UNIVERSITY EXAMINATIONS: 2017/2018

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS

INFORMATION TECHNOLOGY

BUSS 100 INTRODUCTION TO ACCOUNTING I

FULL TIME/PART TIME

DATE: JULY/AUGUST, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer ALL questions.

QUESTION ONE

(a)

i. Discuss the main branches of accounting (3 Mark)

ii. Identify and describe four desirable characteristics of accounting information.

(3 Marks)

iii. Differentiate between sales ledger and sales account (2 Marks)

iv.

On 1 October 2017, Kazi Ngumu had Sh.750,000 in the bank and Sh. 126,000 in hand.

During the month he had the following receipts and payments:

1 October Cash sale – receipt Sh.80,000

4 October Payment to supplier Maina Sh.120,000

Payment of rent Sh.300,000

6 October Payment from credit customer Omondi Sh.450,000

Payment from credit customer Salim Sh.250,000

10 October Cash sale – receipt Sh. 100,000

Payment to supplier Kimatu Sh.500,000

15 October Payment of hire-purchase installment Sh.150,000

17 October Purchase of new machine Sh.1,200,000

19 October Cash sale – receipt Sh.370,000

21 Cash withdrawn from bank for office use 75,000

22 October Payment from credit customer Mokaya Sh.600,000

24 October Payment of fuel bill Sh.175,000

26 October Interest received Sh. 25,000

29 Cash taken from cash till to pay fees for daughter Sh. 25,000

Required:

Prepare a two column cash book and determine bank and cash balances at the end of the month

(7 Marks)

QUESTION TWO

Enter the following transactions of an Antiques Shop in the accounts and extract a trial balance as at 31

March 2018. (20 Marks)

March

1 Started in business with Kshs.800,000 in the bank

2 Bought goods on credit from the following persons. Frank Kshs. 55,000, Baya Kshs.29,000,

Lee Kshs.61,000.

5 Cash sales Kshs.51,000

6 Paid wages in cash Kshs.11,000

7 Sold goods on credit to: Snow Kshs.29,500; Papa Kshs.36,000, Talia Kshs.64,000

9 Bought goods for cash Kshs.12,000

10 Bought goods on credit from: Baya Kshs.41,000, Lee Kshs.124,000

12 Paid wages in cash Kshs.11,000

13 Sold goods on credit to: papa Kshs.61,000, Talia Kshs.20,500

15 Bought shop fixtures oncredit from Mbao Ltd Kshs.74,000

17 Paid Baya by cheque Kshs.70,000

18 We returned goods to Lee Kshs.8300

21 Paid Mbao Ltd a cheque for Kshs.74,000

24 Talia paid us his account by cheque Kshs.84,500

27 We returned goods to Frank Kshs.1,800

30 Pauline lent us Kshs.100,000 by cash

31 Bought a motor van paying by cheque Kshs.625,000

QUESTION THREE

The following information was extracted from the books of Sospeter odeng’e for the

month of October 2017

1. Credit sales: Wahu Sh.56,000; Larry Matu Sh.148,000; Ken Sitati Sh.145,000

3. Credit purchases: Peter Keter Sh.144,000; Harris Mumo Sh.25,000; Alice Kanyi

Sh.76,000

4. Credit sales: Key money Sh.89,000; Nafula Akinyi Sh.78,000; Charles Maku Sh.257,000

6. Credit Purchases: B Perkins Sh.24,000; Harris Mumo Sh58,000; Helen Helen

Sh.123,000

11. Goods returned by us to: Peter Keter Sh.12,000; Alice Kanyi Sh.22,000

16. Goods returned to us by: WahuSh.5,000; Ken Sitati Sh11,000; Key money Sh.14,000

21. Credit purchases: Harris Mumo Sh.54,000;: Luka KitcheSh.75,000.

25. Goods returned by us to Alice Kanyi Sh.14,000

28. Credit sales: K Mohammed Sh57,000; Key money Sh.65,000; Omondi Blackberry

Sh.112,000

29. Goods returned to us by Nafula Akinyi Sh.24,000

31. Credit sales: Charles Maku Sh.55,000

Required:

(a) Prepare the purchases, sales, returns inwards and returns outwards journal of Sospeter

odeng’e from the above. (6 Marks)

(b) Post the items to the relevant personal accounts in the sales and purchases ledger

(6 Marks)

(c) Post the totals of the journals to the sales, purchases, returns inwards and return outwards

accounts. (3 Marks)

QUESTION FOUR

Give the accounting definition of the term depreciation (2 Marks)

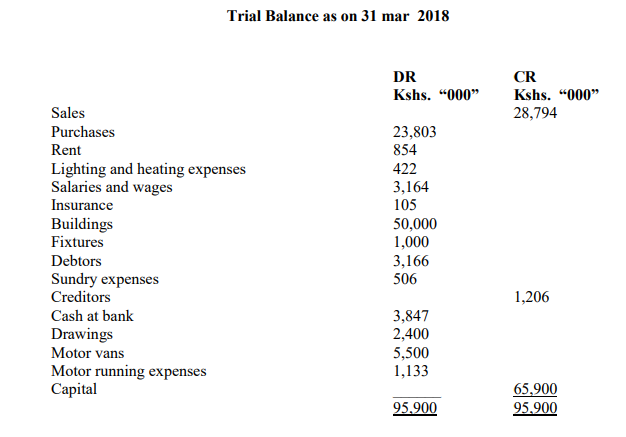

From the following trial balance from Mackintosh after his first year’s trading,

Trial Balance as on 31 mar 2018

Additional information

i. Stock at 31 mar 2018 was Kshs. 4,166,000

ii. He brought in his household furniture for business use. This was not recorded in the books of

accounts

iii. Rent was paid for 18 month period starting 1 April 2017

iv. Motor vehicles are to be depreciated at 10% on cost while fixtures are to be depreciated at 15% on

cost.

v. Debtors include a bad debt of Shs. 66,000

Required:

Statement of financial performance for the year ended 31 march 2018 (10 Marks)

Statement of Financial position as at 31 March 2018 (8 Marks)