MASOMO MSINGI PUBLISHERS APP – Click to download and Access all our materials in PDF

SYLLABUS

PAPER NO. 1 INTRODUCTION TO FORENSIC ACCOUNTING AND AUDIT

UNIT DESCRIPTION

This paper is intended to equip the candidate with knowledge, skills and attitudes that will enable him/her to relate financial and forensic accounting and audit and apply both in fraud investigations.

LEARNING OUTCOMES

A candidate who passes this paper should be able to:

- Demonstrate the Accounting Cycle beginning with the books of original entry to the final accounts

- Identify the difference between Audit, Forensic and Traditional Accounting

- Explore the historical development of Forensic Accounting and Audit

- Apply Ratio Analysis in fraud detection

- Demonstrate understanding of the Forensic Audit Cycle

CONTENTS

- Introduction to Accounting

- Definition of Accounting

- Objectives of accounting and users of accounting information

- Accounting Equation

- Accounting Concepts and Conventions including the Accrual and Cash Basis Accounting

- The Accounting Cycle, source documents and Basic books of Accounts maintained by organisations

- Responsibilities of various stakeholders in regard to Accounting in organisations

- Regulatory bodies in accounting; professional institutes, government regulatory bodies and others

- The Accounting Environment and Regulation

- Key components of the Internal Control Environment in regard to accounting

- Basic understanding of Financial Reporting Standards applied in Public Sector and Commercial Entities (IPSAS and IFRS)

- Understand the roles of various entities in regulation of the Accounting Profession

- Financial Statement and Financial Statement Fraud

- Process of preparing financial statements

- Financial statements for sole proprietors, partnerships, companies, NGOs

- Financial statement/reporting fraud schemes

- Basic Financial Statements

- Balance sheet

- Profit/loss account

- Statement of cash flow

- Statement of owner’s equity

- Financial ratios

- Forensic Accounting

- Definition and purpose of Forensic Accounting

- Forensic Accounting versus traditional accounting

- Forensic Audit versus traditional Audit

- Historical development of Forensic Accounting

- Types of Non-fraud forensic accounting

- Forensic Accounting Data Analytics tools and Benford’s Law

- Key skills required for Forensic Accounting

- Code of Ethics and Regulation of Forensic Accountants

- Qualities/attributes of Forensic Accountants

- Forensic Audit

- Definition and purpose

- Relationship between forensic accounting, forensic audit financial audit and fraud investigation

- Key skills required for Forensic Auditing

- Code of ethics and standards for forensic auditors/forensic investigators

- Qualities/attributes of Forensic Auditors

SAMPLE WORK

Complete copy of CFFE INTRODUCTION TO FORENSIC ACCOUNTING AND AUDIT NOTES is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD copy

Phone: 0728 776 317

Email: info@masomomsingi.com

MASOMO MSINGI PUBLISHERS APP – Click to download and Access all our materials in PDF

CHAPTER ONE

INTRODUCTION TO ACCOUNTING

DEFINITION OF ACCOUNTING

Accounting is considered the language of business. It has evolved throughout the years as information needs changed and became more complex. After finishing this article, the reader should be able to have a general understanding about accounting, be acquainted with the different definitions, know the different types of information found in accounting reports, and know the different uses of accounting information.

Some say that accounting is a science because it is a body of knowledge which has been systematically gathered, classified, and organized. It could be influenced by a lot of factors, specifically by economic, social and political events. Some say that accounting is an art because it requires creative skill and judgment. Furthermore, accounting is also considered as an information system because it is used to identify and measure economic activities, process the information into financial reports, and communicate these reports to the different users of accounting information.

To further understand what accounting is, we must take a look at the different definitions.

| Accounting as a Science | Accounting as an Art | Accounting as an Information System |

| Accounting is the process of identifying, measuring, and communicating economic information to permit informed judgment and decisions by users of information. | Accounting is the art of recording (journalizing), classifying (posting to the ledger), summarizing in a significant manner and in terms of money, transactions and events which are, in part, at least of a financial character, and interpreting the results thereof to interested users. | Accounting is a service activity, which functions to provide quantitative information, primarily financial in nature, about economic entities that is intended to to be useful in making economic decisions. |

The first definition emphasizes the following:

- Identifying – in accounting, this is the process of recognition or non-recognition of business activities as accountable events. Stated differently, this is the process which determines if an event has accounting relevance.

- Measuring – in accounting, this is the process of assigning monetary amounts to the accountable events.

- Communicating – As we could notice with the above definitions, one main similarity between the three is the impact of communication. In order to be useful, accounting information should be communicated to the different decision makers. Communicating accounting information is achieved by the presentation of different financial statements.

The second definition emphasizes the following:

- Recording – The accounting term for recording is journalizing. All the accountable events are recorded in a journal.

- Classifying – The accounting term for recording is posting. All accountable events that are recorded in the journal are then classified or posted to a ledger.

- Summarizing – the items that are journalized and posted are summarized in the five basic financial statements.

The third definition emphasizes that accounting is a service activity and that Information provided by accounting could be classified into 3 types:

- Quantitative information – this is information that is expressed in numbers, quantities or units

- Qualitative information – this is information that is expressed in words

- Financial information – this information is expressed in terms of money

Therefore, given the definitions, accounting is a service activity that is all about recording, classifying and summarizing accountable events in order to communicate quantitative, qualitative, and financial economic information, to different users in order to make relevant decisions.

SAMPLE WORK

Complete copy of CFFE INTRODUCTION TO FORENSIC ACCOUNTING AND AUDIT NOTES is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD copy

Phone: 0728 776 317

Email: info@masomomsingi.com

OBJECTIVES OF ACCOUNTING

The objectives of accounting can be given as follows:

- Systematic recording of transactions – Basic objective of accounting is to systematically record the financial aspects of business transactions i.e. book-keeping. These recorded transactions are later on classified and summarized logically for the preparation of financial statements and for their analysis and interpretation.

- Ascertainment of results of above recorded transactions – Accountant prepares profit and loss account to know the results of business operations for a particular period of time. If revenue exceeds expenses then it is said that business is running profitably but if expenses exceed revenue then it can be said that business is running under loss. The profit and loss account helps the management and different stakeholders in taking rational decisions. For example, if business is not proved to be remunerative or profitable, the cause of such a state of affair can be investigated by the management for taking remedial steps.

- Ascertainment of the financial position of the business – Businessman is not only interested in knowing the results of the business in terms of profits or loss for a particular period but is also anxious to know that what he owes (liability) to the outsiders and what he owns (assets) on a certain date. To know this, accountant prepares a financial position statement popularly known as Balance Sheet. The balance sheet is a statement of assets and liabilities of the business at a particular point of time and helps in ascertaining the financial health of the business.

- Providing information to the users for rational decision-making – Accounting like a language of commerce communes the monetary results of a venture to a variety of stakeholders by means of financial reports. Accounting aims to meet the information needs of the decision-makers and helps them in rational decision-making.

- To know the solvency position: By preparing the balance sheet, management not only reveals what is owned and owed by the enterprise, but also it gives the information regarding concern’s ability to meet its liabilities in the short run (liquidity position) and also in the long-run (solvency position) as and when they fall due.

ELEMENTS OF FINANCIAL STATEMENTS

The elements of financial statements are the general groupings of line items contained within the statements. These groupings will vary, depending on the structure of the business. Thus, the elements of the financial statements of a for-profit business vary somewhat from those incorporated into a nonprofit business (which has no equity accounts).

Examples of the Elements of Financial Statements

The main elements of financial statements are as follows:

- Assets. These are items of economic benefit that are expected to yield benefits in future periods. Examples are accounts receivable, inventory, and fixed assets.

- Liabilities. These are legally binding obligations payable to another entity or individual. Examples are accounts payable, taxes payable, and wages payable.

- Equity. This is the amount invested in a business by its owners, plus any remaining retained earnings.

- Revenue. This is an increase in assets or decrease in liabilities caused by the provision of services or products to customers. It is a quantification of the gross activity generated by a business. Examples are product sales and service sales.

- Expenses. This is the reduction in value of an asset as it is used to generate revenue. Examples are interest expense, compensation expense, and utilities expense.

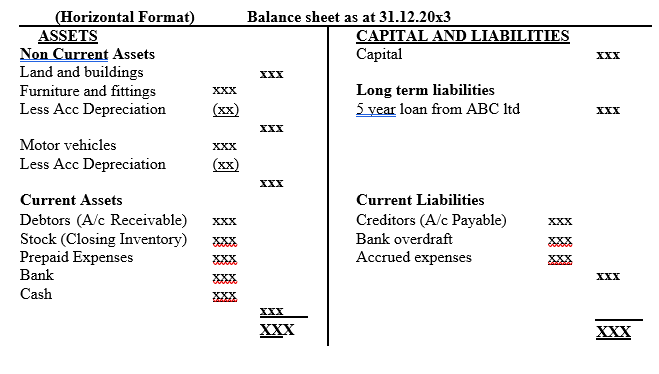

Of these elements, assets, liabilities, and equity are included in the balance sheet. Revenues and expenses are included in the income statement. Changes in these elements are noted in the statement of cash flows.

THE ACCOUNTING EQUATION

- The Accounting Equation

Initially when a business enterprise starts operating, it owns property inform of assets that are equivalent to the startup capital. Later on after continuance in the business, obligations inform of liabilities are incurred hence the equation changes. The total assets are now equivalent to the capital plus the liabilities in the business.

MASOMO MSINGI PUBLISHERS APP – Click to download and Access all our materials in PDF

ASSETS = LIABILITIES + CAPITAL

The accounting equation is summarized in the balance sheet as illustrated below;

SAMPLE WORK

Complete copy of CFFE INTRODUCTION TO FORENSIC ACCOUNTING AND AUDIT NOTES is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD copy

Phone: 0728 776 317

Email: info@masomomsingi.com