UNIVERSITY EXAMINATIONS: 2018/2019

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS

INFORMATION TECHNOLOGY

BUSS306 EVALUATION OF BUSINESS INVESTMENTS

FULL TIME/PART TIME/DISTANCE LEARNING

DATE: DECEMBER, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE

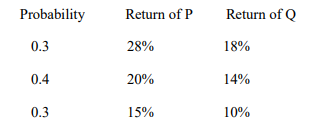

a) Consider the following two securities P and Q with the following characteristics:

Assume that an investor owns 60% of security P and 40% of Security Q.

Required:

i. Determine the covariance between security P and Q. (4 Marks)

ii. Determine the correlation coefficient of P and Q. (4 Marks)

iii. Determine the expected return of the portfolio. (2 Marks)

iv. Determine the percentage risk diversification. (4 Marks)

b) Explain any 5 conceptual differences between the arbitrage pricing theory and capital asset pricing

model. (10 Marks)

c) Discuss Three (3) limitations of capital Asset Pricing Model (6 Marks)

QUESTION TWO

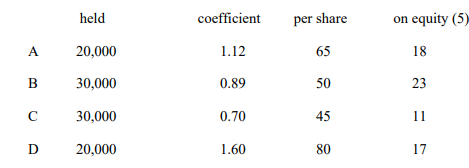

a) James is currently holding a portfolio consisting of shares of companies quoted on the Nairobi

Securities exchange as follows:

Company Number of shares Beta-equity Market price Expected return

held coefficient per share on equity (5)

The current market return is 14% per annum and the treasury bills yield is 9% p.a.

Required:

i. Calculate the risk of James’ portfolio relative to that of the market. (6 Marks)

ii. Explain whether or not James should change the composition of his portfolio. (8 Marks)

b) Using a well labeled diagram differentiate between efficient and optimal portfolio. Your diagram

should be supported by the necessary explanations

(6 Marks)

QUESTION THREE

a) Explain the benefits of merger and acquisition. (10 Marks)

b) Explain the main defensive tactics that a company defends itself from hostile takeover.

(10 Marks)

QUESTION FOUR

a) Explain the term market efficiency (1 marks)

b) Identify and explain the three forms of market efficiency (9 Marks)

c) Differentiate between portfolio theory and Arbitrage Pricing Theory (APT) (10 marks)

QUESTION FIVE

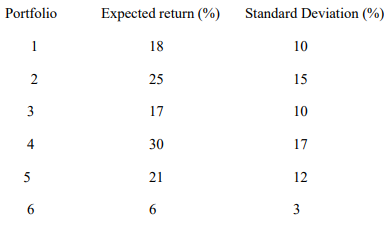

An investor is evaluating the portfolios shown below

Portfolio Expected return (%) Standard Deviation (%)

The expected return on the market portfolio is 10% with a variance of 16%. The risk free of interest rates

is 6%.

Required:

i) Using the CML, advice the investor on which of the above portfolios are efficient or inefficient

(12 Marks)

ii) In the case of any inefficient portfolio (s) above, state what the standard deviation should be for

efficiency to be achieved the above expected returns on the respective portfolio (s)

(4 Marks)

iii) Differentiate between Security Market Line (SML) and the Capital Market Line (CML)

(4 Marks)