of its competitors. They are the qualities a company needs to possess if the cost, differentiation and resource factors that Porter identifies are going to manifest and sustain themselves:

- It has a clearly defined and compelling vision, purpose and value proposition that resonates both with its consumer audience and its employee base,

- Its value proposition is supported by a unique product or service that has significant (measurably significant) demand in the marketplace,

- It has a means of creating an experience with a product or service that is distinct and exceptional, and therefore enjoys significant (measurably significant) demand in the marketplace.

- The demand for the product or service (or experience) is anticipated, by all reasonable measures, to be sustainable for the foreseeable future.

- It has an infrastructure that will allow it to continue to deliver on its value proposition to the marketplace better and/or more cost effectively (both for the company and for its customer/client) than its competition.

- It has the ability to attract, retain and properly focus people of exceptional talent to deliver on and sustain the company‘s value proposition.

Assets that are imperfectly immobile and inimitable are sources of sustainable competitive advantage, as they are related to the company and available for its exclusive use over time. In this sense, innovation is an essential factor in the sustention of a competitive

advantage. The product of an innovation is the creation of new assets combinations, of high value, and specifically related to the company. By implementing innovations, companies establish a flow of resources that leads to the creation of stocks of specific assets that other companies will be unable to rapidly replicate. To sustain competitive advantage, companies must institutionalize their

innovation process by creating an environment in which creative thinking is central to their values, assumptions, and actions. The goal of innovation is to develop products that generate above-average returns. These returns allow companies to re-invest in activities designed to give them a competitive advantage in the marketplace. When the innovation cycle is disrupted, companies do not have this incremental capital base and, therefore, have to fund innovation-related activities with capital initially allocated for other purposes. Companies need to focus innovation-related activities around the three principal elements of corporate culture: core values, beliefs, and norms.

Strong culture enhances performance in two ways. First, it energizes employees by appealing to their higher ideals and

values, and by rallying them around a set of meaningful, unified goals. Second, it boosts performance by shaping and coordinating employee behaviour.

- Businesses thrive because they sell as much of their value as they can to as many customers as possible.

- “Thriving” means setting realistic goals and meeting (or exceeding) them.

- Businesses meet their goals because they have a good business model supported by good strategies (or good strategies supported by a good business model), and businesses that thrive make them work.

- The way they make them work is to make sure their value always has the right qualities needed for the markets they want.

- The quest for competitiveness is based on the obtainment of competencies in different focal points of action of the company:

- Allocative competence (related to the production and price formation decisions);

- Transactional competence (competence in the sphere of purchase and sale relations);

- Administrative competence (determination of the policies and of the organizational structure);

- Technical competence (related to the skill of developing and designing new products and processes) and

- Competencies related to the skill of changing existing competencies, through the innovative activity and learning

- The coordination of resources is the key ingredient in the construction of competencies and in the definition of the firm‘s performance.

- A high level of internal coordination provides the company with enhanced performance indirectly, because it creates the necessary environment for nonimitability, non-transferability and non-substitutability of its resources, boosting the potential of its competitive advantages.

- Sustainable performance results when a firm is able to attain and sustain competitive advantage.

- The indicators of sustainable performance are developed using a sustainable balanced scored methodology.

- The sustainable balanced scorecard encompasses indicators on six perspectives:

- Financial,

- Customer/market

- Internal processes

- Learning and development

- Social

- environmental

1.Financial

• Sales growth

• Return on sales

• Return on assets

• Return on equity

• Gearing etc

2.Customer/market

• Market share

• Number of new customers

• Product return rate

• Defects

• Order cycle time etc

Internal processes

• Productivity

• Labour turnover

• Capacity utilization

• Average unit production

• Working capital/sales etc

3. Learning and development

• R&D expenditure/sales

• New markets entered

• New products

• Investment/total assets

• Training expenditure/sales etc

4. Social

• Employee satisfaction

• Social performance of suppliers

• Community relationships

• Philanthropic investments/revenue or profit

• Industry-specific factor e.g. community open days

5. Environmental

• Key material usage/unit

• Energy usage/unit

• Water usage/unit

• Emissions, effluent & waste/unit or as % of total resources used

• Industry-specific factor e.g., GHG emissions

To improve competitive performance, there is need for organizations to address to sustained competitive performance.

• These include but not limited to:

• Inadequate or unavailable resources

• Poorly communicated strategy

• Actions required to execute not clearly defined

• Unclear accountabilities for execution

• Organizational silos and culture blocking execution

• Inadequate performance monitoring

• Inadequate consequences or rewards for failure or success

• Poor leadership

• Uncommitted leadership

• Unapproved strategy

• Other obstacles (including inadequate skills and capabilities)

Porter‘s model is the most popular and most relevant for open market economies. Porter discusses five forces that determine the nature of competition in an industry. These are: threat of new entrants, rivalry among industry competitors, threat of substitute products, bargaining power of suppliers, and bargaining power of customers. The power of each force tends to vary in different industries. Even in the same industry the power varies over time.

1. Threat of new entrants

This depends on entry barriers, such as:

- Economies of scale

- Proprietary product differences

- Brand identity

- Switching costs

- Capital requirements

- Access to distribution

- Government policy

2. Rivalry within the industry

This depends on factors such as:-

- Industry growth rate

- Product differences

- Brand identity

- Switching costs

- Exit barriers

3. Threat of substitute products

Substitute here refers to products of other industries that can be used to substitute the industry’s products e.g. gas is a substitute for electricity.

Power or threat of substitutes depends on factors such as:

- Relative price performance of substitutes

- Switching costs

- Buyer propensity to substitute

4. Supplier power

This depends on factors such as:

- Differentiation of inputs

- Switching costs of suppliers and firms in the industry

- Presence of substitute inputs

- Supplier concentration

- Threat of forward integration relative to threat of backward integration by firms in the industry.

5. Buyer power

This depends on factors such as:-

- Buyer concentration versus firm concentration

- Buyer volume

- Buyer switching costs relative to firm switching costs

- Ability to backward integrate

- Substitute products

- Price sensitivity

- Product differences

- Brand identity

- Porter‘s five-force model is most applicable in open-market economies where the forces are not constrained in any way.

- The model does not apply in all industries equally because some industries may have restrictions. In what industry in Kenya is the model least applicable?

- Scholars have modified the model in various ways by adding other forces.

DOMINANT ECONOMIC FEATURES

A dominant feature in an industry is an outstanding factor that characterizes the industry. Extreme factors rather than moderate factors tend to be outstanding. For example, market size will be a dominant feature if it is too small or too large in the industry.

Dominant features usually include the following. The dominant features among these will depend on the industry. This is a checklist.

- Market size

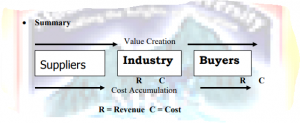

- Suppliers Industry Buyers

- Market growth rate

- Scope of competitive rivalry e.g. whether local, national, regional, or global.

- Number of rivals and their relative sizes.

- Number of buyers and their relative sizes.

- Extent of product differentiation.

- Extent of vertical integration.

- Extent of horizontal integration.

- Distribution channels used

- Resource requirements

- Ease of entry or exit

- Learning and experience effects

- Industry profitability or attractiveness

- Capacity utilization i.e. levels required to achieve production efficiency

DRIVERS OF CHANGE

- A driver of change in an industry refers to what is causing change in the industry i.e. what is making the industry to change.

- It is meaningless to talk of a driver of change in a static industry.

- Drivers of change in an industry usually includes:-

- Changes in long term industry growth rate

- Changes in buyers or users of the product

- Changes in uses of the product

- Product innovation

- Market innovation

- Technological change

- Globalization

- Government policy changes

KEY SUCCESS FACTORS (KSF)

- A success factor in an industry is a factor that enables firms in the industry to succeed.

- In an industry, success factors may be many, but key ones or those with strongest effect are few.

- Key success factors vary across industries and includes:

- Management

- Human resources

- Equipment or facilities

- Cost of production and operations

- Prices or rates

- Product quality

- Service quality

- Customer care

- Volume of operations or sales

- Image or reputation

- Marketing effectiveness

- Finance

- Technology

- Research and Development

- Location

- Processes or systems

- Key success factors in an industry may be identified through:

- Experience or knowledge of the industry

- Expert opinion

- Research/survey

- Competence on key success Sound strategy incorporates efforts to be competent on all key industry success factors and to excel on at least one such factor.

- Factors determine a firm‘s competitive position in the industry.

- Analysis of competitive position may be based on any one of the following:

- Sales volume

- Profits

- Firm size

- Technology

- Key success factors

- Key success factors is the best gauge of competitive position because it is a composite index unlike the others, which are single factor indexes (unidimensional indexes).

- Competitive position analysis can be done as shown using key success factors.