UNIVERSITY EXAMINATIONS: 2018/2019

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS IN

INFORMATION TECHNOLOGY

BUSS100 INTRODUCTION TO ACCOUNTING I

FULL TIME/PART TIME/DISTANCE LEARNING

DATE: DECEMBER, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer ALL questions.

QUESTION ONE

a) The following categories of people are recognized as users of the information contained in

financial statements:

Owners

Financial analysts

Lenders

For each of the above users of financial statements, identify the kind of information they may

required, why they require it and the decisions they made from that information.

(6 Marks)

b) Dawn ltd offers accountancy services. The following relates to transactions done in the month

of March 2018.

2018

Mar 1 Balances brought forward: Cash Kshs230; Bank Kshs 4,756.

Mar 2 The following paid their accounts by cheque, in each case deducting 5 percent

discounts: R Burton Kshs140; E Taylor Kshs220; R Harris Kshs800.

Mar 4 Paid rent by cheque Kshs120.

Mar 6J Cotton lent us Kshs1,000 paying by cheque.

Mar 8 We paid the following accounts by cheque in each case deducting a 2 ½ per cent

cash discount: N Black Kshs360; P Towers Kshs480; C Rowse Kshs300.

Mar 10Paid motor expenses in cash Kshs44.

Mar 12 H Hankins pays his account of Kshs77, by cheque Kshs74, deducting Kshs3 cash

discount.

Mar 15Paid wages in cash Kshs160.

Mar 18 The following paid their accounts by cheque, in each case deducting 5 per cent

cash discount: C Winston Kshs260; R Wilson & Son Kshs340; H Winter

Kshs460.

Mar 21Cash withdrawn from the bank Kshs350 for business use.

Mar 24Cash Drawings Kshs120.

Mar 25 Paid T Briers his account of Kshs140, by cash Kshs133, having deducted Kshs7

cash discount.

Mar 29 Bought fixtures paying by cheque Kshs650.

Mar 31 Received commission by cheque Kshs88.

Required:

i) Prepare a three-column cashbook as at 31st March (9 Marks)

(Total: 15 Marks)

QUESTION TWO

Mr J Ockey commenced trading as a wholesaler stationer on 1 May 2018 with a capital of

Kshs5,000.00 with which he opened a bank account for his business.

During May the following transactions took place.

May 1 Bought shop fittings and fixtures from store fitments Ltd for Kshs2,000.00

May 2 Purchased goods on credit from Abel Kshs650.00

May 4 Sold goods on credit to Bruce Kshs700.00

May 9 Purchased goods on credit from Green Kshs300.00

May 11 Sold goods on credit to Hill Kshs580.00

May 13 Cash sales paid into bank account Kshs200.00

May 16 Received cheque from Bruce in settlement of his account

May 17 Purchased goods on credit from Kay Kshs800.00

May 18 Sold goods on credit to Nailor Kshs360.00

May 19 Sent Cheque to Abel in settlement of his account

May 20 Paid rent by cheque Kshs200.00

May 21 Paid delivery expenses by cheque Kshs50.00

May 24 Received from Hill Kshs200.00 on account

May 30 Drew cheque for personal expenses Kshs200.00 and assistant wages

Kshs320.00

May 31 Settled the account of Green.

Required

i) Record the transactions in the books of prime entry. (10 Marks)

ii) Post the entries in the ledger accounts (5 Marks)

iii) Extract a trial balance as at 31 May 2018. (5 Marks)

(Total: 20 Marks)

QUESTION THREE

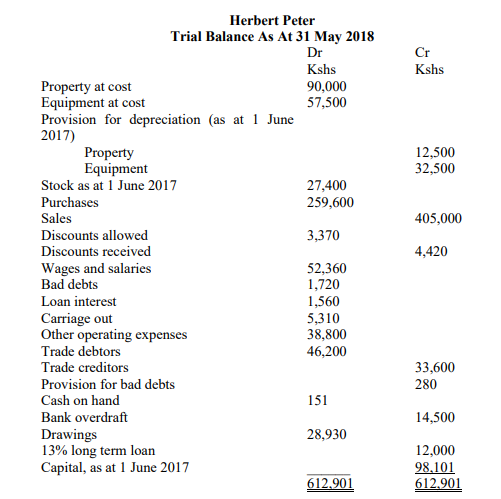

The following trial balance has been extracted from the ledger of Herbert Peter, a sole trader, as at

31 May 2018, the end of his most recent financial year.

The following additional information as at 31 May 2018 is available:

(a) Stock as at the close of business was valued at Kshs 25,900.

(b) Depreciation for the year ended 31 May 2018 has yet to be provided as follows:

Property – 1% using the straight-line method

Equipment – 15% using the straight-line method

(c) Wages and salaries are accrued by Kshs140.

(d) Other operating expenses include certain expenses prepaid by Kshs 500. Other expenses

included under this heading are accrued by Kshs 200.

(e) The provision for bad debts is to be adjusted so that it is 0.5% of trade debtors as at 31 May

2018.

(f) Purchases include goods valued at Kshs1,040, which were withdrawn by Mr Peter for his own

personal use.

Required:

i) Statement of Financial Performance for the period ended 31st May 2018 (12 Marks)

ii) Statement of Financial Position as at 31st May 2018 (8 Marks)

(Total: 20 Marks)

QUESTION FOUR

a) State the causes of depreciation (4 Marks)

b) A business started trading on 1st January 2016. During the two years ended 31st December 2017

the following debts were written off to bad debts account on the dates stated:

31st August 2016 N. Jane Kshs. 8,500

30th September 2016 M. Ann Kshs.14,000

28th February 2017 N. Mary Kshs.18,000

31st August 2017 J. Susan Kshs. 6,000

30th November 2016 A. Alice Kshs.25,000

On 31st December 2016 there had been a total of debtors remaining of Kshs.4,050,000. It was

decided to make a provision for doubtful debts of Kshs.55,000.

On 31st December 2017 there had been a total of debtors remaining of Kshs.4,730,000. It was

decided to make a provision for doubtful debts of Shs.60,000

You are required to show:

i) The bad debts account and the provision for bad debts account for each of the two years.

(4 Marks)

ii) The charges to the statement of financial performance for each of the two years.

(3 Marks)

iii) The relevant extracts from the statement of financial position as at 31st December 2016 and

2017 (4 Marks)

(Total: 15 Marks)