UNIVERSITY EXAMINATIONS: 2016/2017

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS IN

INFORMATION TECHNOLOGY

BUSS 306 EVALUATION OF BUSINESS INVESTMENTS

FULL TIME/PART TIME & DISTANCE LEARNING

DATE: DECEMBER, 2016 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE – COMPULSORY

a) Explain the benefits of merger and acquisition. (10 Marks)

b) Explain the main defensive tactics that a company defends itself from hostile takeover.

(10 Marks)

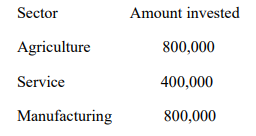

c) Mariam has a capital of sh 2,000,000 which he wishes to invest in three sectors of the

economy agriculture, service and manufacturing. The funds will be allocated as follows;

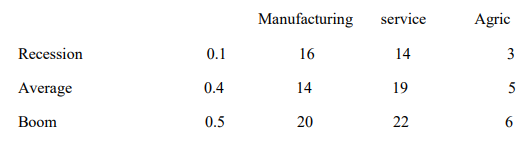

Details on the possible future economic states , their probabilities of occurrence and the expected

return for each of the sectors is as shown below;

Required;

i) Determine the risk associated with the investment in each of the three sectors above

(8 Marks)

ii) Determine the expected portfolio return (2 Marks)

QUESTION TWO

The economy has four likely states of outcome; depression, recession, normal and boom. Each of

these states of outcome have a 0.25 chance of occurrence. ABC ltd a listed company expect that

the following returns would be made in the states of the outcome respectively:

20% !0% 30% and 50%

Required:

i) Determine the expected return for the company (2 Marks)

ii) Compute the variance and the standard deviation of the company (6 Marks)

iii) Discuss THREE assumptions of Arbitrage Pricing Theory (APT) (6 Marks)

iv) Elucidate on TWO weaknesses of Arbitrage Pricing Theory (APT) (2 Marks)

v) Highlight FOUR uses of CAPM (4 Marks)

QUESTION THREE

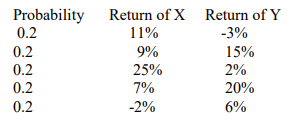

BBIT University student, Fiona & Eliud are planning to invest in either of the securities X and Y

or a combination of them. They have sought the advice of a financial analyst, who gives him the

following data about the securities:

Required:

a) Expected return and standard deviation of the following portfolios:-

i. 100% X and 0 % Y

ii. 75% X and 25 % Y

iii. 50% X and 50 % Y

iv. 0% X and 100 % Y (12 Marks)

b) From the following financial information calculate beta of security j and the expected rate of

return of security j

δj = 12 % δm = 9% and Cor (j,m) = +0.72 Rf = 10% Rm = 18% (8 Marks)

QUESTION FOUR

a) Discuss the factors that affect the efficiency of a portfolio (6 Marks)

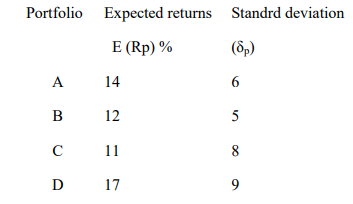

b) An investor holds the following four (4) portfolios

i) If the market return is 12% with a standard deviation of 5% and risk free rate of 8%.

Determine using the capital market line (CML) equation which of the portfolios are efficient and

which are inefficient.

(8 Marks)

ii) Use a diagram to show how the portfolios appear on the capital market line (CML).

(6 Marks)

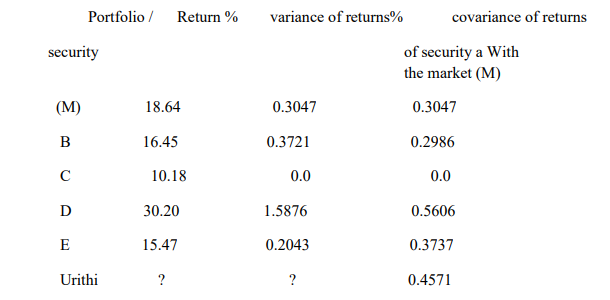

QUESTION FIVE

The directors of Urithi limited, wish to use an alternative estimate of cost of capital. They prefer

to use the capital asset pricing model. The following details have been provided;

Portfolio / Return % variance of returns% covariance of returns

security of security a With

the market (M)

Required;

i. Determine the beta coefficient of each portfolio / security and interpret the results of

each.

(14 Marks)

ii. Predict the cost of capital of urithi limited using the capital asset pricing model.

(6 Marks)