Capital budgeting deals with the allocation of funds to competing projects; they involve commitment of funds to receive future benefits.

2.1 Characteristics of Capital Budgeting Decisions

- They involve investment in fixed assets whose useful life is more than the effect of the investment decision and therefore felt longer

- They affect the firm’s cash flows and therefore may change the risk complexion of the firm.

- They affect the company’s profitability and therefore will affect the valve of the firm.

- Most are irreversible because it is difficult to get a second hand market for fixed assets

2.2 Steps in Investment Decisions

- Generating investment proposals

- Estimating future cash flows

- Evaluating the cash flows

- Making the selection decision & implementation

- Re – evaluation (for replacement decision)

2.2.1 Generating Investment Proposals

Usually, investment proposals are generated by other departments, not the finance department. E.g. the marketing department will generate proposal on new product development; production department would generate replacement proposals; Research and development would come up with new technology, exploration etc. Other external sources include the government through law legislation, competitors etc.

2.2.2 Estimating Cash Flows

In capital budgeting we are interested in after tax incremental cash flows. We are interested in operating as opposed to financing cash flows. In calculating the incremental cash flow, it is helpful to place the project cash flows in to three categories based on

timing:

1. Initial cash out flow :The initial net cash investment

2. Interim incremental net cash flows: Those net cash flows occurring after the initial cash investment but not including the final period’s cash flow.

3. Terminal year incremental net cash flow: The final period net cash flow (it is singled out for attention because a particular set of cash often occur at project termination)

Basic Format for Determining Initial Cash Flows

- Cost of new assets

- + Capitalized expenditures (e.g. installation costs, shipping costs)

- + (-) Increased (decreased) level of “net” working capital

- – Net proceeds from sale of old assets(s) if the investment is a replacement decision.

- + (-) Taxes (tax savings) due to the sale of “old” assets if the investment is a replacement decision

- = Initial cash out flow

Basic Format for Determining Interim and Terminal Year Incremental Net Cash Flow

- Net increase (decrease) in operating revenue less (plus) any net increases (decrease) in operating expenses excluding depreciation

- – (+) Net increase (decrease) in depreciation charges

- = Net change in income before taxes

- – (+) Net increase (decrease) in taxes

- = Net change in come after taxes

- + (-) Net increase (decrease) in tax depreciation charges

- = Incremental cash flow for the terminal year before project wind up

- + (-) Final salvage valve (disposal/ reclamation) of ‘new’ assets

- – (+) Taxes (tax saving) due to sale or disposal of “new” assets

- + (-) Decrease (increase) level of net working capital

- = Terminal year incremental net cash flow

Note: Items (a) to (g) constitute interim cash flows while (h) to (k) constitute terminal year net cash flows

2.2.3 Evaluating the Cash Flows

Features of a sound investment evaluation method

- It should be consistent with the overall objective of the firm- shareholders wealth maximization; maximize the net present value.

- It should be a measure of the projects over all profitability and hence should consider all cash flows.

- It provide a means of distinguishing between acceptable and non-acceptable projects

- It should provide a ranking of projects in order of economic importance

- Should be rational and consistent

- Should be applicable to any conceivable investment project

There are two methods of evaluating cash flows:

1. Discounted cash flow methods

2. Non-discounted cash flow methods

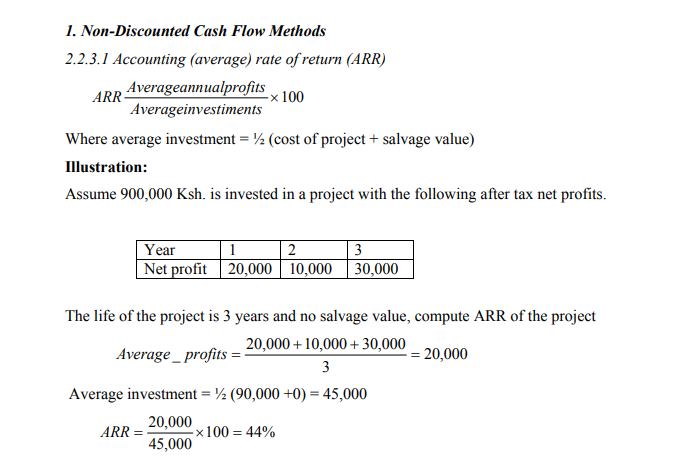

Advantages of ARR

- Easy to compute and use

- Computed from readily available accounting information

Disadvantages of ARR

- Ignores time value of money

- Ignores uncertainty of cash flows and there is no consideration of risk in calculation

- Uses accounting profits rather than cash flows

- Doesn’t give a decision criteria

- Not consistent with share holder wealth maximization

2.2.3.2 Non-discounted pay back period

This is the number of year taken to recover the original (initial) investment from annual cash flows. The lower the pay back period the better the project is

Advantages of Non-discounted pay back period

- Easy to calculate

- Uses project cash flows

- Can be used as an indicator of projects risk. The longer the pay back period the higher the risk of project

Disadvantages of Non-discounted pay back period

- Ignores time value of money

- Ignores cash flows beyond bay back period

- doesn’t show/give a decision criteria

- Not consistent with share holder wealth maximization

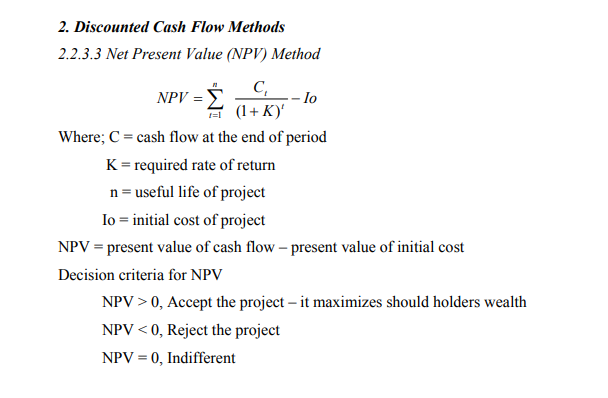

Advantages of NPV

- Considers time value of money

- Consistent with shareholder wealth maximization

- Gives a decision

- Recognizes uncertainty of cash flow by discounting

Disadvantages of NPV

Gives absolute values which cannot be used to compare project of different sizes

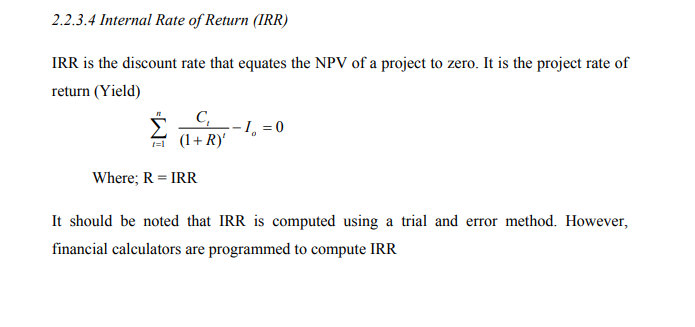

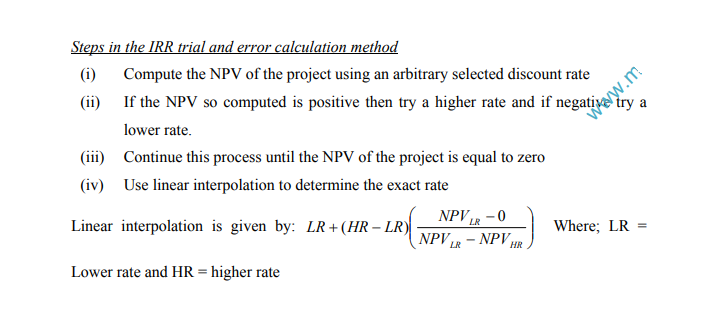

Advantages of IRR

- Can be used to compare projects of different sizes

- Considers time value of money

- Uses project cash flows

Disadvantages of IRR

- Some project have multiple IRRs if their NPV profile crosses the x-axis more than once (project cash flow signs change several time)

- Some project may theoretically have no IRR if their NPV profile doesn’t cross the x-axis ( no negative cash flow)

- Assumes re-investment of cash flows occurs of project’s IRR which could be exorbitantly high

- Doesn’t provide a decision criteria

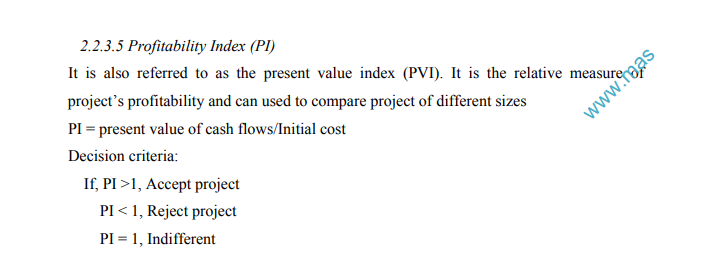

Advantages of PI

- Recognized time value of money

- Consistent with shareholders wealth maximization objects

- Compares projects of different sizes

- Gives a decision criteria disadvantages

- Inapplicable for projects with no negative cash flows

2.3 Comparing Projects with Unequal Life

If we are choosing between two mutually exclusion alternatives with significantly different lives, an adjustment would be necessary in order to come up with a logical comparison. Two procedures may be used in order to compare projects with unequal lives.

- Replacement chain method

- Equivalent annual annuity method

1. Replacement Chain (Common Life) Approach

This is a method of comparing projects of unequal lives which assumes that each project can be repeated as many times as necessary to reach a common life span. The NPVs over the life span are then compared and the project with the higher common life NPV is

chosen.

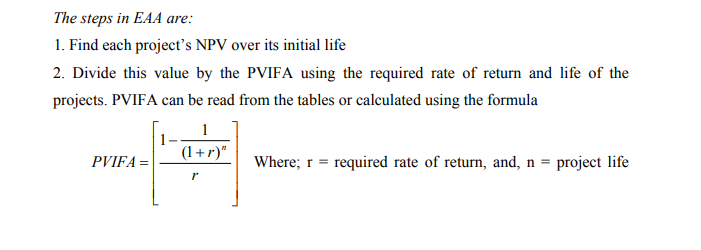

2. Equivalent Annual Annuity (EAA) Approach

This is a method which calculates the annual payments a project would provide if it were an annuity. When comparing project of unequal lives, the one with the higher EAA should be chosen.

2.4 Capital Rationing

This is a situation where a constraint (or budget ceiling) is placed on the total size of capital expenditures during a particular period

2.4.1 Causes of Capital Rationing

- Capital constraints a rising from the market (external capital rationing) As the firm goes for more capital, the additional capital comes at an increased cost to the form. The increase in price of capital is so great that it renders low return projects undesirable.

- Managerial imposed capital constraint (internal capital rationing)

- Policy of reliance on internally generated funds

- Dilution effect:- to prevent outsiders from gaining control of the form

- Capital rationing for units of on organization:- fixed allocation from the headquarters to departments

- Higher cut off ratio:- setting the firms at off rte for investments higher than the firms cost of money.

- Organizational limits on the growth of the firm:- when the desirable investment is larger than the size of the firm it is thought that the firm will be unable to exploit the project due to short term constraints on the availability of managerial talent.

Methods of Selecting Investment Proposal under a Capital Constraint

1. Profitability Index

Steps:

- Compute the index for all proposals

- For mutually exclusive proposals retain the one having the positive index

- Rank them in the order of their index values

- Begin with the proposal having the highest index value until their accumulated total costs exhaust the available capital.

2.5 Inflation and Capital Budgeting

Does inflation have an impact in capital budgeting analysis? The answer is a qualified yes in that inflation does have an impact on the numbers that are used in a capital budgeting analysis, but it does not have an impact on the results of the analysis if certain conditions are satisfied. To show what this statement means consider the following illustration.

Illustration:

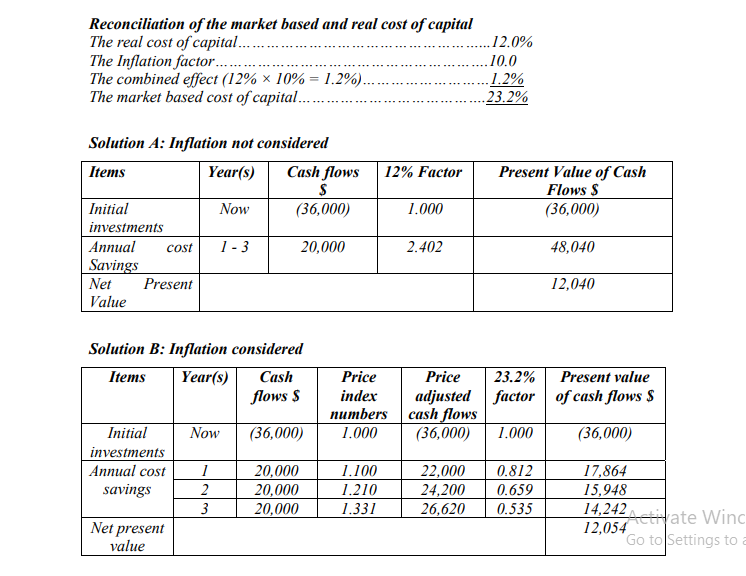

XYZ Company wants to purchase a new machine that costs $36,000. The machine would provide annual cost savings of $ 20,000, and it would have a three year life with no salvage value. For each of the nest three years, the company expects a 10% inflation rate in the cash flow associated with the new machine. If the company’s cost of capital is 23.2%, should the new machine be purchased?

To answer this question, it is important to know how the cost of capital was derived. Ordinarily, it is based on the markets rates of return on the company’s various sources of financing- both debt and equity. This market rate of return includes expected inflation; the higher the expected rate of inflation, the higher the market rate of return on debt and equity. When the inflationary effect is removed from the market rate of return, the results is called a real rate of return. For example, if the inflation rate of 10% is removed from martin’s cost of capital of 23.2 %, the “Real cost of the capital” is only 12%, as shown in below (You can simply subtract the inflation rate from the market cost of capital to obtain the real cost of capital. The computations are a bit more complex than that)

When performing a net present value analysis, one must be consistent. The market based cost of capital reflects inflation. Therefore, if a market based cost of capital is used to discount cash flows, then the cash flows should be adjusted upwards to reflect the effects of inflation in forthcoming periods. Computations for XYZ Company under this approach are given in solution B above On the other hand, there is no need to adjust the cash flows upwards if the “real cost of capital” is used in the analysis (since the inflationary effects have been taken out of the discount rate). Computations for XYZ Company under this approach are given is solution A above. Note that under solutions A and B that the answer will be the same (within rounding error) regardless of which approach is used, so long as one is consistent and all of the cash flows associated with the project are affected equally by inflation.

Several points should be noted about solution B, where the effects of inflation are explicitly taken into account. First, note that the annual cost savings are adjusted for the effects of inflation by multiplying each year’s cash savings by price-index number that

reflects a 10% inflation rate. Second, note that the net present value obtained in solution B, where inflation is explicitly taken into account, is the same, within rounding error, to that obtained in solution A, where the inflation effects are ignored. This result may seem surprising, but it is logical. The reason is we have adjusted both the cash flows and the discount rate so that they are consistent, and these adjustments cancel each other across the two solutions.

Throughout the topic we assumed for simplicity that there is no inflation. In that case, the market based and real costs of capital are the same, and there is no reason to adjust the cash flow for inflation since there is none. When there is inflation, the unadjusted cash flows can be used in the analysis if all of the cash flows are affected equally by inflation and the real cost of capital is used to discount the cash flows. Otherwise, the cash flows should be adjusted for inflation and the market based cost of capital should be used in the analysis.