A cashbook records all the receipts (cash and cheques from customers and debtors or other sources of income) and all the payments (to creditors or suppliers and other expenses) for a particular financial period. The cashbook will also show us the cash at

bank and cash in hand position of the firm.

There are two types of cashbooks:

- Cash in hand cashbook, which records the cash transactions in the firm or business.

- Cash at bank cashbook, which records the transactions at/with, the bank.

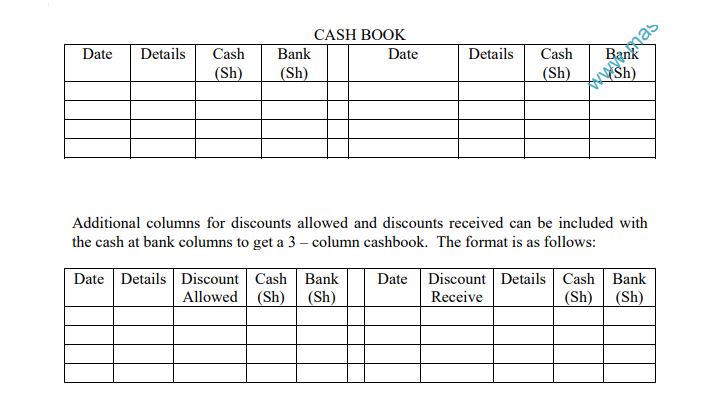

The cashbook is the most important book of prime entry because it forms part of the general ledger and records the source documents (receipts and cheques). The cash at bank cashbook and cash in hand cashbook are combined together to get a two-column

cashbook. The format is as follows:

Two-column cashbook.

The balance carried down (Bal c/d) for cash in hand and cash at bank will form part of the ledger balances and the discounts allowed and discounts received columns will be added and the totals posted to the respective discount accounts. The discount allowed

total will be posted to the debit side of the discount allowed account in the general ledger and the total of the discount received will be posted to the credit side of the discount received account of the general ledger. Cash at bank can have either a credit or debit balance. A debit balance means the firm has some cash at the bank and a credit balance means that the account at the bank is overdrawn (the firm owes the bank some money).