Commercial Paper

This is a short term debt instrument issued by financially sound companies (Blue chip companies) so as to raise funds to finance their working capital needs. Is a form of unsecured promissory note, issued by firms to raise short term finance. Normally commercial papers are sold to other companies, pension firms, banks and insurance companies.

The interest rate on A CP is a function of prime lending rate, maturity, credit worthiness of the issuer and the rating of the paper provided by the rating agency. Interest rate on commercial paper is less than the bank borrowing rate. They are sold at a discount.

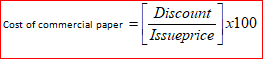

Cost of commercial paper

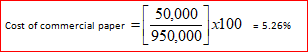

Illustration One

A commercial paper whose fair value is shs. 1,000,000 is being issued at shs. 950,000.

Required

Calculate the cost of the commercial paper.

Solution

Cost of commercial paper

Features of Commercial Papers

- It’s usually not secured.

- It carries a fixed rate of interest.

- It is issued at a discount.

- Its effective cost is the difference between the discount sum and the fare value of instruments.

- It can be issued through commercial banks or a securities exchange.

Advantages of Commercial Papers

- Alternative source of raising short term credit.

- Cheaper source compared to the bank credit

Disadvantages of Commercial Papers

- Impersonal method of financing

- Available always to financially sound and highest rated companies.

- Amount available is limited to the excess liquidity of various purchases of CP.

- Cannot be redeemed until maturity.