UNIVERSITY EXAMINATIONS 2017/2018

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS IN

INFORMATION TECHNOLOGY

BUSS 306 EVALUATION OF BUSINESS INVESTMENTS

FULL TIME/PART TIME/DISTANCE LEARNING

DATE: DECEMBER, 2017 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE

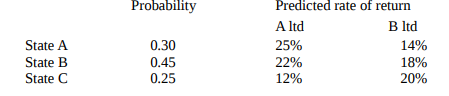

a) You have identified two quoted shares

Required:

i) Calculate the expected return of each security (2 Marks)

ii) variance and standard deviation of each security. (8 Marks)

iii) Compute the correlation coefficient between the two share returns and comment on the results

( 6

Marks)

iv) Compute the expected returns for a portfolio consisting of Sh 7000,000 of A ltd and Sh 3000,000 of B

ltd.

(2 Marks)

v) Compute the risk of the portfolio in part 9iv) above (4 Marks)

b) Explain by giving examples how the nature of the relationship between the security returns forming the

portfolio affect the efficiency of a portfolio. (4 Marks)

c) Highlight FOUR uses of CAPM (4 Marks)

QUESTION TWO

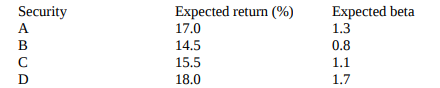

a) The risk free rate of return is 10% and the expected return of the market portfolio is 15%. The expected

returns of four securities are listed below together with their expected betas.

On the basis of these expectations, which securities are expected to be overvalued, undervalued or

correctly priced?

(8 Marks)

b) Outline any 5 limitations of the capital asset pricing model. (10 Marks)

c) Define the term portfolio giving an example of any possible kind of a portfolio (2 Marks)

QUESTION THREE

a) Explain the benefits of merger and acquisition. (10 Marks)

b) Explain the main defensive tactics that a company defends itself from hostile takeover.

(10

Marks)

QUESTION FOUR

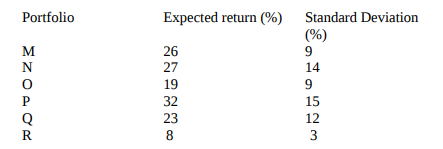

Consider the information on the portfolios below:

The expected return on the market portfolio is 12% with a standard deviation of 3%. The risk free of

interest rates is 5%

Required:

i. Using the CML, advice the investor on which of the above portfolios are efficient or inefficient

(10 Marks)

ii. Using the information, identify which of the portfolio(s) above represent the market (2 Marks)

iii. In the case of any inefficient portfolio (s) above, state what the standard deviation should be for

efficiency to be achieved the above expected returns on the respective portfolio (s).

(4 Marks)

iv. Discuss the difference between Security Market Line (SML) and the Capital Market Line (CML)

(4 Marks)

QUESTION FIVE

a) Explain the term market efficiency (1 Marks)

b) Identify and explain the three forms of market efficiency (9 Marks)

c) Differentiate between portfolio theory and CAPM