UNIVERSITY EXAMINATIONS: 2021/2022

EXAMINATION FOR THE DEGREE BACHELOR OF BUSINESS

INFORMATION TECHNOLOGY

BUSS 203: BUSINESS FINANCE

FULLTIME/PART TIME

DATE: DECEMBER, 2021 TIME: 2 HOURS

INSTRUCTIONS: QUESTION ONE IS COMPULSORY, CHOOSE TWO OTHER

QUESTIONS

QUESTION ONE (20 Marks) Compulsory

a) Discuss Three (3) financial instruments traded in money markets. (6 Marks)

b) Individuals prefer current cash than the future cash due to a number of reasons. Identify four

(4) reasons for the time preference of money (4 Marks)

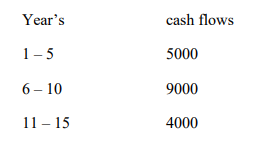

c) ABC ltd is in the process of completing a construction plant. The finance manager has

estimated that the project’s useful life is 15 years and shall generate the following cash flows

The required rate of return for the company is 10%

Required

Calculate the present value of the project. (5 Marks)

d) Aquinas borrowed Kshs 1,000,000 from Baraka bank at annual compound interest rate of

14% on reducing balance basis. The loan is payable over 4 years in equal instalments at the

end of each year. Draw a loan amortization schedule. (5 Marks)

QUESTION TWO (15 Marks)

a) Explain the Importance of cost of capital to an organisation (4 Marks)

b) Branch Ltd is in the process of raising additional finance. The company’s financial structure

comprises ordinary share capital, preference share capital, debenture capital and retained

earnings. Each of these sources of finance is analyzed below:

Ordinary share capital

The current market price by share is Sh. 80. The company expects to pay a cash dividend of Sh. 6

per share in the next financial year. The annual rate of growth in dividend per share is 6%.

Floatation costs amount to Sh. 8 per share.

11% Preference Share capital

The par value per share is Sh. 100. The shares are currently trading at par. Floatation costs amount

to Sh. 4 per share.

10% Debenture Capital

The par value is Sh. 1000 for each debenture stock. The debentures have a ten year maturity period.

The floatation cost for each debenture stock is Sh. 50.

Retained Earnings

The company expects to have Sh. 225,000 of retained earnings available for the next financial

year.

Required:

i) The cost of ordinary share capital (3 Marks)

ii) The cost of retained profit (2 Marks)

iii) The cost of 10% Debenture Capital (3 Marks)

iv) The cost of 11% preference share capital (3 Marks)

QUESTION THREE (15 Marks)

a) Differentiate between cash operating cycle and the working capital operating cycle.

(5 Marks)

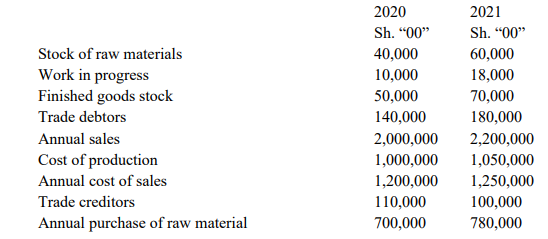

b) The following information was extracted from the books of Modern Ltd at the end of the

financial years ended 31st October 2020 and 2021.

Required:

(i) Working capital cycle in days of Modern Ltd (8 Marks)

(ii) Explain two (2) ways in which Modern Ltd might reduce working capital Cycle.

(2 Marks)

QUESTION FOUR (15 Marks)

a) Explain the limitations of the percentage of sales method (3 Marks)

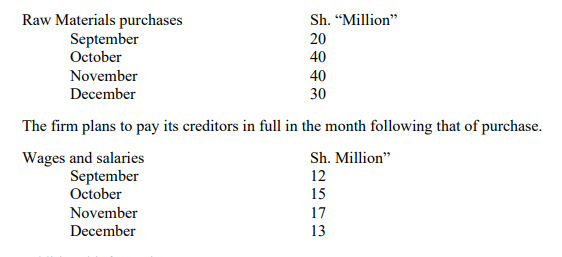

b) The following information relates to PQR Enterprises for the four months given below:

All sales will be made on credit

Half of the debtors are expected to pay within the month of sale and are also expected to claim a

2% cash discount. The remaining debtors are expected to pay by the beginning of the following

month.

Additional information:

1. All employees are paid in the month in which the wage or salary is earned.

2. Rent of Sh. 10 million for each quarter is paid in March, June, September and December.

3. Other cash overheads of Sh. 2 million per month are payable.

4. A new plant due for delivery in September will be paid in November at a cost of Sh. 25

Million.

5. On 1 October, the firm plans to have Sh. 10million in the bank.

Required:

A cash budget for the three months ending in December (12 Marks)