5.0 Introduction

Any prudent financial manager will be concerned as to how efficiently he can allocate funds at his disposal to various ventures available in the investment market. to a company , investment should be a continuous process if it is to survive in the future. it is important because it affects ;

- The size of the company.

- The risk of the finance invested.

- The company’s growth prospects.

The most important characteristics of these capital budgeting decisions are;

- They are long-term, i.e. extend beyond one financial period and they are expected to generate benefit [returns] for a long period in the future.

- The benefits from these investments are supposed to be in cash. It is important to note that this decisions are supposed to make by the top management with the assistant of external consultants sol as to ensure sound investment decisions.

- Such ventures must yield a return acceptable to both owners and creditors and this return acceptable to both owners and creditors and this return should not bank rates on fixed deposits.

5.1 Importance of capital budgeting

- Capital budgeting decisions are very important because if they result in a viable venture it will have the effect of increasing the value of the company’s shares in the stock exchange and thus the value of shareholders’ investment.

- These decisions expose the company’s money to a risk which will depend upon the nature of the investment and if they are badly made they can in the extreme lead the company into receivership and consequently liquidation.

- These decisions are reversible in that once the venture has been undertaken liquidating it or changing its nature is either difficult or not possible. This therefore calls for prudent financial management attitudes towards all investment decisions.

5.2 Classification of Investments.

- mutually exclusive investments

These are alternative options which serve the same purpose and compete with each other. if the firm is for instant considering three mutually project and one of them is undertaken the other two will automatically be rejected irrespective of their profitability, - Independent investments.

These projects serve different purposes and do not compete with each other. If the firm is considering five independent projects, all of them can be undertaken subject to their profitability and availability of funds. - Contingent / complementary investments

These are dependent projects. One project is required in the implementation or operation of another. This implies that the functioning of each project requires an input from the other complementary project.

5.3 Capital budgeting methods.

Methods used to assess the viability of an investment in capital budgeting. Any appraisal method to be used to assess the viability of a venture must fulfill the following requirements;

1. It should appreciate that bigger returns are preferable to small ones and early returns are preferable to later benefits.

2. The method should be able to rank various ventures available in the investment market in order of their profitability

3. The method should distinguish which investment ventures are acceptable and which ones should be rejected and why

4. The method should be able to be used for gauging the viability of any other investment ventures as and when they arise.

Features of a sound investment evaluation method

- It should be consistent with the overall objective of the firm- shareholders wealth maximization; maximize the net present value.

- It should be a measure of the projects over all profitability and hence should consider all cash flows.

- It provide a means of distinguishing between acceptable and non-acceptable projects

- It should provide a ranking of projects in order of economic importance

- Should be rational and consistent

- Should be applicable to any conceivable investment project

There are two methods of evaluating cash flows:

1. Traditional methods/ Non-discounted cash flow methods

- The payback period approach ( PBP)

- The accounting rate of return approach (ARR)

2. Modern methods or discounted cash flow techniques.

- The net present value method (NPV)

- The internal rate of return method (IRR)

- Profitability index or cost benefit ratio method

5.3.1 Non-Discounted Cash Flow Methods

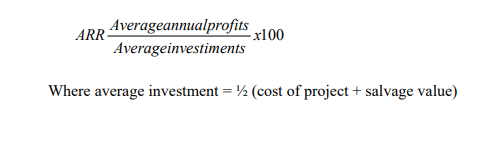

Accounting (average) rate of return (ARR)

This method utilizes information obtained in financial statements in particular from the profit and loss account and the balance sheet is to access the viability of an investment proposal. This method divides the average income after taxes by average investment, i.e. average book value of investment after allowing for depreciation. The rate obtained should then be compared with the rates given by banks on savings account on savings or fixed deposit etc a specific investment. If the rate obtained from a given investment is greater than the above rates, then such a venture is deemed to be viable; otherwise, if it less, such a project should be rejected. It many be noted that for analysis purposes, any investment should not yield a return lower than the bank rates otherwise it may be more prudent to save such money with a bank where it is more secure than to invest in a risky venture

In all it is important to note the following; –

- ARR uses average profits after depreciation, except in the above case where it would have given negative figures.

- Profits may be before or after tax.

- Capital may be initial or average capital investment.

- Capital may or may not include working capital.

In any case, ARR should not be used alone to gauge the viability of an investment but should be supplemented by two or more other methods in identifying a viable project.

Advantages of ARR

- Easy to compute and use

- Computed from readily available accounting information

- This method is simple to understand and use in practice.

- It is conveniently compared from accounting, data that is readily available in financial statements of a business organization.

- It uses the entire return from a given investment and thus it may give a fairly accurate picture of the profitability of a venture unlike the PBP, which ignores the income earned after PBP.

- It does not entail the use of computers or other sophisticated computations, which makes it cheaper to use.

Disadvantages of ARR

- It ignores time value of money like PBP because it lumps different cash flows together regardless of their timing.

- There is no universally acceptable way of computing ARR and this means that different parties can come up with different rates depending on the formula used.

- The method uses accounting profits rather than cash flows (in-flows) thus it ignores the fact that profits have subjective elements, e.g. accounting conventions and the company’s own ways of treating items in the profit and loss account.

- It ignores the fact that intermediary profits can be re-invested and generates the company extra return, and thus may lead to understatement of profits.

That except for investment made in phases otherwise all investments is made at the beginning of the period or year zero.

Non-discounted pay back period

This is the number of year taken to recover the original (initial) investment from annual cash flows.

Advantages of using payback period approach

- Payback period approach is simple to understand and easy to use in evaluating the viability of a venture and due to this it has been relied upon to gauge the viability of an investment by most traditional financial managers.

- As opposed to modern methods, which may call for the use of computers, this approach does not entail any cost on the part of the company and thus it is cheaper to use to gauge the viability of a venture. For companies operating in high risk areas it is a powerful tool asset will choose the venture that pay back earliest which minimizes the risks associated with returns which will be generated some time in future and which may be uncertain.

- It allows the company to identify those ventures, which can pay earlier, which will improve the liquidity position of the company.

- Payback period will be realistic for those companies which wish to re-invest intermediary returns as it will choose those ventures that generate big returns earlier and such early returns can be re-invested to generate some profits to the company before they are paid back to their lenders.

- Payback period is also consistent with the most prudent method of financing the company’s activities via matching approach – and will thus choose those ventures which are self-liquidating, thus avoiding any unnecessary costs of further borrowing to pay off the existing loans.

Disadvantages of using pay back period

- The biggest draw back in the use of PBP to evaluate the viability of an investment is the fact that it ignores time value of money.

- It ignores all returns generated after the payback period as these are not part of the payback; thus it is more lenders oriented, because thedoes not only want to pay back the cost of then investment but also wants to ear n a profit on such an investment while the (PBP) method caters for the former and ignores the latter which is the most important concern of any investor.

- It may pose problems of setting a yardstick as to which should be the standard payback period.

- In case a project does not yield uniform returns its payback period will not be accurate, as it will assume that the last inflows/returns needed to pay off the cost of the investments will be generated on a uniform basis, which is highly unrealistic and may lead a business to fail to repay the loan in time. This may occasion the company unnecessary penalties from lenders and this may lead in extreme to low credit rating on the part of the company using such method.

- Despite the above disadvantages (PBP) still remains a useful technique in assessing the viability of an investment both by traditional financial managers and also companies operating in high-risk ventures.

5.3.2 Discounted Cash Flow Methods

Modern Methods also known as time Adjusted or Discounted Cash Flow Methods. Unlike the traditional methods, modern methods of assessing the viability of an investment consider the time value of money and appreciate the fact that a shilling received now is more valuable than a shilling received in five years time and that the two can only be compared if they are of the same value i.e. after discounting them. However when using the modern methods of investment appraisal the following assumptions should be made. (Most of which are unrealistic); –

- That uncertainty does not exist.

- That appropriate rate to discount cash flows is known.

- That the company operates under financial constraints, i.e. in a financial market where the amount of finances necessary for all viable ventures cannot be available to the company due to internal or external forces.

- That the company operates in a situation where inflation does not exist.

1) That the cash flows or returns generated at the end of the year are strictly in cash form.

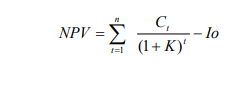

Net Present Value (NPV) Method

NPV can be defined as the process of computing the present value of future cash inflows (returns) from a project, less its cost or investment. This NPV is computed following the steps below:

1) A rate of interest, which is usually, the cost of the funds used or the return investors expect from their investments is used to discount future cash inflows.

2) The present value of future cash inflows or returns is then computed by using the rate of interest in (1) above.

3) The NPV should be computed by subtracting the present value of future cash outflows from the present value of cash inflows from the project using discounted figures.

Where; C = cash flow at the end of period

K = required rate of return

n = useful life of project

Io = initial cost of project

NPV = present value of cash flow – present value of initial cost

Decision criteria for NPV

NPV > 0, Accept the project – it maximizes should holders wealth

NPV < 0, Reject the project

NPV = 0, Indifferent

Advantages of using NPV to assess the viability of a venture.

1) It recognizes the time value of money in that it compares different amounts coming in at different periods in time .

2) It takes into account all the entire inflows or returns generated from a given project and as such it is realistic in gauging the profitability of a project.

3) It can rank projects according to their profitability whereby the highest rank will be given to that project with the highest NPV which will be the most profitable project.

4) It uses cash flows and not profits which makes it a reasonable assessment of the investments viability.

Disadvantages of NPV

1) It is more difficult to use than the traditional methods as it will involve tedious computations in assessing the viability of a venture.

2) it uses the cost of finance to discount the cash inflows, but it ignores the fact that the cost of finance is not

3) Gives absolute values which cannot be used to compare project of different sizes

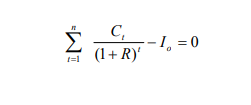

Internal Rate of Return (IRR)

IRR of a project is that rate which equates the present value of cash inflows to the present value of cash outflows .i.e. that rate internal to the project at which the present value of cash inflows and present value of costs are equal or it is that rate at which the NPV of a project is zero. IRR is the discount rate that equates the NPV of a project to zero. It is the project rate of return (Yield)

Where; R = IRR

Where; R = IRR

IRR can be computed in two ways:

- Using the trial and error approach

- Using interpolation and extrapolation

1. Using the trial and error

Steps in the IRR trial and error calculation method

- Compute the NPV of the project using an arbitrary selected discount rate

- If the NPV so computed is positive then try a higher rate and if negative try a lower rate.

- Continue this process until the NPV of the project is equal to zero

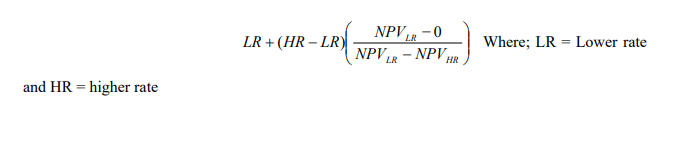

- Use linear interpolation to determine the exact rate

Linear interpolation is given by:

Advantages of IRR

- It takes into account the time value of money and thus gives a sound measure of the viability of a project as it lumps inflows together at their present values.

- It considers all the inflows or returns generated by a given venture and as such it will gauge the company’s profitability with more accuracy

- It indicates the minimum rate of return at which the company will break even and any rate above such a rate will yield a return to the company to boost its profitability.

- In the absence of cost of capital which is usually the yardstick to gauge the viability of a venture.

- Can be used to compare projects of different sizes

- Considers time value of money

- Uses project cash flows

Disadvantages of IRR

- Some project have multiple IRRs if their NPV profile crosses the x-axis more than once (project cash flow signs change several time)

- Some project may theoretically have no IRR if their NPV profile doesn’t cross the x-axis ( no negative cash flow)

- Assumes re-investment of cash flows occurs of project’s IRR which could be exorbitantly high

- Doesn’t provide a decision criteria

- It may involve tedious computations in particular if the returns are earned for quite sometime

- In some cases it may yield multiple and negative rates which may not have any meaning and a lot of assumptions will have to be made

- It may not give a good measure of the viability of investments which differ in their economic life and returns

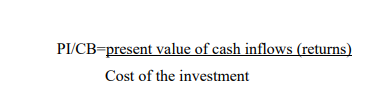

Profitability Index (PI) / Cost Benefit Ratio.

This is the ratio of the present value of cash inflows or returns at a required rate of return to the cost of the investment. It can be computed using the following formula:

It is also referred to as the present value index (PVI). It is the relative measure of project’s profitability and can used to compare project of different sizes

PI = present value of cash flows/Initial cost

Decision criteria:

If, PI >1, Accept project

PI < 1, Reject project

PI = 1, Indifferent

Advantages of PI

- Recognized time value of money

- Consistent with shareholders wealth maximization objects

- Compares projects of different sizes

- Gives a decision criteria disadvantages

Disadvantages of IRR

- Inapplicable for projects with no negative cash flows