PAPER NO.2 FINANCIAL MATHEMATICS

GENERAL OBJECTIVE

This paper is intended to equip the candidate with knowledge, skills and attitudes that will enable him/her to apply financial mathematics in decision making.

2.0 LEARNING OUTCOMES

A candidate who passes this paper should be able to:

- Compute present and future values of cash flows

- Apply financial forecasting techniques in business

- Apply mathematical functions in finance

- Apply statistical tools in finance

- Use of probability to solve business problems

- Compute and interpret index numbers

- Use of financial calculators to solve financial

CONTENT

- Introduction to financial mathematics

- Nature and scope of finance; financing, investment, management of working capital and profit sharing (dividend policy) decisions

- Relationship between finance and other disciplines; finance and economics, finance and accounting, finance and mathematics

- Purpose of financial modeling

2.2 Financial algebra

- Simultaneous and quadratic equations

- Developing finance functions

- Interactive graphs; graphing financial functions

- Overview of calculator operations: Turning on and off the calculator, selecting second functions, setting calculator formulae, clearing calculator memory, mathematical operations, memory operations, using worksheets

2.3 Time value of money and interest rate mathematics

- Concept of interest rates and inflation

- Simple interest

- Compound interest

- Continuously compounded interest

- Present values

- Basics of capital budgeting

- Loan amortisation

Time value of money and mamortisation worksheets, entering variables in amortisation worksheets, entering cash inflows and outflows, generating amortisation schedules

- Cash flow worksheets; calculator worksheet variables for both even and uneven and grouped cash flow, entering, deleting, inserting and computing results

- Bond worksheets: Bond worksheets variables and terminology, entering bond data and computing results

- Depreciation worksheets; depreciation worksheet variables, entering data and computing results

- Other worksheets: Percentage change/compound interest worksheets, interest conversion worksheets, profit margin worksheets, break-even worksheets, memory worksheets

2.0 Financial forecasting

- Need for financial forecasting

- Techniques of forecasting: statistical and non-statistical methods

- Time-series components and analysis

- Share valuation

- Fixed income models for bonds and construction of yield curves

- Regression and correlation

- Use of financial calculators in regression and correlation models, entering data, computing the results and interpretation

2.1 Financial calculus

- Introduction to calculus

- Differentiation; ordinary and partial derivatives

- Integration

- Application of calculus to solve financial problems relating to maximisation of returns and minimisation of costs

2.2 Descriptive statistics

- Measures of central tendency; mean, mode, median

- Measures of relative standing; quartiles, deciles, percentiles

- Measures of dispersion; range, mean deviation, variance, standard deviation, coefficient of variation

- Statistical worksheets; statistical worksheet variables, computing statistical results and interpretation

2.3 Probability theory

- Relevance of probability theory

- Events and probabilities

- Probability rules

- Random variables and probability distributions

- Binomial random variables

- Expected value

- Variance and standard deviation

- Probability density function

- Normal probability distribution

- Stochastic functions

- Application of probability to solve business problems

2.4 Index numbers

- Purpose of index numbers

- Construction of index numbers

- Simple index numbers; fixed base method and chain base method

- Weighted index numbers; Laspeyre’s, Paasche’s, Fisher’s ideal andMarshall- Edgeworth’s methods

- Consumer Price Index (CPI)

- Use of Consumer Index Price (CPI); inflation, cost of living

- Limitations of index numbers

2.5 Emerging issues and trends

CONTENT PAGE

Past papers

- November 2019……………………………..…6

- May 2019…………………………….…………..11

- November 2018………………………………17

- May 2018……………………………….………..23

- November 2017………………………..…….…28

- May 2017………………………………………..…34

- November 2016………………………………..39

- May 2016…………………………………..……45

- November 2015……………………….……….51

- Pilot paper 2015…………………… ……….56

Suggested answers and solutions:

- November 2019 ………………..…………..61

- May 2019………………………………..…….76

- November 2018……………………………89

- May 2018……………………….……..……103

- November 2017………………..…………….115

- May2017……………………………………….129

- November 2016……………………..…….141

- May 2016………………………………………156

- November 2015………………………….……170

- Pilot paper 2015……………………………..185

SAMPLE WORK

PAST PAPERS

KASNEB

CIFA PART I SECTION 1

FINANCIAL MATHEMATICS

TUESDAY: 26 November 2019. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

(a) Explain four types of finance. (8 marks)

(b) Analyse the relationship between the discipline of finance and:

- Financial accounting. (2 marks)

- Cost accounting. (2 marks)

- Management accounting. (2 marks)

(c) Solve the following equation using matrix method:

4x — 3y = 9

3x — 2y = 7

(6 marks)

(Total: 20 marks)

SAMPLE WORK

CIFA PART I SECTION 1

FINANCIAL MATHEMATICS

MONDAY: 20 May 2019. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

(a) Highlight four roles played by financial forecasting in a business. (4 marks)

(b) A company has identified two investments which are mutually exclusive. The cash flow patterns for the investments are as provided below:

KASNEB

CIFA PART I SECTION 1

FINANCIAL MATHEMATICS

MONDAY: 26 November 2018. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

- Highlight four factors that might necessitate the shifting of the base of an index number. (4 marks)

KASNEB

CIFA PART I SECTION 1

FINANCIAL MATHEMATICS

MONDAY: 21 May 2018. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

- Explain how a finance manager might apply financial mathematics in performing any four of his/her functions in a company. (8 marks)

- A wholesaler sells 760 articles at a total price of Sh.3,952,000. His profit is 25% on the cost of all the sold articles. The selling price per article is the same. After selling 20% of the articles, 10% of the articles were found to be defective with no resaleable value.

SAMPLE WORK

KASNEB

CIFA PART I SECTION 1

FINANCIAL MATHEMATICS

MONDAY: 27 November 2017. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

(a) Explain the following concepts as applied to indices:

- Time reversal test. (2 marks)

- Factor reversal test. (2 marks)

- Base shifting. (2 marks)

(b) An index was at 100 in year 2012. The index rose by 6 per cent in year 2013 and subsequently fell by 4 per cent in year 2014. Thereafter, the index fell by 6 per cent in year 2015 and then rose by 5 per cent in year 2016.

SAMPLE WORK

KASNEB

CIFA PART I SECTION 1

FINANCIAL MATHEMATICS

MONDAY: 22 May 2017. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

- Explain the following methods of valuing shares:

- Dividend yield method. (2 marks)

- Earnings method. (2 marks)

- Net asset method. (2 marks)

- Discounted cash flow method. (2 marks)

KASNEB

CIFA PART I SECTION 1

FINANCIAL MATHEMATICS

MONDAY: 21 November 2016. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

- Highlight four disadvantages of using the net present value (NPV) method for project appraisal. (4 marks)

- The table below shows fluctuations in price of two shares, A and B over the last four months.

SAMPLE WORK

KASNEB

CIFA PART I SECTION 1

FINANCIAL MATHEMATICS

MONDAY: 23 May 2016. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

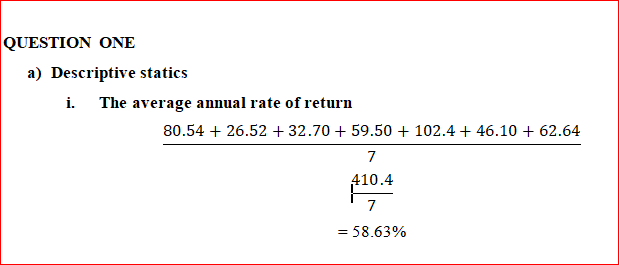

- The following table shows a sample of the rates of return of a certain company for a 7-year period:

KASNEB

CIFA PART I SECTION 1

FINANCIAL MATHEMATICS

FRIDAY: 20 November 2015. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

- Outline four uses of time series analysis. (4 marks)

- The table below shows the sales of new cars by quarters during a period of four years:

KASNEB

CIFA PART I SECTION 1

FINANCIAL MATHEMATICS

PILOT PAPER

September 2015. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question.

QUESTION ONE

- Explain four determinants of working capital of a business organisation (8 marks)

- The Ministry of Economic Development in a country has provided the following data to estimate the cost of living of several households over a two month period:

SAMPLE WORK

FINANCIAL MATHEMATICS

NOVEMBER 2019

SUGGESTED ANSWERS

QUESTION ONE

Types of finance

Finance is the management of money and includes activities such as investing, borrowing, lending, budgeting, saving and forecasting. Types of finance include:

- Personal finance: this refers to managing the finance or funds of an individual and helping them achieve their desired goals. Personal finance is specific to individuals and the strategies on the individuals earning potential, requirements, goals, time frame e.t.c. Personal finance include investment in education, assets like real estate, cars, life insurance policies, saving and expense management

- Corporate finance: is about funding the company expenses and building the capital structure of the company. It deals with source of funds and the channelization of those funds like the allocation of funds for resources and increasing the value of the company by improving the financial position. Corporate finance focus on maintaining the balance between the risk and opportunities and increasing the asset value

SUGGESTED ANSWERS

MAY 2019

QUESTION ONE

- Roles of financial forecasting in a business

A financial forecast is an estimate of future financial outcomes for a company. Financial forecasts estimate future income and expenses for a business over a period of time, generally the next year. They are used to develop projections for profit and loss statements, balance sheets, burn rate, and other cash flow forecasts.

Financial forecasts can use historical accounting and sales data, and external market and economic indicators, to predict what will happen to the company in financial terms over the given period of time. Roles: –

SAMPLE WORK

SUGGESTED ANSWERS

NOVEMBER 2018

QUESTION ONE

Factors that might necessitate the shifting of the base of index number

- The previous base has become too old and is almost useless for purposes of comparison. By shifting the base, it is possible to state the series in terms of a more recent time period

- It may be desired to compare several number series which have been compared on different base period; participating if the several series are to be shown on the same graph; particularly if the several series are to be shown graph, it may be desirable, for them to have the same base period. This may necessitate shifting bases.

SUGGESTED ANSWERS

MAY 2018

QUESTION ONE

How a finance manager might apply financial mathematics in performing any four of his/her functions in a company

- Knowledge on forecasting can be used by finance manager to craft proforma financial statements

- Forecasting using targets and budgets acts as a motivation to employees who aim at achieving targets set

SUGGESTED ANSWERS

NOVEMBER 2017

QUESTION ONE

Indices terms

- Time reversal set

A test that may be used under the axiomatic approach which requires that if the prices and quantities in the two periods being compared are interchanged the resulting price index is the reciprocal of the original price index. According to Prof. Fisher, the formula for calculating and index should be such that it gives the ratio between one point of time and the other, no matter which of the two time is taken as the base. That is to say, when the data for any two years are treated by same method, but with the base reversed, the two numbers should be reciprocals of each other.

SAMPLE WORK

SUGGESTED ANSWERS

MAY 2017

QUESTION ONE

Methods of valuing shares

- Dividend yield method

Also called the Gordon model. This method utilizes the dividend paid by the company to calculate the theoretical value of the share

- Earnings method

This involves the use of ratios in order to determine the theoretical value i.e price earnings ratio (PER)

SUGGESTED ANSWERS

NOVEMBER 2016

QUESTION ONE

Disadvantages of using net present value (NPV) method for project appraisal

- Cash flows are mere estimates rather than actual.

- Assumes that the discounting rate / required rate of return remains constant over time.

- In some cases, it gives conflicting results with internal rate of return.

- It ignores the payback period

- It may not give good assessment of alternative projects if the projects have unequal lives, returns or costs

- It is ideal for assessing the viability of an investment under certainty because it ignores the element of risk

SUGGESTED ANSWERS

MAY 2016

SUGGESTED ANSWERS

NOVEMBER 2015

QUESTION ONE

Uses of time series analysis

Is the arrangement of statistical data in chronological order. Time series carries profound importance in business and policy planning. Its uses are:

- Used to study the past behavior of the phenomenal under consideration.

- The cyclic variation helps us understand the business cycles.

- It is used to compare current trends with that in the past or the expected trends. Thus it gives a clear picture of growth or downfall.

- It is used in business forecasting and policy planning by various organisations.

- The seasonal variation are very useful for business and retainers as they earn more in certain seasons. For example, a seller of clothes will earn more profit if he sells more woolen clothes in winter and silk clothes in summer.

SAMPLE WORK

SUGGESTED ANSWERS

PILOT PAPER 2015

QUESTION ONE

Determinants of working capital of a business organization

Working capital refers to the portion of capital which is employed in the business to run it on a day to day basis. Factors that determine working capital requirements include:

- Operating efficiency: the operating efficiency affects firm’s need of working capital. The operating efficiency of the firm results in optimum utilization of assets. The optimum utilization of assets in turn results in more fund release for working capital.

- Working capital cycle: when the working capital cycle is long, it will require larger amount of working capital but if working capital cycle is short, it will need less working capital.

SAMPLE WORK