UNIVERSITY EXAMINATIONS: 2018/2019

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS

INFORMATION TECHNOLOGY

BUSS106 COST ACCOUNTING

FULL TIME/PART TIME/DISTANCE LEARNING

DATE: DECEMBER, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer ALL questions.

QUESTION ONE (20 MARKS)

(a)Explain any four purposes of cost accounting (8 Marks)

(b)Demand for part ND 484 used by XICO Lt tends to be constant at an annual rate of 4 million units.

The cost per unit for this part is sh.200 and the cost of placing an order is 500. XICO ltd. estimates that

the annual inventory carrying cost of the part expressed as percentage of cost of inventory is 20%.

Required:

(i)Compute the Economic Order Quantity (EOQ) (4 Marks)

(ii) Compute the annual number of orders (4 Marks)

(iii)Calculate the reorder point .Assume lead time is 10 days and the company works for 300 days in a

year. (4Marks)

QUESTION TWO (15 MARKS)

Discuss any three advantages and three disadvantages of piece rate method of remunerating workers

(6 Marks)

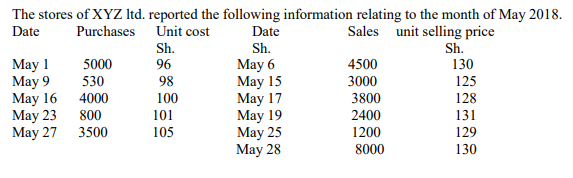

The stores of XYZ ltd. reported the following information relating to the month of May 2018.

Date Purchases Unit cost Date Sales unit selling price

Required:

A stores ledgers card using the

(i)First In First Out (FIFO) (5 Marks)

(ii) Weighted average method (4 Marks)

QUESTION THREE (20 MARKS)

Rinshi Limited manufactures and sells a single product branded Tinchi. The standard cost per

unit of Tinchi is as follows

Direct materials 8kilograms at Sh. 30 240

Direct labour 4hours at Sh.50 per hour 200

Production overheads Variable 50

Fixed 70

560

Addition information

1. The company achieved the following production and sales levels

Year ended 31 December

2015 2016 2017

Unit’s units units

Production 2,000 3,000 2,800

Sales 1,500 2,500 3,000

2. There was no inventory as at 1 January 2015

3. Fixed production overheads per units are calculated on the basis of budgeted production

level of 3,000 units per annum

4. Cost relating to selling and distribution are as follows

Variable 20% of sales

Fixed Sh.90, 000 per annum

5. The selling price per unit of Tinchi is Sh.1,000

6. There were no differences between actual and standard costs or selling prices

Required

(a) Income statements for each of the three years using

(i) Marginal costs (8 Marks)

(ii) Absorption costing (8 Marks)

(b) Reconcile the profit figures in (a) (i) and (ii) above (4 Marks)

(Total 20 Marks)

QUESTION FOUR (15 MARKS)

Zed Company manufactures a product called “Jirma”. Pertinent cost and revenue data relating

to the manufacture of this product is given below:

Shs

Selling price per unit 66

Variable production cost per unit 44

Variable selling cost per unit 4

Fixed production cost (total) Shs.200,000

Fixed selling and administrative cost (total) Shs.99,000

Required

a) Calculate the break-even sales level in shillings; (4 Marks)

b) Suppose the company desires to make a profit of shs.195,000, what should be the output in units?

(3 Marks)

© Identify three limitations of break even analysis (3 Marks)

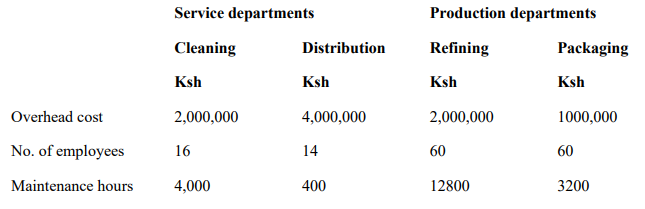

Maxxi Limited operates two production department and two service department. The budgeted

cost and normal activity levels for each of the four departments are given below:

Additional information

The cost of maintenance department is allocated on the basis of number of employees while

those of power department on the basis maintenance hours

Required

Allocate the service department overheads using:

i) Direct allocation method ( 5 Marks)