UNIVERSITY EXAMINATIONS: 2016/2017

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS IN

INFORMATION TECHNOLOGY

BUSS 306 EVALUATION OF BUSINESS INVESTMENTS

FULL TIME/PART TIME/DISTANCE LEARNING

SPECIAL /SUPPLEMENTARY EXAMINATION

DATE: JULY, 2017 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE – Compulsory (Total Marks: 30)

a) Mr. Invent has a capital of 1,000,000 which he wishes to invest in three projects A, B & C.

The funds will be allocated as follows:

Sector Amount Invested

A 400,000

B 200,000

C 400,000

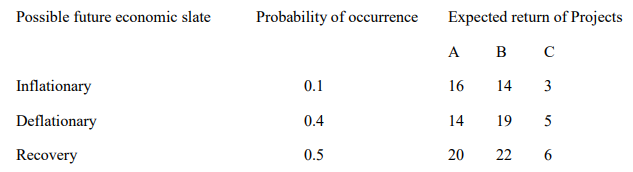

Details on the possible future economic states, their probabilities of occurrence and the expected

return for each of the projects are as shown below;

Possible future economic slate Probability of occurrence Expected return of Projects

Required:

i. Determine the risk associated with the investment in each of the Projects (6 Marks)

ii. Compute portfolios expected return. (3 Marks)

b) Highlight the uses and application of the Capital Asset Pricing Model (4 Marks)

c) Distinguish between Capital market line (CML) and Securities market line (SML)

(4 Marks)

d) State the Problems experienced in counter trade (3 Marks)

e) Highlight the costs an organization is likely to incur when undergoing financial distress and

suggest measures that it can put in place to avoid getting in such a situation.

(10 Marks)

QUESTION TWO (20 MARKS)

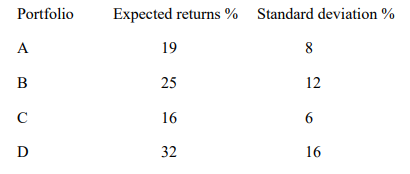

An investor is evaluating six portfolios with the following characteristics;

The expected return on the market portfolio is 12% with an accompanying standard deviation of

4%. The risk free rate of interest is 5%.

Required:

a) Using the capital market line, advice the investor on which of the above portfolios are efficient

and which are inefficient.

(8 Marks)

b) Illustrate using a well labeled diagram how these portfolios appear on the capital market line

(CML)

(8 marks)

b) In the case of an inefficient portfolio on (a) above state what the standard deviation should be

for efficiency to be achieved with the given expected return.

(4 Marks)

QUESTION THREE (20 MARKS)

a) Explain the term market efficiency (1 Mark)

b) Identify and explain the three forms of market efficiency (9 Marks)

c) Differentiate between portfolio theory and CAPM (10 marks)

QUESTION FOUR (20 MARKS)

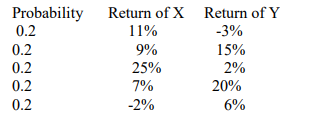

A KCA University student, Joseph Kamuyu is planning to invest in either of the securities X and

Y or a combination of them. Joseph has sought the advice of the financial analyst, Jimmy Mbaru,

who gives him the following data about the securities:

Required:

a) Expected return and standard deviation of the following portfolios:-

i. 100% X and 0 % Y

ii. 75% X and 25 % Y

iii. 50% X and 50 % Y

iv. 0% X and 100 % Y (12 Marks)

b) From the following financial information calculate beta of security j and the expected rate of

return of security j

δj = 12 % δm = 9% and Cor (j,m) = +0.72 Rf = 10% Rm = 18% (8 Marks)

QUESTION FIVE (20 MARKS)

a) Explain the following terms as applicable in merger and acquisitions:

Corporate Restructuring

– Merger (2 marks)

– Acquisition (2 marks)

– Consolidation (2 marks)

– Absorption (2 marks)

b) Explain the three types of mergers (6 marks)

c) Discuss THREE strategies that a company can explore to avoid a hostile takeover

(6 marks)