MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS

2016/2017 ACADEMIC YEAR

FIRST YEAR SECOND SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

CERTIFICATE IN HUMAN RESOURCE MANAGEMENT

COURSE CODE: CHR 109

COURSE TITLE: INTRODUCTION TO ACCOUNTING

DATE: 27TH APRIL 2017 TIME: 8.30AM-10.30AM

INSTRUCTIONS TO CANDIDATES

• Answer question ONE (compulsory) and any other THREE

• Question one carries 25 marks

• All other questions carry 15 marks

This paper consists of 7 printed pages. Please turn over

QUESTION ONE

a) A, B and D have been trading as partners sharing profits and losses in the ratio 4:3:2 respectively. On 1 November 2015 an employee D was admitted as a partner. He was to contribute Ksh 250,000 as capital and Ksh 180,000 as his share of goodwill. The partners do not intend to open a goodwill account and therefore the old partners shall share this amount in their old profit and loss sharing ratios. The admission of D has not been fully recorded in the books of accounts other than the cash receipts.

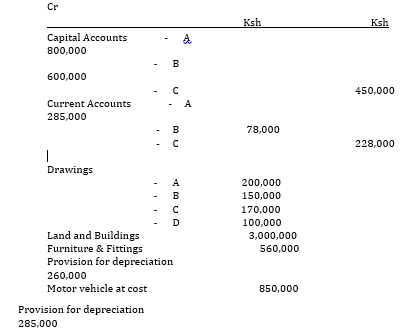

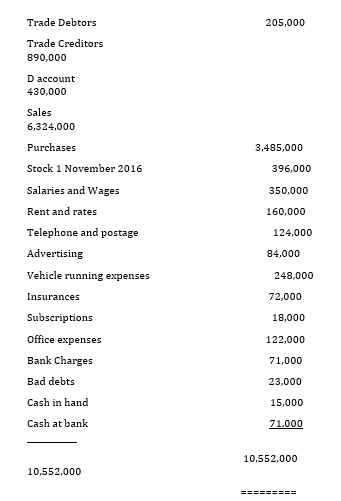

The following trial balance was extracted from the books of the partnership at 31st October 2016. Dr Cr

Notes:-

1. The new profit & loss sharing ratio was agreed as 4:3:2:1 for A, B, C, and D respectively.

2. The closing stock was valued at Ksh 428,000

3. Accrued salaries & wages expenses amounted to Ksh 29,000 and 18,000 respectively.

4. Prepaid insurances and subscriptions amounted to Ksh 16,000 and 6,000 respectively.

5. It was further agreed that since D was a former employee, he would be entitled to a salary of Ksh 8,000 per month with effect from 1 November 2016.

6. The partners resolved that the partners would be paid an interest of 12% per annum on the balances of the fixed capital at the beginning of the year.

7. The depreciation is provided at 10% and 20% on cost on the furniture and fittings and motor vehicles respectively.

Required:

i. Trading, profit and loss account for the year ended 31st October 2016 (10marks)

ii. Partners current accounts for the year ended 31st October 2016 (4marks)

iii. Balance sheet as at 31st October 2016 (6 marks)

b) List five users of financial information and the benefits they derive from such accounting information. (5 marks)

QUESTION TWO

a) State and explain the four phases of accounting cycle (4 marks)

b) State and explain the five branches accounting (5 marks)

c) List and explain the attributes of good accounting information (5marks)

d) Write the Accounting Equation and explain the key terms used (1 mark)

QUESTION THREE

a) State and briefly explain the common causes of difference between the cash book balance (bank column) and the bank statement. (3 marks)

b) The bank statement of Watu traders showed a balance of Ksh 264,000 while the bank column of the cash book showed a balance of Ksh 247,500 as of 31st October 2016. On rechecking the records, the following items were not properly recorded in the books.

1. Cheques drawn by the trader amounting to Ksh 114,400 had not been presented to the bank.

2. Cheque and cash amounting to 155,600 banked 30th October 2016 had been credited by the bank.

3. Bank charges amounted to ksh 12,500. They have not been posted in the cash book.

4. Standing orders of ksh 25,000 have been paid by the bank but have not been posted to the cash book.

5. The credit side of the cash book had been under cast by ksh 9,000

6. Instructions to transfer ksh 150,000 from savings account to the current account have not been effected in the cash book.

7. A cheque of ksh 18,500 banked on 28th October 2016 has been dishonored but the information was not received by the trader until 3 November 2016.

8. A cheque of ksh 74,000 drawn by the trader has been posted as 47,000 in the cash book.

Required:

i) Adjusted Cash Book (8marks)

ii) Bank Reconciliation statement as at 31st October 2016 (4marks)

QUESTION FOUR

a) Donald Trump came to Kenya and commenced a business on 1st January 2017 with a capital of ksh 65,000 in the bank and ksh 10,000 in cash. The transaction for the business during the month were as follows:-

January 4th

Bought foods on credit from;

B.Aoke ksh 20,000

J. Wahome 7,500

B. Kinoti 16,600

5th Paid for shop fittings by cheque ksh 56,000

6th Paid for one month’s rent by cheque ksh 3,600

7th sold goods on credit to: W. Sikuti Ksh 17,500

J. Mbalo Ksh 16,000

8th Cash sales Ksh 9,000

11th Bought goods on credit from from J. Wahome Ksh 26,000

12th Sold Goods on credit to V. Shiliku ksh 8,300

15th W. Sikuti and J. Mbalo settled their account by cheque less 10% discount in each case.

19th Bought goods by cheque ksh 10,000

19th Sold goods to P. Oparo on credit Ksh 14,000

21st Cash sales Ksh 12,000

21st Returned goods to J. Wahome Ksh 3,700

22nd Paid sundry expenses in each ksh 1,500

25th Sold goods to W. Sikuti on credit Ksh 8,400 and V. Shiliku Ksh 16,200

26th V. Shiliku returned goods for Ksh 4,400

27th Paid Aoke and Kinoti by cheque the amounts due less 5% discount in each case.

28th D. Trump took cash for personal use Ksh 6,000

29th paid cash to bank Ksh 10,000

30th Paid wages in cash 12,500

Required:

i) Record the appropriate transactions into a three-column cash book at 31st January 2017. (5 marks)

ii) Write up all the Ledger Accounts, bring down all the balances and extract a trial balance (5 marks)

iii) What is a contra entry? (1 mark)

iv) List and explain four books of original entry (4 marks)

QUESTION FIVE

a) Explain the meaning of the following accounting concepts;

i. Going concern (1 mark)

ii. Materiality (1mark)

iii. Prudence (1mark)

iv. Consistency (1 mark)

v. Accrual (1 mark)

b) List two examples of profitability Ratios for use in financial statement analysis. (2 marks)

c) With the aid of examples clearly distinguish between capital and revenue expenditures (3 marks)

d) Explain three Limitations of Accounting information. (3 marks)

e) With aid of examples, distinguish between errors that affect the agreement of a trial balance from errors that do NOT affect the agreement of a trial balance. (2marks)