UNIVERSITY EXAMINATIONS: 2021/2022

EXAMINATION FOR THE DEGREE OF BUSINESS INFORMATION

TECHNOLOGY

BUSS 200: INTRODUCTION TO ACCOUNTING II

FULL TIME/PART TIME/DISTANCE LEARNING

DATE: DECEMBER, 2021 TIME: 2 HOURS

INSTRUCTIONS: Answer Question ONE and any other TWO Questions

QUESTION ONE

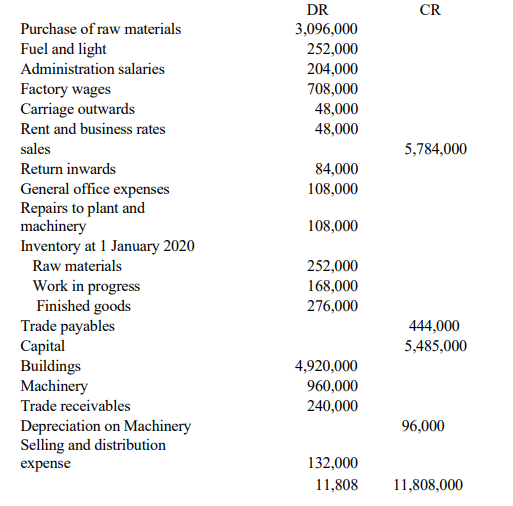

The trial balance provided below was obtained from sweet bakers industries for the

period ended 31 December 2020.

Additional information

1. Stock in hand as at 31 December 2020

Raw materials 300,000

Work in progress 132,000

Finished goods 312,000

2. Depreciation of 10% on plant and machinery using straight line method

3. 80% of fuel and light and 75% of rent and rates to be charged to manufacturing

4. Doubtful debts provision is 5% of sundry debtors

5. Sh. 48,000 outstanding for fuel and light

6. Rent and business rates paid in advance Sh. 60,000

7. Market value of finished goods is Sh. 4,584,000

Required

i. Manufacturing Statement of Financial Performance showing profit realized on

transfer from the manufacturing department (12 Marks)

ii. Statement of Financial Position 31 December 2020 (8 Marks)

QUESTION TWO

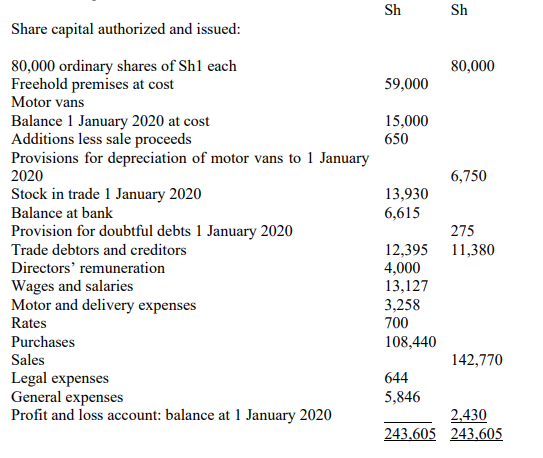

The Following Trial Balance Was Extracted From The Books Of Collins Ltd At 31 December 2020

Share capital authorized and issued:

80,000 ordinary shares of Sh1 each

Freehold premises at cost

Motor vans

Balance 1 January 2020 at cost

Additions less sale proceeds

Provisions for depreciation of motor vans to 1 January

2020

You are given the following information.

i. Stock in trade, 31 December 2020, Sh14,600.

ii. Rates paid in advance as at, 31 December 2020, Sh140.

iii. Debts of Sh1,075 to be written off and the provision to be increased to Sh350.

Required:

1. Prepare a trading and profit and loss account for the year 2020.

2. Balance sheet at 31 December 2020

(15 Marks)

QUESTION THREE

a) Explain the following clauses as used in partnership deed / agreement (4 Marks)

i. Capital contribution clause

ii. Profit or Loss sharing ratio

iii. Salaries to partners

iv. Drawings

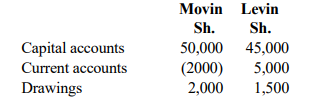

B) A partnership made a net profit of Sh. 120,000 for the year ended 31st December 2020. The partners

comprise of Movin and Levin who have the following capital composition:

The following information is also available:

i. The partners agreed to charge interest on capital and on drawings at 8% and 5%

respectively for each of the partners

ii. Salaries to the partners were paid at Sh. 2,000 and Sh.1,800 for Movin

and Levin respectively

iii. The profit sharing ratio was agreed as 3:2 for Movin and Levin respectively

Required:

i. The partnership appropriation account for the year ended 30th June 2020

ii. The current account for the partners (11 Marks)

QUESTION FOUR

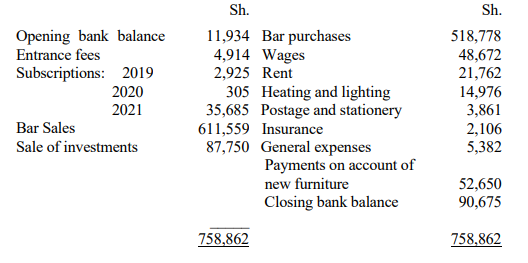

The following is the receipts and payments account of the Bull and Push Club for the year

ended 31 December 2020:

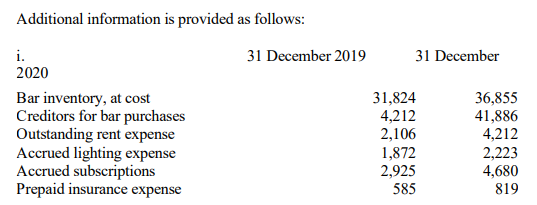

n is provided as follows:

ii. On 31 December 2009, the club held investments which cost Sh.58, 500.

During the year ended 31 December 2010, these were sold for Sh.87, 750.

iii. Furniture was valued at Sh.35, 100 on 31 December 2019. On June 2020,

the club purchased additional furniture at a cost of Sh.60, 840. Depreciation

of all furniture is to be provided for at the rate of 10% per annum.

Required:

(a) Prepare an income and expenditure account for the year ended 31

December 2020 (8 Marks)

(b) Statement of Financial Performance as at 31 December 2020 (7

Marks)