MASOMO MSINGI PUBLISHERS APP – Click to download and access all our materials in soft copies

PAPER NO. 9 COLLECTIONS MANAGEMENT

UNIT DESCRIPTION

The paper is intended to equip the candidate with the knowledge, skills and attitude that will enable him or her to effectively manage debt collections.

LEARNING OUTCOMES

A candidate who passes this paper should be able to:

- Employ concepts, processes, techniques and best practices for effective debt collection in consumer, trade and export credit

- Establish, arrange and negotiate debt repayment plans with various clients

- Integrate ICT skills in collection process

- Examine the risks associated with consumer, export and trade debt collection

- Evaluate the impact of legal regulatory and industry framework on consumer, export and trade debt collection

CONTENT:

- Introduction to credit control /Collections

1.1 Importance of credit control/collection in an organisation

1.2 Organisational structure of credit control/collection function

1.3 Roles and objective of a collection officer

1.4 Collection cycle in consumer credit, trade credit and export credit

1.5 Collection Skills and attitudes

1.6 Steps in collecting a debt – Manual and Automated processes

- Collection Communication and personal skills

2.1 Personal Skills and behaviour required in collection

2.2 Characteristics of Effective communication in collection

2.3 Negotiation skills in collection

2.4 Negotiation principles and decision making skills in collection

- Collection Methods and Techniques

3.1 Types of collection tools

3.1.1 Telephone

3.1.2 Letters

3.1.3 Sms

3.1.4 Emails

3.1.5 Sales Team

3.1.6 Suspension of credit

3.1.7 Personal Visit

3.1.8 Skip Tracing and asset Searches

3.1.9 Third party collectors

3.2 Advantages and disadvantages of collection methods

3.3 Collection techniques – 80/20 rule

3.4 Handling of non-payment and disputes

3.5 Building Blocks for collection success

3.6 Revenue collection challenges

- Documentary Collections – Export, consumer & Trade Credit

4.1 Documentary collection vs Documentary credit

4.2 Parties to documentary collection

4.3 Documentary Collection procedures

4.4 Types of collections

4.5 General notes and cautions on documentary collection

4.6 Do’s and Don’ts in documentary collection

4.7 International collection process

- Collection policy, procedures, services and Measurement

5.1 Contents of a collection policy

5.2 Role of a collection policy

5.3 Collection procedures

5.4 Functions and responsibilities of collection officers

5.5 Debt collection measurement

- Application of Debt Re-arrangement schemes

6.1 Structuring Successful Negotiations

6.2 Rescheduling, consolidation of debtors accounts

6.3 Decisions on debtor’s Work-outs, Deferment, Forbearance, graduated payments, debt Write-off

6.4 Application of retention of title, Discounts and Rebates as customer payment incentives

6.5 Counseling and advising debtors

6.6 Alternative Debt Resolutions ADR Methods- Arbitration, Mediation and Adjudication

- Computerised collections and management system

7.1 Components of an effective collection system

7.2 Customer information storage

7.3 Billing

7.4 Collection aids

7.5 Cash allocation

7.6 Customer reconciliation

7.7 General Ledger management and reports

7.8 System Tasks

7.8.1 Online document management system for collections management

7.8.2 Maintain a database of – contacts, orders and assets

7.8.3 Payment deduction investigation system

7.8.4 Offer customer secure internet payment options

7.8.5 Automate the customer communication system

7.9 Online Based Tools

7.9.1 Collection through Social Media – Guidelines, risks and Tips for successful collection on Social Media

7.9.2 Collection through Call Centres, Types of call centres, How to handle angry, difficult and irate callers, Reasons for using call centres, Benefits of call centres

7.9.3 Artificial Intelligence in Debt Collection – Use of Chatbods, AI and Virtual Agents for debt collection, Benefits of AI in collection

- Risks Associated with Debt Collection

8.1 Lack of credible customer information

8.2 Operational capacity challenges

8.3 Identifying the vulnerable groups

8.4 Credit Fraud – Asset concealment, Fraudulent financial statements and trade references, check frauds

8.5 Foreign Corrupt Practices

8.6 Language to be used when chasing foreign customers

- Collections – Regulation and industry Framework

9.1 Background The debt collection industry

9.2 Regulation of collection Practices

9.3 Restraints and Restrictions on Gathering and Disseminating Credit Information

9.4 Consumer protection laws

9.5 Data protection Act

9.6 Role of third party buyers and collectors

9.7 Communication with Debtors – Deceiving Debtors, Harassing phone calls, communicating with Third parties

9.8 Export licenses, the foreign corrupt practices act and compliance with foreign regulations governing imports

9.9 Ethical and Professional standards in collection

CHAPTER ONE

INTRODUCTION TO CREDIT CONTROL/COLLECTIONS

Credit control, also called credit policy, is the strategy used by a business to accelerate sales of products or services through the extension of credit to potential customers or clients. Generally, businesses prefer to extend credit to those with “good” credit and limit credit to riskier borrowers who may have a history of delinquency. Credit control might also be called credit management, depending on the scenario.

How Credit Control Works

When a business uses credit control, it means they are taking steps to protect their business from risky borrowers as they issue credit.

A business’s success or failure primarily depends on the demand for products or services. As a rule of thumb, higher sales lead to bigger profits, which in turn leads to higher stock prices. Sales, a clear metric in generating business success, in turn, depend on several factors. Part of a company’s efforts to boost its sales can include credit control.

In general, credit control seeks to extend credit to a customer to make it easier for them to purchase a good or service from the business. This strategy delays payment for the customer, making the purchase more attractive, or it breaks the purchase price into instalments, also making it easier for a customer to justify the purchase, though interest charges will increase the overall cost.

The benefit of credit control for the business is potentially higher sales. The important aspect of a credit control policy, however, is determining who to extend credit to. Extending credit to individuals with a poor credit history can result in not being paid for the good or service.

SAMPLE WORK

Complete copy of CCP COLLECTIONS MANAGEMENT STUDY NOTES is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD COPY

Phone: 0728 776 317

Email: info@masomomsingi.com

Types of Credit Control

A company can decide on the type of policy it wishes to implement when drafting its credit control policy. The options typically include three levels: restrictive, moderate, and liberal. A restrictive policy is a low-risk strategy, limiting credit only to customers with a strong credit history, a moderate policy is a middle-of-the-road risk strategy that takes on more risk, while a liberal credit control policy is a high-risk strategy where the company extends credit to most customers.

Businesses that aim to gain higher levels of market share or that have high-profit margins are typically comfortable with liberal credit control policies.

Companies that have a monopoly in their industry may include to adopt a liberal control policy so that they can hold onto their monopoly. However, if the monopoly is unthreatened by other competitors, the company may adopt a restrictive policy.

Credit Control Factors

Credit policy or credit control primarily focus on the four following factors:

- Credit period: Which is the length of time a customer has to pay

- Cash discounts: Some businesses offer a percentage reduction of discount from the sales price if the purchaser pays in cash before the end of the discount period. Cash discounts present purchasers an incentive to pay in cash more quickly.

- Credit standards: Includes the required financial strength a customer must possess to qualify for credit. Lower credit standards boost sales but also increase bad debts.

- Collection policy: Measures the aggressiveness in attempting to collect slow or late paying accounts. A tougher policy may speed up collections, but could also anger a customer and drive them to take their business to a competitor.

A credit manager or credit committee for certain businesses are usually responsible for administering credit policies. Often accounting, finance, operations, and sales managers come together to balance the above credit controls, in hopes of stimulating business with sales on credit, but without hurting future results with the need for bad debt write-offs.

Collections management

The Collections page provides a centralized view where accounts receivable collections information is managed. Collections managers can use this centralized view to manage collections. Collections agents can begin the collections process either from customer lists that are generated by using predefined collection criteria or from the Customers page.

Before you start to set up or work with collections, you should understand the following concepts:

- Customer aging snapshots contain aged balance information at a specific point in time.

- Collections customer pools help you organize your work.

- Collections agents can have their own customer pools.

- List pages organize collections customers, activities, and cases.

- All collections information for a customer is on one page, and you can take action from that page.

- Interest and fees can be waived, reinstated, or reversed in one step.

- Write-off transactions can be created in one step.

- Not sufficient funds (NSF) payments can be processed in one step.

MASOMO MSINGI PUBLISHERS APP – Click to download and access all our materials in soft copies

Benefits of credit control

The main benefit to the company is greater sales, which leads to higher profitability. The most crucial component of a credit management policy is deciding who to give credit to. At the most basic level, companies want to provide credit to people with excellent credit and limit lending to those with poor credit or a history of delinquency. Extending credit to those with a poor credit history may result in not receiving payment for the product or service offered. Depending on the firm and the quantity of poor credit provided, this might have major consequences.

For instance, a lender extends credit to a borrower with a poor credit history. Due to the borrower’s previous credit history, there’s a good chance that the borrower may miss or delay payments. If this occurs on a larger scale, when the borrower defaults on payments, the lender may eventually run out of money. Credit management ensures that the company only selects potential clients with a satisfactory credit history and a track record of making debt repayments. This can guarantee that the firm has sufficient cash flow and liquidity to continue operating.

Below are some additional benefits of credit control:

- Cash flow protection: Credit control ensures that your cash inflows are always greater than your cash outflows to pay your bills and coworkers on schedule.

- Late payment reduction: Having credit control policies can significantly reduce late payments by recognising them early and preventing bad debts, lowering the likelihood that a default would have a negative impact on the firm.

- Increased business liquidity: Credit management encourages clients to perform debt recovery quickly. Lower bad debt and more timely debt repayments can enhance business liquidity.

- Better resource allocation: Credit control ensures adequate spare financial resources that are essential for identifying opportunities and releasing working money for important business investments that can support strategic development. It may also assist you in planning and analysing performance, allowing you to establish financial budgets for the coming years.

IMPORTANCE OF CREDIT CONTROL/COLLECTION IN AN ORGANISATION

Credit control and collection are important in an organization because they help to manage the flow of money in and out of the business. Effective credit control and collection practices can help to ensure that the business is able to meet its financial obligations, such as paying bills and employees, while also maximizing profits by minimizing the amount of money tied up in unpaid debts. Additionally, credit control and collection can help to prevent financial loss due to bad debts, which can have a significant impact on a business’s bottom line. Overall, credit control and collection play a vital role in the financial health and stability of an organization.

Importance of Credit and Collections Management System Functionality

CCM system functionality varies widely by publisher but typically supports six key functional areas – credit facilitation, billing and invoicing, remittance processing, collections management, dispute resolution, and reporting and analysis.

- Credit Facilitation includes several key collections department functions around credit, such as: credit scoring, credit application processing, reference checking, ordering credit reports from credit bureaus, financial statement analysis, new account approval, order approval, credit limit decisions, accounts receivable portfolio monitoring and credit risk management.

- Bill Management and Invoicing involves identifying invoice errors, ensuring vendor compliance, generating an accurate invoice; generation, transmittal and distribution of invoices and statements; trade promotion planning; contract management; Electronic Invoice Presentment and Payment (EIPP); and Electronic Bill Presentment and Payment (EBPP).

- Remittance Processing includes financial EDI (Electronic Data Interchange), EFT (Electronic Funds Transfer), auto-cash algorithms and routines, payment-to-invoice matching, cash settlement, and cash forecasting.

- Collections Management includes workflow automation driven by a collection strategy engine, prioritized collection activities, integration of A/R data, a reminder system, activity logs, account and invoice level notes, integrated communication tools, faxing capabilities, e-mail, invoice reprinting, other forms of data export, payment plan calculators, imaging tools, and auto-dialers.

- Dispute Management focuses on dispute and deduction resolution, chargeback processing, exception reporting with automated escalation processes, a routing engine, collaboration tools, document sharing, and tools for root cause identification.

- Reporting and Analysis incorporates cash forecasting, dashboards, email alerts, query capabilities, out-of-the-box reports, report generators, workload balancing, exception reporting, cycle time analysis, portfolio risk management, customer intelligence, and month end reporting tools.

The consequences of poor credit control can be:

- Increased payment term.

- The need for a bank overdraft

- Bad debts being incurred.

- Blocking of accounts, stop of deliveries and customers’ loss.

- Other consequences on the image and the reputation of the company.

Abuse of Credit

As with all things, with the good, comes the bad. Customers can take advantage of a credit account, or slip up in their payments, and for small and medium businesses this can have devastating effects.

Ignoring bad habits and unpaid debt may find your company in hot water. This is where credit management systems come into play to minimise risks for your company.

If customers don’t pay you, you cannot pay your suppliers. This will lead to a lack of supplies and services, and soon you will lose production time and customers, and your good reputation.

ORGANISATIONAL STRUCTURE OF CREDIT CONTROL/COLLECTION FUNCTION

The purpose of Collections is to ensure that delinquent accounts are reconciled and paid in a timely, cost-effective manner. Companies must balance direct credit losses and the costs of debt recovery judiciously. Most companies are willing to allow small debts to lapse if the cost of recovery starts to exceed the amount being collected. Companies can afford to devote considerable time and energy, however, to the collection of larger debts. Typically, collections agencies follow an escalation method based on the number of days the account has been delinquent and the amount owed.

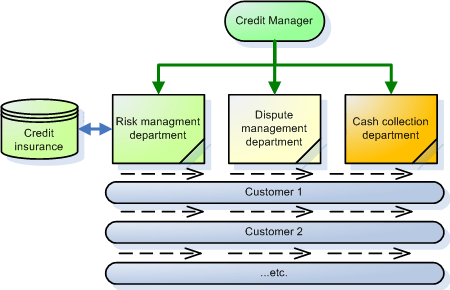

Common Collections job titles: Chief Financial Officer, Director of Credit & Collections

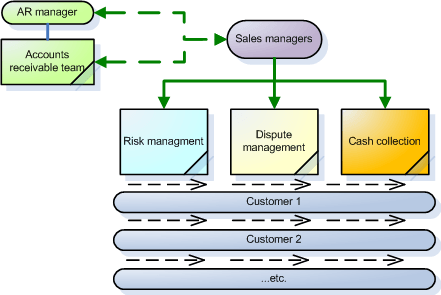

The different organizational models

The Anglo-Saxon model

The credit analysis, the payment terms negotiation and the bills collection is performed by a single person responsible for a portfolio of clients on all aspects of credit management.

The validation of credit limits is done on the basis of formal delegations thresholds written in an approval matrix, part of the credit management policy.

The Taylorist model

The credit management process is divided into several parts: credit analysis and risk management, cash collection, dispute management, accounts receivable management.

Each “job” is done by a specialist who intervenes only on its part. One client is “treated” by different teams according to stage it is in the sales process.

The credit analyst does only the credit assessment, the cash collector does only actions of recovery. The advantage of this system is the specialization of people who reach a high degree of efficiency in their field.

- The disadvantages are the counterpart of this benefit:

- Positions less valuable than in the Anglo-Saxon model.

- Redundancy of actions to perform that can generate a certain weariness of the teams.

- Lack of an overall vision of the situation of each customer unless for the credit manager.

The back-office model

Credit team acts only on the internal management of accounts receivable and is not in direct contact with customers. The negotiation of payment conditions and the cash collection are made by only commercial who monopolize the customer relationship.

The credit management team is involved only in support of sales managers to provide them with the information they need. Being cut off from the customer relationship, it is dependent on information from business managers which may be given according to their interest. This positioning puts credit team in a weak situation and does not allow to reach a good performance.

However, this model can be used when the sales managers have a very high level and can handle all aspects of the business relationship. However, it is less effective and has major disadvantages:

- The sales manager is very often focused on obtaining the order and on the margin improvement. He often considers the cash as a secondary stake.

- The sales manager is not in a position to make an effective debt recovery and at a good level. He doesn’t have the skills for it and he is penalized by recurrent situations of conflict of interest. Indeed, it is difficult to request a payment to his client while trying to get a new order.

The customer reminders are done when he has the time and opportunity to do them. First level reminders are usually not directed to the right person. Their efficiency is low. - The credit management department is more an accounting function rather than what it should be. It does not weigh on the business relationship. The financial stakes are neglected.

SAMPLE WORK

Complete copy of CCP COLLECTIONS MANAGEMENT STUDY NOTES is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD COPY

Phone: 0728 776 317

Email: info@masomomsingi.com