UNIVERSITY EXAMINATIONS: 2019/2020

UNIVERSITY EXAMINATIONS: 2019/2020

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS IN

INFORMATION TECHNOLOGY

BUSS 200: INTRODUCTION TO ACCOUNTING II

FULL TIME/ PART TIME/DISTANCE LEARNING

DATE: MAY, 2020 TIME: 6 HOURS

INSTRUCTIONS: Answer ALL Questions

SECTION B: (20 MARKS)

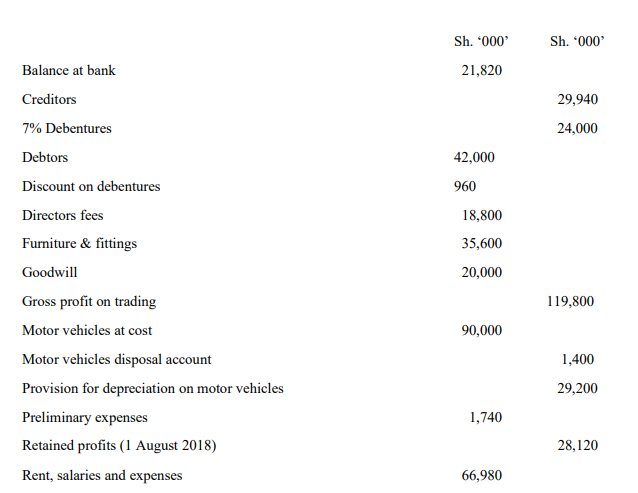

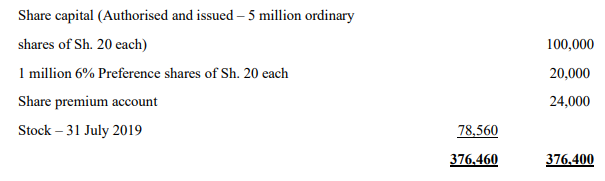

The following trial balance was extracted from the books of Clay Company Limited as at 31 July 2019.

Additional Information

1) On I August 2018, motor vehicles, which cost Sh. 6 million on 1 August 2001 were sold for Sh. 1.4

million. The only entries to record this transaction were made in the bank and motor vehicle disposal

accounts. Depreciation is provided on motor vehicles at 20% per annum on cost but no amount had

been provided for the year to 31 July 2019.

2) A provision for doubtful debts is to be created at 4% of the debtors.

3) Provision is to be made for corporation tax at 30% on chargeable profits of Sh. 22.4 million for the

year ended 31 July 2018.

4) The debentures were issued on 31 July 2019. They are secured on all the assets of the company.

5) Those items which the Companies Act (Cap 486) permits to be charged against the share premium

account are to be written off out of the balance of that account.

6) The directors have proposed to pay the preference dividend and a dividend of 5% on the ordinary

share capital.

Required:

a) Income Statement for the year ended 31 July 2019.

Statement of Financial Position as at 31 July 2019

SECTION C: (20 MARKS)

QUESTION TWO

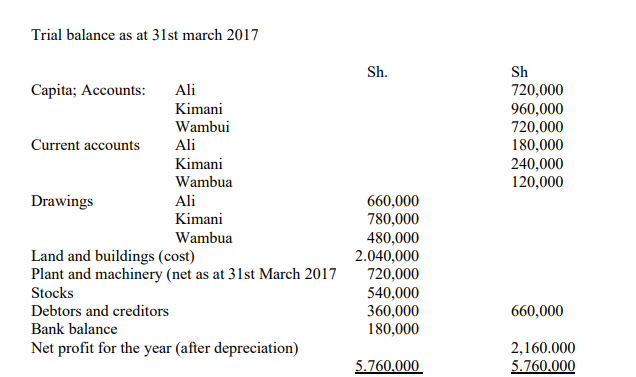

Ali, Kimani and Wambua had been trading in partnership, sharing profits and losses equally after

allowing interest on capital at 10% per annum. Wambua retired from the partnership on 31

December 2001 arid Ali and Kimani agreed to continue with the business sharing profit and

losses in the ratios 3/5 and 2/5 respectively after allowing interest on capital as before.

Wambua agreed that repayment of his capital be delayed for three years and the outstanding

amount be the subject of interest at the rate of 15% per annum .Any balance on Wambua’s

account is to be held in a separate account and be payable on demand.

Page 3 of 3

On 31st December 2016, a valuation of goodwill was carried out and agreed at Shs. 1,440,000

but this was not to be reflected in the books. The land buildings were revalued at the same date

as Sh. 2,760,00 and were to be adjusted in the books to this figure.

The firm prepared its accounts annually to 31 March, and at the time the following trial balance

was extracted , the above adjustments relating to the change in partnership had not been made

Trial balance as at 31st march 2017

Assume the net profit accrued evenly over the year

Required:

a) Appropriation account for the year ended 31 March 2017

b) Current Accounts

c) Statement of Finical Position as at 31st march 2017