UNIVERSITY EXAMINATIONS: 2019/2020

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS

IN INFORMATION TECHNOLOGY

BUSS 203: BUSINESS FINANCE

FULL TIME/ PART TIME/ DISTANCE LEARNING

DATE: MAY, 2020 TIME: 6 HOURS

INSTRUCTIONS: Answer ALL Questions

SECTION TWO: (20 MARKS)

QUESTION ONE

a) You are a bachelor of Business and information technology (BBIT) student at the KCA

University currently studying Business finance in the current semester.

Explain how the knowledge acquired from the study of this unit will be useful to you

(10 Marks)

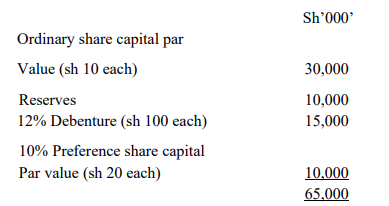

b) The existing capital structure of XYZ Ltd is given as follows:

Additional information:

1) Ordinary shares of this firm are currently selling at sh.60 each. The 12% Debentures

and 10% preference shares are currently selling at sh.80 and sh 30 respectively

2) The most recent dividend paid by this company is sh.2.This is expected to grow at the

rate of 10% each year in perpetuity

3) The corporation tax rate applicable is 30%

Required:

a) The cost of equity capital (2 Marks)

b)The cost of 12% Debenture capital (2 Marks)

c) The cost of 10% preferred stock (2 Marks)

d) Weighted average cost of capital (4 Marks)

(Total: 20 Marks)

SECTION THREE: (20 MARKS)

QUESTION ONE

a) Firms strive to achieve various financial and non-financial objectives which at times

overlaps with each other in some cases conflict with each other. Explain the overlaps and

conflicts that may arise amongst the objectives that firms strive to achieve in the context of a

corporate set up (8 Marks)

b) Omondi expects to make a deposit of sh.500, 000 at the end of the year 2020.He expects to

make a deposit of sh.200, 000 at the end of each subsequent year. The sum deposited will

earn interest at the rate of 8% per annum interest compounded annually.

Required:

i) The cumulative amount in the account at the end of the year 2024 (4 Marks)

ii) The return he expect to earn over the entire period (2 Marks)

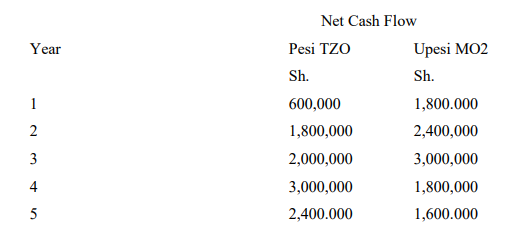

c) Kiwanda Limited is considering the purchase of a new machine. Two alternative

machines, Pesi TZO and Upesi MO2, which will cost sh. 6,000,000 and sh. 5,000,000

respectively, are available in the market. The net cash inflows of each machine are estimated

as follows:

Kiwanda’s cost of capital is 11% per annum.

Required:

Compute the net present value of each machine ( 6 Marks)

(Total:20 Marks)